New Delhi: Since 1991, Hero FinCorp has been helping people finance their dreams, goals, and emergencies. Through their instant Personal Loan app, they allow loan seekers to apply for a Personal Loan online and get the required funding in minutes. These might include renovating a property, covering an urgent wedding expense, joining a study abroad programme, going on a foreign vacation, or getting the much-required medical treatment. Having acquired a customer base of millions, the NBFC offers easy Personal Loans with rapid approval and quick disbursal online through the Hero FinCorp Personal Loan app.

Here's everything you need to know about Hero FinCorp Personal Loans, which offers instant funding without branch visits or paperwork.

How Can an Instant Personal Loan Help You?

If you have a decent credit score, regular income, and professional stability, you might already qualify for a quick Personal Loan from Hero FinCorp. Here’s a quick look at the features and benefits of instant Personal Loans from the lending institution:

- Ample Loan Amount: Whenever you feel stuck in an emergency or fed up with delaying the realisation of your dreams, a Personal Loan of up to Rs. 3 Lakh can help cover most expenses without hassle.

- Attractive Interest Rates: Professional experts at Hero FinCorp determine each applicant's interest rate based on eligibility, income, DTI ratio, credit history, repayment capacity, and other essential parameters. The interest rate at Hero FinCorp starts at 15%.

- 100% Digital Loan Procedure: If you plan to apply for a Personal Loan online, you can simply download the loan app on your smartphone and begin the application process. No single branch visit or paperwork is necessary for the application.

- Flexible Repayment: Hero FinCorp offers a repayment tenure of up to 60 months. You can choose a convenient term according to your repayment capacity. Use a Personal Loan EMI Calculator on their website to determine a loan term with EMIs you can easily adjust into your monthly budget.

- No Collateral Requirement: You can apply for a Personal Loan at Hero FinCorp even if you don’t own an asset to pledge as collateral. The NBFC offers unsecured loans that you can obtain without providing any security or guarantor.

Do You Qualify for a Personal Loan at Hero FinCorp?

You must think that such a helpful loan offer must be available only for a select few borrowers. However, that's not true. Hero FinCorp has some of the simplest eligibility criteria that both salaried employees and self-employed professionals can fulfil without hassle. These are the only few conditions that make you eligible for an application for Personal Loan:

- Age between 21 and 58 years

- Indian citizenship

- Work experience of at least six months in the same job for salaried employees and at least two years for self-employed professionals

- Monthly income of at least Rs. 15,000

- A decent credit score and low debt-to-income (DTI) ratio

Role of Credit Score in Your Loan Application

Although Hero FinCorp does not have a minimum credit score requirement for Personal Loan applications, a decent score will go a long way in getting quick approvals, ample loan amounts, and the lowest interest rates. Since these are unsecured loans, your credibility largely depends on how you have handled credit in the past. So, a decent credit score would be a bonus in your application for a Personal Loan.

