In today’s world, it is important to make strategic investment plans to achieve financial stability and growth. If you are looking for a disciplined and regular investment mode, SIPs are perfect. They are both practical and efficient, and they ensure that your capital is invested automatically every month.

The best part is that you can decide the date on which this SIP amount is to be deducted, and thus, you can ensure that it coincides with your salary cycle. Investing through SIPs ensures that you do not have to be financially strained by accumulating a large amount of capital in your early years.

Apart from their flexibility and convenience, did you know that just a modest amount of ₹1000 per month can make you a millionaire? If this aroused your curiosity, check out this article to discover this SIP strategy to make you a millionaire.

How to Turn ₹1000 SIP into a Million?

If you were to invest in mutual funds through the SIP method with the expectation of reaping a million rupees, which is equivalent to ₹10 lakhs, it would take you a certain number of years. Factors such as interest rates play a crucial role in determining the duration it would take for you to convert your ₹1000 SIP into ₹10 lakh.

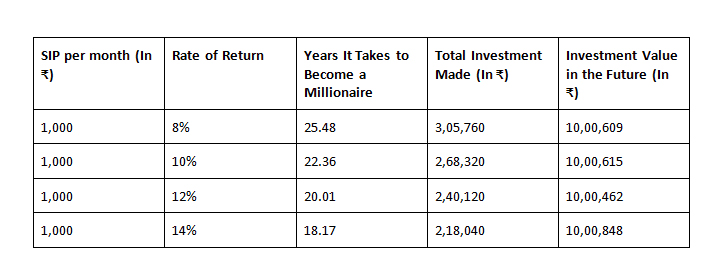

The table below compares the time required to convert your monthly SIP of ₹1000 into ₹10 lakh at different interest rates.

From this table, you can notice that with an increase in the rate of returns on these mutual funds, the duration required for you to obtain ₹10 lakhs decreases. Additionally, with an increase in the rate of interest, the investment you make also decreases.

For example, when you compare the 8% and 14% rates of returns, the investment made decreases from ₹3,05,760 to ₹2,18,040. Additionally, the number of years it takes to obtain a million decreases from 25.48 to 18.17 years.

In a nutshell, it can be concluded that as the interest rate increases by 2%, the number of years required to obtain a million decreases by 2 to 3 years.

Another critical thing to note is that these rates of return are only representative, and the actual returns could be much higher or lower depending on the market conditions.

For example, if a fund offers 30% returns annually, you would only have to invest a total of ₹1,06,920 over a period of 8.91 years to accumulate a wealth of ₹10,01,641.

These returns depend on the type of funds you invest in, which depends on your financial goals and risk appetite.

You can use Dhan’s SIP calculator to further calculate your returns at different interest rates over specific durations.

Step Up SIP Investments

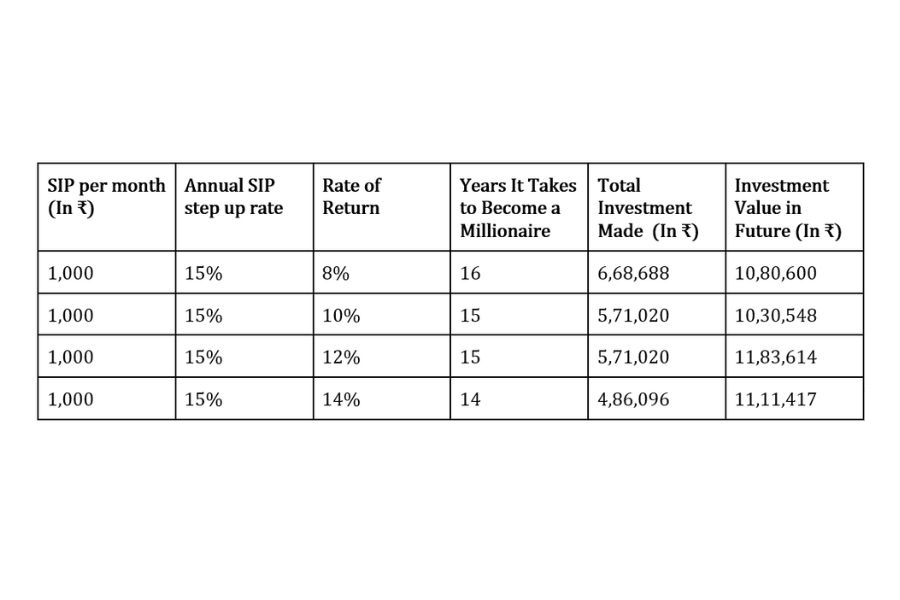

If you want to increase the SIP amount over time and reduce the number of years to become a millionaire, step-up SIP investments are the perfect option for you. Let us consider an example again to understand how stepping up your SIP will affect your returns.

Suppose you invest in a SIP scheme that offers 10% annual returns with an initial SIP amount of ₹1000 and step up your monthly SIP by 15% annually. In that case, you can obtain a total return of ₹10,30,462 after investing Rs 5,70,965 over 15 years.

When you compare this to the previous example, the duration required to obtain ₹10 lakhs is reduced from 22 years to 15 years! The table below indicates the total number of years required to obtain ₹10 lakhs when your monthly SIP is increased by 15% annually.

Factors to Consider Before Investing in SIP Mutual Funds

Having covered the calculation part, it is time to check out a few tips to help you make strategic and secure SIP investments.

1. Diversified investments

Mutual funds are all subject to different types of risks, such as market risk. Therefore, it is wise to invest in various types of funds, such as equity and index funds. This ensures you can spread risk over your different investments while maximising your returns!

2. Assessment of risk appetite

Before you invest in SIP mutual funds, ensure that you assess your risk appetite. This step is crucial so that you can choose the right mutual fund. This risk tolerance will depend upon your income, age, and other factors.

Once you gauge your risk appetite, you can choose the funds that best fit your risk profile.

3. Be consistent

Discipline is the key to ensuring that you reach your target at the predicted speed. By being consistent in your investments and ensuring that your bank has sufficient balance, you can truly leverage the benefits of rupee-averaging costs and the compounding effect.

4. Use a SIP calculator

When calculating the total returns at the end of your investment period, there are many variables. The only thing you can be sure about is your monthly SIP value. Therefore, using a SIP calculator can help you determine the duration of your investment and the total wealth you will accumulate by the end of this investment period.

This will help you make data-driven decisions while balancing your risks and returns.

Conclusion

Through discipline and clear planning, you can ensure you become a millionaire by keeping aside ₹1000 every month. The best part is that you do not have to worry about accumulating a large corpus; instead, you can systematically dedicate a small amount of money monthly.

This added flexibility ensures you can invest money without any financial pressure or burden. Lastly, remember that while the amount may seem small in the initial few years, you will start to notice the growth of your investment significantly later, and with the power of compounding, your investment can grow multifold!

This article has been produced on behalf of Dhan by ABP Digital Brand Studio.