We want our children to have it all, and be financially literate too. In these times of ever-increasing expenses, the best way to teach children about saving and budgeting is to model these behaviours ourselves. I want to secure my son’s future and his dreams. With Instagram financial gurus preaching about new schemes and pitching SIPs using complex financial jargon, this may seem intimidating, but there’s no need to feel overwhelmed. Good old government schemes are a great starting point and I am going to outline the most effective ones. The interest rates on the plans mentioned are accurate as of April 1, 2024.

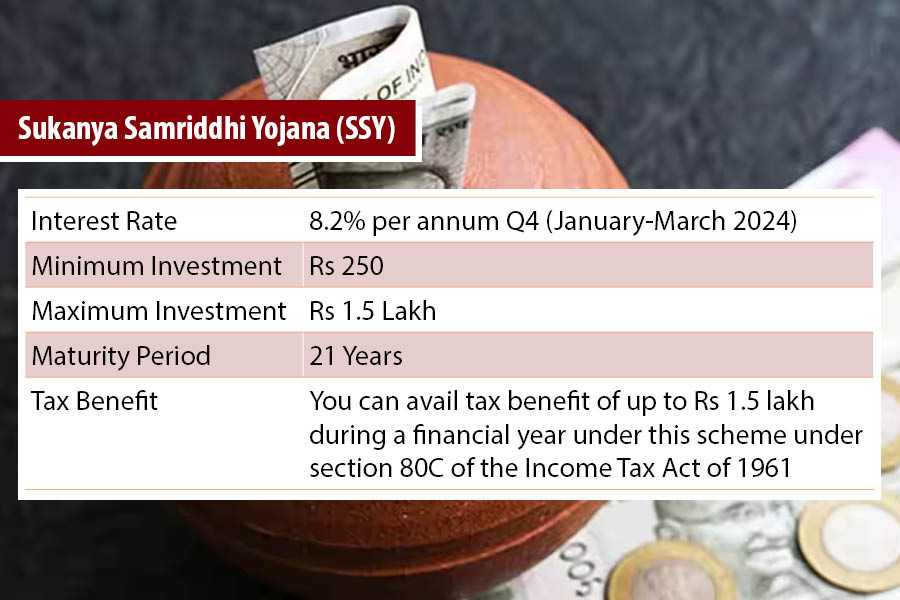

Sukanya Samriddhi Yojana

Launched as part of the Beti Bachao Beti Padhao campaign, the Sukanya Samriddhi Yojana is applicable for girl children only Shutterstock

In 2015, the Indian government launched a savings scheme known as Sukanya Samriddhi Yojana, which was intended to encourage parents to save leftover money for their daughters’ education and marriage. The account can be opened at any post office or any authorised bank till your daughter attains the age of 10 years. The maximum deposit limit for the year is Rs 1.5 lakh, and the minimum is Rs 250. At the age of 21, when it matures, she can withdraw all the money to spend on further education or a wedding. It allows partial withdrawals after the age of 18. The scheme enjoys a compounded interest rate of 8.2 per cent, the highest among small saving schemes.

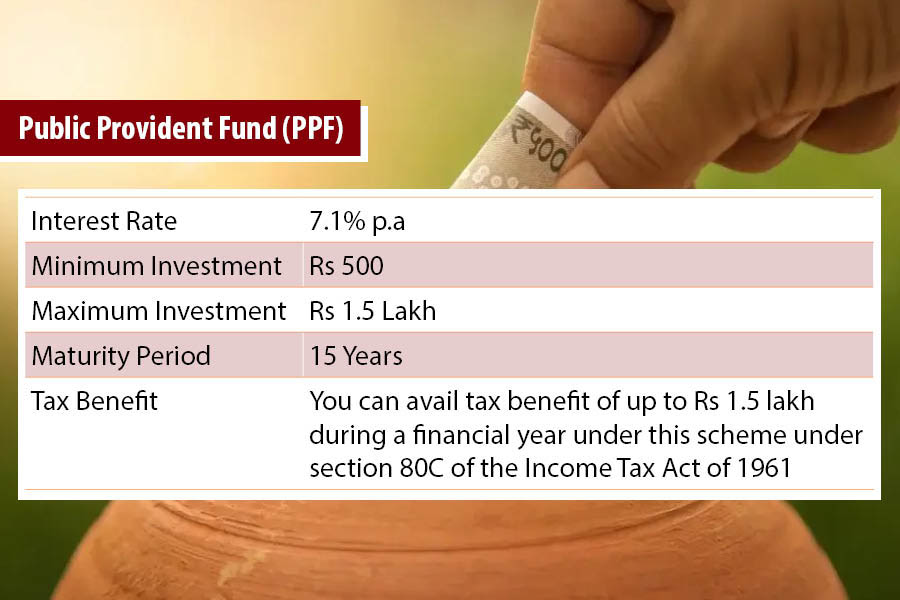

Public Provident Fund (PPF)

The Public Provident Fund is a popular and significant long-term investment scheme Shutterstock

It is a significant investment scheme targeted at tax-saving after its inception in 1968. Being an investor, you can keep investing in this fund and avail of the scheme benefits for an entire time frame of 15 years. PPF accounts can be initiated by any Indian citizen, including minors, at any post office or authorised bank. The minimum deposit amount is Rs 500 per financial year, while the maximum deposit amount is Rs 1.5 lakh. Depositors have the flexibility to opt for monthly, quarterly, or half-yearly instalments. The government determines the interest rate on PPF deposits every quarter. The current interest rate stands at 7.1 per cent per annum. The interest is compounded annually, meaning that the interest earned is added to the principal amount at the end of each financial year. Subsequently, the interest is calculated on the new principal amount in the following financial year. It allows partial withdrawal after seven years. Investing in PPF presents an excellent choice for securing children’s financial futures, offering several advantages.

