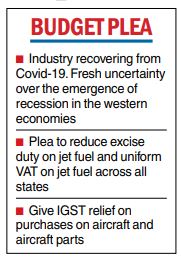

The aviation sector — recovering from Covid19 — has sought a wide range of concessions on jet fuel in the Union budget.

Airlines want the government to consider a reduction in the excise duty on aviation turbine fuel (ATF) and a uniform 4 per cent VAT on the fuel across all states, the Federation of Indian Chambers of Commerce and Industry (Ficci) said in its budget memorandum to the government.

They have also sought exemption on aircraft and aircraft parts from IGST (integrated GST). The industry is grappling with the consequences of the war in Ukraine and the emergence of recessionary conditions in several economies.

“The sector is gradually moving towards duopoly comprising Vistara-Air India and market leader IndiGo. The two carriers combined are in due course expected to achieve a domestic market share of 75-80 per cent,” CAPA India, an aviation consultancy, said. “This will redraw the market and consumer power in the international arena back to Indian carriers, which has been dominated by foreign airlines.”

The finance ministry was urged to reduce the burden on fuel cost by reducing the central excise duty rate on ATF to 5 per cent from 11 per cent in the short-run, the airlines said.

Airlines also asked finance minister Nirmala Sitharaman to push for a uniform tax rate of 4 per cent VAT/CST across the states to avoid disparity.

With states having the freedom to impose VAT, the rates range from 0 per cent to 30 per cent, with the rates in the 20-30 per cent bracket for 70 per cent of the ATF of airlines. VAT in India is one of the highest in the world. Besides, ATF is out of the GST, which has resulted in higher costs to the industry.

The import of ATF needs to be allowed under an open general license, the industry said. The announcement of prices by the refiners every fornight is relatively opaque compared with the pricing for international airlines.