“My budget is over. Can I get a new one?” — Mira, age 9

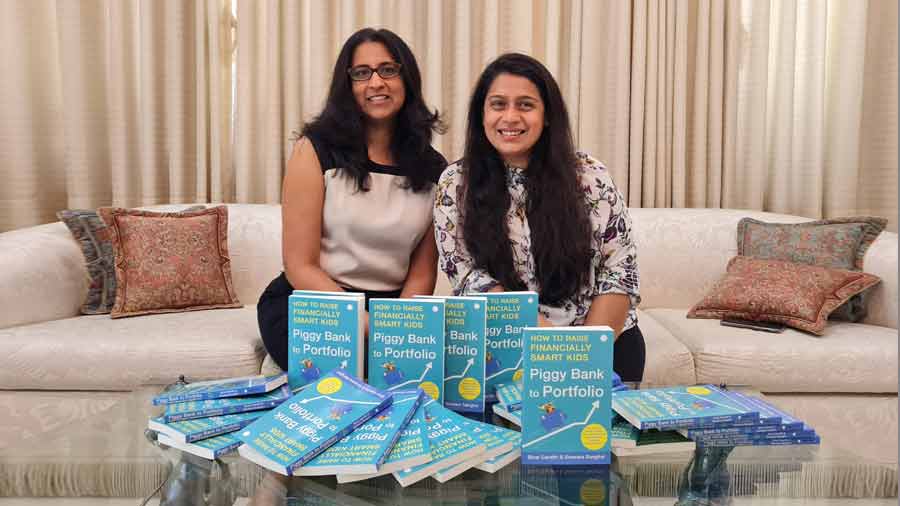

Each chapter of Piggy Bank to Portfolio begins with an endearing quote from a child that’s surprisingly relatable to adults. My Kolkata caught up with authors Binal Gandhi and Soneera Sanghvi, to talk money (often the lack of it!), financial planning and why parents should discuss money matters with kids early. Gandhi works in education, running a gamified financial education program called Finance GYM, and is mother to two teenage girls, “who have been a strong source of inspiration” for her work in financial education. Sanghvi works in education consultancy and is mom to two young kids. She says it’s her daughter who inspired her to write this book when she said ‘You save, I’ll spend’.

My Kolkata: Do kids really need to know about money?

Soneera Sanghvi (S): Your kids’ financial habits are formed by their personality traits. Even if they have not handled money, things like delayed gratification and planning for the future – everything which affects your ability to save later…those are things which take root as early as age 7 or 8, and affect their ability to manage their finances later in life. There’s a strong correlation – kids who are able to delay gratification and plan for savings are more likely to have better credit scores, more savings or have paid off their house. It’s about raising kids who have a holistic view of money later in life.

Binal Gandhi (B): When they are growing up, even if we feel like they don’t need to deal with money, they already are. So as parents it is important to be able to build healthy habits.

By Tiyasa Das

As a child what was your relationship with money? Any interesting anecdotes there?

S: Growing up, I was not great with money. I remember as a kid, my mom would give me pocket money and she would insist we maintain a proper hisaab (list of expenditure) for it. The rule was that we would not get our second disbursement of funds until we had turned in the hisaab for the first one. Towards the end of the week, I would try to sit and recall and when I couldn’t, I would bluff my way through it! It felt like a chore, but as an adult you appreciate the ability to track your expenses.

B: In my house, curiosity about every topic was encouraged, but when you asked questions about money, it was considered impolite. So if you ask me what my relationship with money was, I would say it was non-existent.

Do you think having a conversation about financial literacy is more important today than it was when our parents or grandparents were growing up?

B: It is definitely more important today, owing to a few changes: Those days people stayed in their jobs for longer periods of time than now. And eventually you were paid some pension from wherever you worked, so there was some financial security available during your old age. For our grandparents, their plan after retirement was that they relied on their children. So, our grandparents relied on our parents…but today, all these things have changed.

