With favourable government policies and a boom in startup culture, the last few years have witnessed a flood of companies launching their IPOs. In 2023, 60 companies made public issues under the Mainboard category, while the SME IPO numbers stood at 182. By the first week of July 2024, 40 Mainboard and 122 SME IPOs had already hit the market.

Most of these IPOs have seen oversubscription from investors. But with this much hype, can IPOs make you rich? Let's understand.

Understanding IPOs

An IPO is the process through which private companies raise funds from the general public by issuing securities for the first time. Such issuance is primarily done to support the expansion of operations, finance research and development, or clear existing debts.

IPOs are of two types: fixed-price offerings and book-building offerings. In the former, the company sets a fixed price at which its shares will be made available to the public, while in the latter, a price range is defined within which investors can bid for the shares.

The first is often used for small and medium enterprise (SME) IPOs. For mainboard IPOs, book building is used. Also, companies must meet specific criteria set by the Securities and Exchange Board of India (SEBI) to issue an IPO. Investors can apply for an IPO via a demat account.

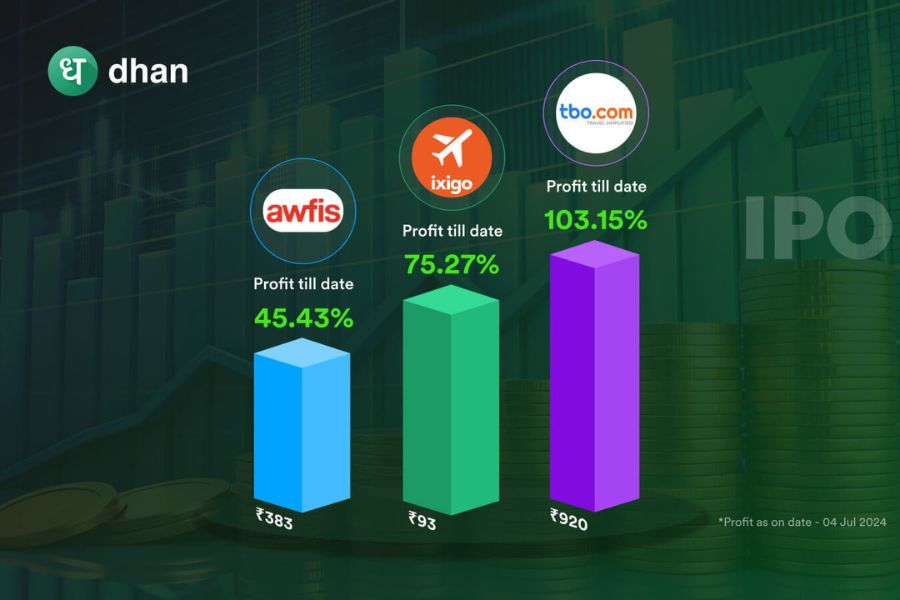

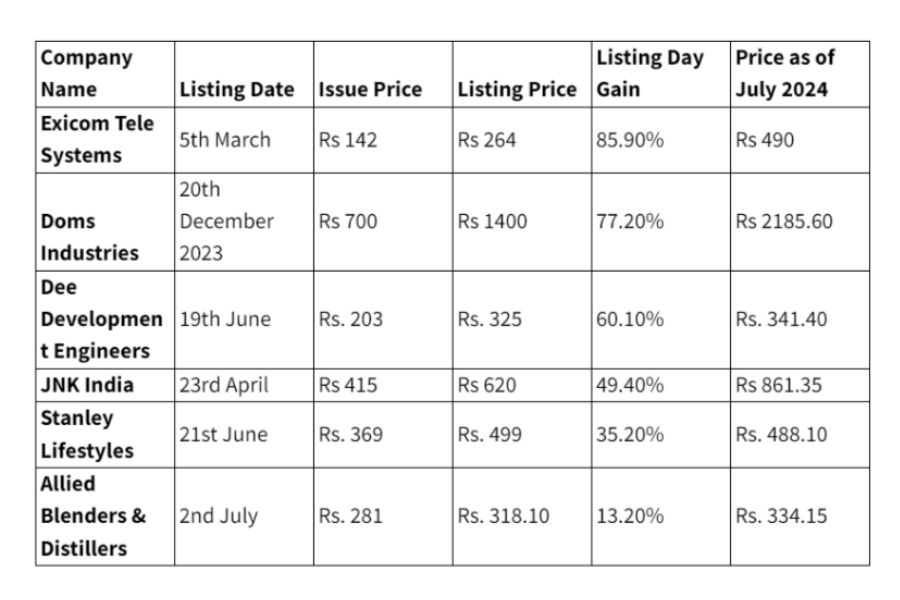

Recent IPO Launches and Gains

In 2024, 40 mainboard IPOs debuted on the stock market. Many of these IPOs have given attractive gains to investors. Here are some of the latest IPOs from this year that had good listing games.

Which IPOs to Expect in 2024?

How Can IPOs Help You Build Wealth?

Here is how IPOs can help you build wealth over time.

Listing Gains

Listing gains refer to the difference between an IPO's initial offer price and the price at which its shares are listed on the stock exchange. This phenomenon is influenced by various factors, the primary one being the demand-supply mechanism.

When a reputable company with solid financials and a justified price range enters the market, many investors rush to subscribe to its IPO.

The oversubscription creates a situation where demand exceeds supply, leading to significant stock price inflation, sometimes exceeding 100% compared to the issue price. Medicament Organics' IPO was the perfect example of this. The company issued an IPO for Rs. 34 per share. The stock surged to Rs 137.85 on the listing day, giving a whopping listing day return of 305.44%.

Capital Appreciation

If you have been allotted shares in an IPO of a fundamentally strong company raising funds for business expansion rather than debt settlement, you can expect capital appreciation over time.

Take Doms Industries, for example. The company didn't halt its bullish trend. Since its listing in December 2023, it has yielded a return of 64.82% to date.

Helps achieve long-term goals

IPOs, post-listing, if they offer consistent returns, can help you achieve long-term objectives. If you are considering buying a house or car in the next few years, IPO investments can help reduce your financial burden to some extent.

To help you understand this better, let's take the example of Alkem Laboratories Limited, which launched its IPO in 2015. Since its listing, the stock has given returns of around 260% in nine years. Not only that, the company also maintains a healthy dividend payout ratio of 37.4%. If you had invested in this company, you would have amassed a decent amount of wealth in the long run.

Benefit from Early Investment

Early investors often have the chance to purchase shares at a relatively low price, which can lead to substantial profits if the company performs well post-IPO. This is particularly true for companies in high-growth sectors, where rapid expansion can significantly increase share prices.

It is important to note that the returns of any stocks allotted during an IPO are not guaranteed in the highly volatile stock market. To ensure you earn decent returns over time and keep building your wealth, consider a company with steady revenue, fewer debts, positive cash flow, and decent promoters' holdings.

Also, regularly review your holdings and assess the returns against the indexes. If required, rebalance by redeeming some old units and holding new ones.

Conclusion

Applying for an IPO brings a wide range of benefits for investors, from capital appreciation to listing gains. However, it is important to do due diligence and check the history and fundamentals of the company issuing the IPO to make an informed decision. To pre-apply for an IPO, use Dhan. This feature lets you apply for an IPO in advance. Your application will be automatically sent once the IPO window opens. Happy Investing!

This article has been produced on behalf of Dhan by ABP Digital Brand Studio.