Uco Bank on Monday reported a net loss of Rs 1,136.44 crore for the second quarter of 2018-19 with provisions pulling down the bottomline of the city-based bank.

The bank had registered a net loss of Rs 622.56 crore in the September quarter of 2017-18. In the June quarter of 2018-19, the company’s net loss stood at Rs 633.88 crore.

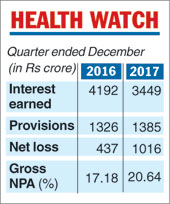

Total income also fell to Rs 3,749.18 crore in the reported quarter against Rs 3,757.51 crore in the same period of 2017-18, the bank said in a BSE filing.

The net interest income during the quarter increased to Rs 964.58 crore from Rs 655.46 crore a year ago.

The bank’s asset quality worsened as the gross non-performing assets rose to 25.37 per cent of the gross advances as on September 30, 2018, against 19.74 per cent at the end of September 2017. Net NPAs were 11.97 per cent compared with 9.98 per cent in the year-ago period.

In absolute terms, gross NPAs, or bad loans, stood at Rs 29,581.49 crore at the end of September 2018 against Rs 24,434.95 crore earlier. Net NPAs rose to Rs 11,820.21 crore from Rs 11,008.23 crore.

Rising NPAs prompted the bank to hike the provisions for bad loans to Rs 1,410.94 crore during the reported quarter, up from Rs 1,323.36 crore in the year-ago period.

The capital adequacy ratio of the bank under Basel III for the quarter ended September saw a significant deterioration, dropping to 7.57 per cent against 9.32 per cent in the year-ago period.