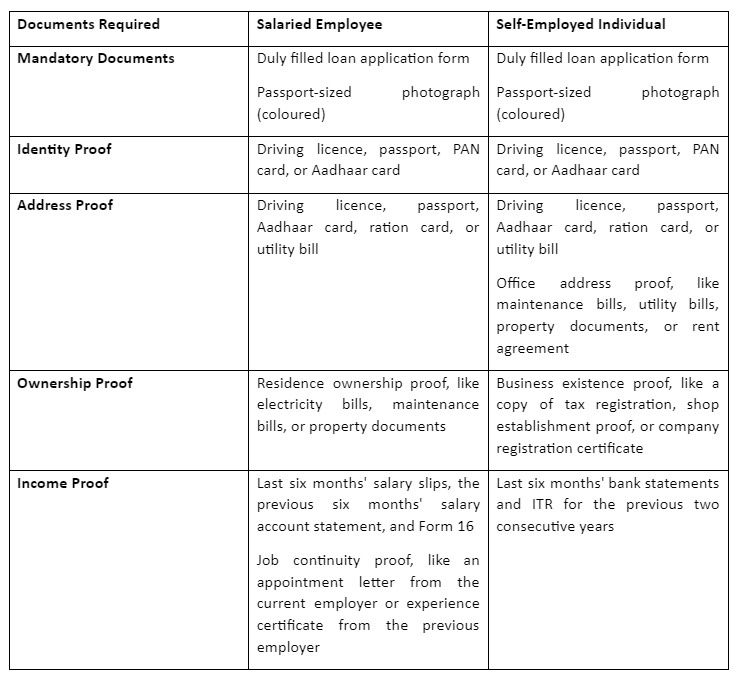

Documents Required for a Personal Loan Application

The Personal Loan application procedure at Hero FinCorp is completely digital and involves no paperwork. You can simply scan soft copies of the following documents according to your occupation:

What Will Be Your Personal Loan EMI Amount?

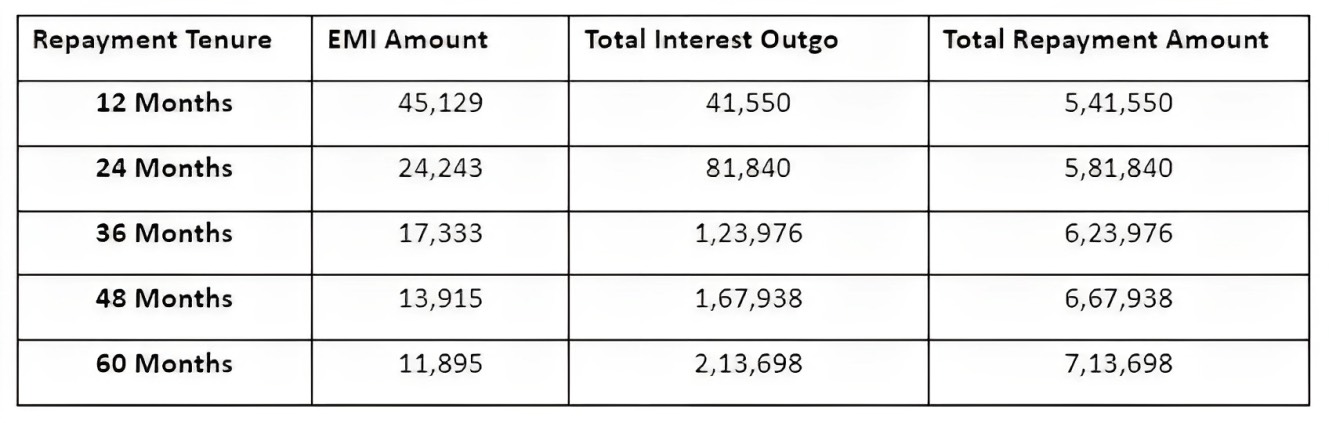

Your final EMI amount to pay each month largely depends on three variables: your loan amount, interest rate, and repayment tenure. A Personal Loan EMI calculator is an online tool that uses these three figures to calculate your EMIs for various loan terms. If you qualify for a Rs. 3 Lakh Personal Loan at a 15% interest rate, your repayment plan will look something like this:

As you increase the length of your repayment tenure, you can see that the interest and total repayment amounts increase. So, choose the shortest possible loan term with budget-friendly EMIs.

Steps to Apply for a Personal Loan Online

Are you eligible and ready to apply for a Personal Loan online? Here’s a stepwise guide to make it happen:

- Download and install the Hero FinCorp Instant Personal Loan app.

- Register using your mobile number and email address.

- Enter a few necessary details like your personal, professional, employment, and financial information.

- Scan and upload the required documents, including your identity, address, and income proofs.

- Let the verification process complete and get approval with a loan offer.

- Accept the loan offer to initiate the disbursal process.

About the Hero FinCorp Personal Loan App

A quick Personal Loan app from Hero FinCorp offers convenient short-term credit options to fund various cash requirements. Swift processing, prompt approvals, and super-fast disbursals characterise these unsecured loans. However, consider the eligibility criteria and documentation requirements to avoid increasing your debt burden instead of getting financial support.

Disclaimer: This is a sponsored article and does not involve any editorial input. The views expressed, including any statements, views, opinions, announcements, declarations, or affirmations are neither supported, nor endorsed by The Telegraph Online.