The Narendra Modi government has finally run out of explanations for the sharp slowdown in the economy. After the National Statistical Office came out with data last week showing that gross domestic product growth had tumbled to a 26-quarter low of 4.5 per cent in the quarter ended September 30, it can no longer continue with the charade of deny, falsify and prevaricate and hope to persuade its citizens into believing that things are actually better than what they seem. The industry-level numbers are downright ugly: the manufacturing sector has seen growth contract to -1.0 per cent from 0.6 per cent in the first quarter. It is only the second time since the current series of reporting national accounts was adopted in January 2015, with the base year set at 2011-12, that growth in manufacturing has actually shrunk. The last time this happened was in the first quarter of 2017-18 when it contracted by -1.7 per cent, clearly impacted by the reckless experiment with demonetization.

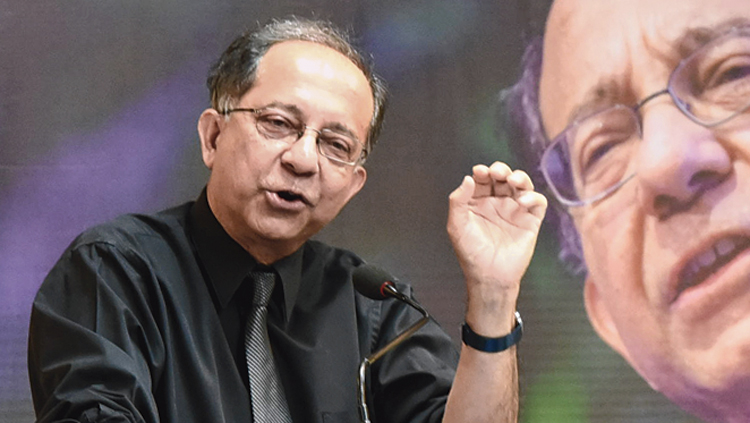

The pundits had been forecasting a sharp slowdown in the second quarter of this fiscal as well even though the government tried hard to argue that the 5 per cent GDP growth in the first quarter was just a small blip from which the economy would quickly rebound as the cyclical factors played out. This jejune belief that everything will be hunky-dory has got to go pretty soon. There is a growing realization that there probably are structural issues dogging the economy which the government is not willing to acknowledge; much less address. After the latest GDP figures came out, the chief economic adviser, Krishnamurthy Subramanian, insisted that the fundamentals of the Indian economy were strong and it was only a matter of time before the elephant heaved itself out of the slough. Economists and researchers are not ready to accept that. Their forecasts are pretty grim: most expect full-year growth at anywhere between 4.5-4.7 per cent. The Reserve Bank of India will have to trim its October 4 forecast of 6.1 per cent.

The pressure will build on the central bank to cut rates later this week — for the sixth time this year. The policy rate cuts have not been passed on by the commercial banks at the same pace, limiting the effectiveness of using monetary policy tools to reignite the economy. The Centre does not have the money to pump-prime the economy either: tax collections have fallen short of projections, and the government has chosen not to raise borrowings. Investment growth has fallen to a woeful 1 per cent against 11.8 per cent in the same quarter a year ago. The Centre wants the private sector to crank up capital spending. But policy and tax cut inducements will not be enough. The bleak industrial climate does not inspire business confidence in the short term. The government needs to grapple with the specifics of business policy; the optics can wait.