Calcutta, Aug. 8: Uco Bank's first-quarter net profit dipped 50.76 per cent as lower interest income and higher provisions pulled down its bottomline.

Calcutta, Aug. 8: Uco Bank's first-quarter net profit dipped 50.76 per cent as lower interest income and higher provisions pulled down its bottomline.

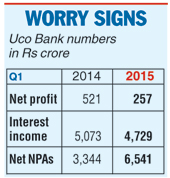

The bank's net profit in the said quarter was Rs 256.70 crore compared with Rs 521.40 crore a year ago.

Interest income fell to Rs 4,728.99 crore from Rs 5,072.94 crore in the year-ago period. The city-based bank continued to lose revenue in the corporate sector as credit demand remained weak. Provisions and contingencies increased to Rs 763.56 crore from Rs 521.40 crore in the year-ago period.

"Credit growth remained muted not only because of very little incremental capital expenditure but also because many companies opted for cheaper fund raising options such as bonds," said chairman Arun Kaul.

Gross non-performing assets (NPAs) as a per cent of advances increased to 7.30 per cent from 4.31 per cent. In absolute terms, gross NPAs during the quarter was Rs 10,894.41 crore compared with Rs 6,346.32 crore in the year-ago period. Fresh slippage of advances as NPAs during the quarter was Rs 1,252.98 crore. The bank also sold Rs 115.56 crore in bad assets to asset restructuring companies.

"Some large borrowal accounts facing difficulties contributed to the slippage, a large amount is from restructured category," said Kaul.

Maximum slippages were in power, textiles, manufacturing and real estate sectors.

The bank's capital adequacy ratio according to Basel III norms in the first quarter was 11.71 per cent compared with 12.30 per cent in the year-ago period. Bank officials said for the current fiscal there is no immediate capital requirement.

Central Bank net

The Central Bank of India's June-quarter net profit rose 6 per cent to Rs 203 crore led by a reduction in cost of deposits and lower provisioning for bad loans.

However, the profitability was dragged down by a rise in non-performing loans.

"Our cost of deposits has come down by around 20 basis points. We are aware that NPAs are going to happen and the resultant erosion of interest income," said chairman and MD Rajeev Rishi.