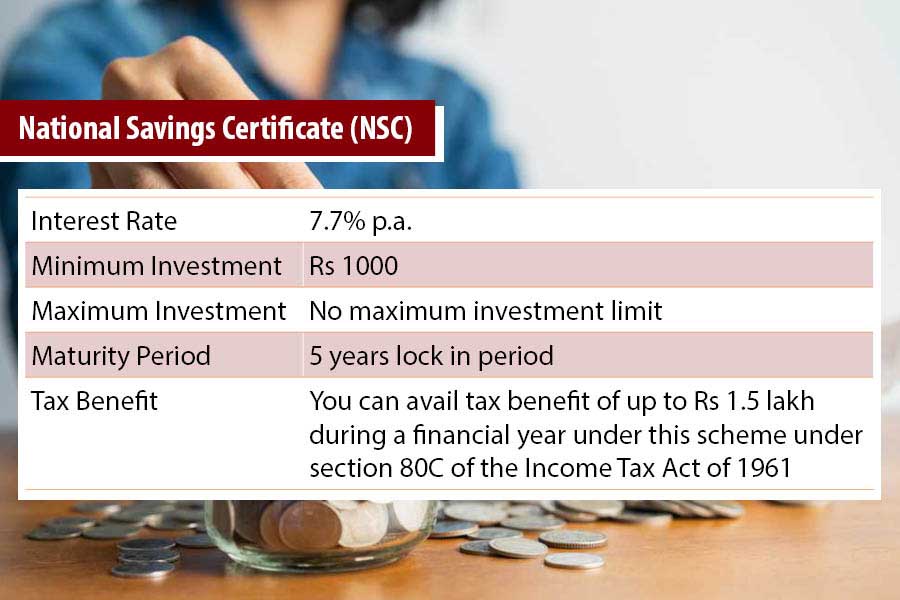

National Savings Certificate (NSC)

The National Savings Certificate is fixed-income investment scheme with a five-year lock-in period Shutterstock

A Government of India initiative, the NSC is a fixed-income scheme you can easily open with any post office while saving income tax. Minimum investment required to open an NSC account is Rs 1,000 and a monthly deposit in multiples of Rs 100. There’s no maximum investment limit on NSC accounts. Individuals, including minors aged 10 and above, have the option to invest in an NSC. Legal guardians or parents can also invest on behalf of a minor child. Presently, the NSC scheme is available in two modes: electronic mode (e-mode) or passbook mode. These can be acquired from public sector banks, specific authorised private banks, or post offices. For those with a savings account at an authorised bank or post office, the NSC scheme can be conveniently purchased online in e-mode, assuming internet banking is activated.

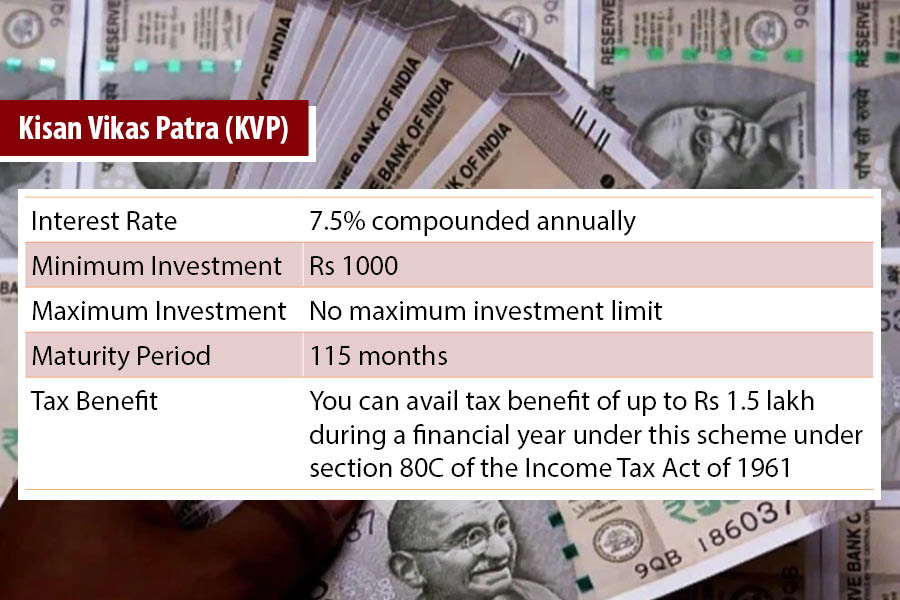

Kisan Vikas Patra (KVP)

An initiative of India Post, the Kisan Vikas Patra is a certificate scheme that doubles the initial investment Shutterstock

Kisan Vikas Patra was introduced in the year 1988 as a small saving scheme by India Post. This was mainly introduced to build the habit of saving in people for the long term. Any Indian citizen above the age of 18 is eligible and parents or legal guardians can apply on behalf of a minor. The scheme has been amended multiple times, and as per the latest amendment, the tenure of the scheme is 115 months, that is, nine years and four months, and the prevailing interest rate of KVP is 7.5 per cent per annum. You can operate the same on behalf of a minor as a legal guardian. One can invest a minimum of Rs 1,000, and there is no maximum limit on the investment. The investment must be in multiples of Rs 1,000. Any amount exceeding Rs 50,000 will need PAN details provided by the city’s head post office. Within the 115-month tenure, the amount invested would double itself, and one can withdraw the same after the tenure ends.

Government schemes aim to foster financial security, education funding and long term savings that are secure for your child. They are accessible, require minimal paperwork, and provide a jumpstart to building a financial umbrella for your little one. Offered across all post offices and select banks, they can be operated pan India and help become building blocks for a brighter future.

The author is an economist and full-time millennial mother, struggling to cope with daily chores