People change jobs more frequently these days, and there are no jobs that pay a pension anymore. You are expected to set aside money for yourself. Many of our kids are going to move away from us with jobs… You not only have to earn money but you also really need to learn how to manage it.

S: When we were growing up, social media didn’t exist. But now you have so many people constantly showing you vacations they are taking or things they are buying, the consumerism is very apparent… There is more need to buy things in our lives now than there was in our parents’ age… Which also explains why debt in India has grown so much over the last few years. Across socio-economic classes, people are buying more and spending more, so I’d say financial literacy is becoming even more important now. Also, the shift from cash to digital has led people to spend more, because you don’t feel that pinch of money being spent and it is easier for kids to fall into that trap.

How do you think the pandemic has changed conversations around money? How can parents help kids understand the impact of the pandemic on finances?

B: With everyone at home during the pandemic, and especially for families suffering from job losses, kids were definitely aware of what was happening and if the parents didn’t talk, these kids were drawing their own conclusions, be it right or wrong. So, one important approach is to be direct with kids, but of course in an age-appropriate way. Instead of trying to hide the reality, share it with them and look at it as a learning opportunity for the children. Balancing it out and having that conversation is crucial.

S: I think the pandemic drove home the importance of having a contingency plan. It was an opportunity for a lot of parents to discuss the concept of saving and talk about an emergency fund. Another silver lining of the pandemic was that so many people started home businesses, as a result of which, kids were more involved in these ventures. They were doing deliveries within residential complexes, collecting money, seeing the transaction happening. It was such a great learning experience for children.

Which aspect of financial literacy do you find most difficult to talk to your kids about?

B: One of the toughest challenges is to answer straightforward questions like “How much money do you make?” or questions about being rich vs. poor. In the section titled ‘Money Talk’, we have tried to answer some of these questions and given parents alternatives to help them come up with an answer. We believe that parents should not view these conversations as being uncomfortable, and instead see them as opportunities to share their financial values so that kids can develop a healthy relationship with money over time.

S: Conversations around pocket money, spending, saving, are easy to explain. But it is difficult for parents to explain to their children about handling finances in their absence. You want to do it in a very emotionally sensitive way where you don’t want your child to think that you will not be around, but at the same time make them aware that in the event of something happening to you, they are planned for and taken care of. And the pandemic has really driven that home.

Across socio-economic classes, people are buying more and spending more, so I’d say financial literacy is becoming even more important now.

Soneera Sanghvi

What aspect of finance do children find most difficult to understand?

B: For kids, I feel the power of compounding is a very difficult concept. Most people understand it because we learn it in school, but they don’t grasp the reality of it. It’s about understanding how small amounts of money can become huge amounts over time — be it in debt or in savings. In the book, we have also suggested different ways to show kids how compounding works, so that they can absorb the idea over time.

S: Children understand what interest means, but they don’t really understand how to make it work for them.

Most of us learn about interest in school, but it remains confined to the textbook. Why do you think there’s this gap between our lessons and our application in real life? How can the gap be bridged?

B: I think there are three aspects of financial literacy: knowledge, experience and observing. The school takes care of the knowledge part, but when kids are younger, they observe their parents. So after a point, when kids are older, they need to be given practical experience. For example, parents do open a bank account for their kids, but the kids are not involved in the process most of the time. Involving them and enabling them to ask questions helps kids build confidence and understand money.

What’s your No. 1 advice for parents when it comes to financially educating their kids?

S: Kids mirror what you do and not your advice… and it works for financial role modelling as well. So the biggest takeaway is practise what you preach, follow the role model behaviour you want your children to have and talk to them about it.

With previous generations, conversations around money often diverged when it comes to raising kids – boys were taught how to invest and girls were taught how to save money. I think that can change with future generations where we have holistic financial conversations with all our kids.

B: If we as parents want our kids to have a healthy relationship with money, we need to start teaching them some of these values and habits much earlier in life vs. them learning later through their mistakes. So starting early is really important…and teaching them how to grow and manage their money.

Piggy Bank to Portfolio is published by Juggernaut Books. Buy it here.