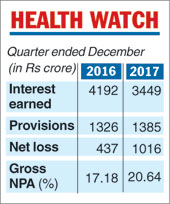

Calcutta: UCO Bank has suffered a third-quarter loss of Rs 1016.43 crore compared with a loss of Rs 437.09 crore a year ago. Higher provisions for stressed assets ate into the bank's bottomline even as interest income of the bank remained low.

Interest income during the quarter was Rs 3449.55 crore, compared with Rs 4192.47 crore in the corresponding previous period. Contribution of treasury operations to the bank's income also came down during the quarter.

Provisions other than tax and contingencies during the quarter was Rs 1,385.38 crore, compared with Rs 1,326.05 crore in the comparative quarter previous year.

The gross non-performing assets ratio of the bank during the quarter further increased to 20.64 per cent compared with 17.18 per cent in the corresponding quarter a year ago.

Return on assets, which was already in the negative, further deteriorated to 1.75 per from 0.77 per cent a year ago.

More provisions

The Calcutta-based bank envisages a provisioning requirement of Rs 722.12 crore in the January-March quarter for stressed assets.

These provisions include select accounts identified under the provisions of the Insolvency and Bankruptcy Code, two large corporate accounts identified by the RBI last month as well as those referred to the NCLT by any lenders.

These provisions, according to market analysts, are expected to have an adverse impact on the bank's performance in the fourth quarter.

Capital infusion

During the quarter, the central government has infused Rs 1,375 crore by way of preferential allotment of equity shares.

The board of the bank on Friday decided to consider further preferential allotment of shares to the government amounting to Rs 5,132 crore.

The Centre has decided to infuse a total of Rs 6,507 crore to improve the capital adequacy of the bank in 2017-18.