Troubled ed-tech start-up Byju’s is heading on a collision course with the minority shareholders of its profitable arm, Aakash Educational Services Ltd (AESL).

Think and Learn Pvt Ltd (TLPL), which operates under Byju’s brand name, has sent a notice to the founders of AESL following their alleged resistance to complete a share swap that was unconditionally agreed as part of the sale of AESL, sources said.

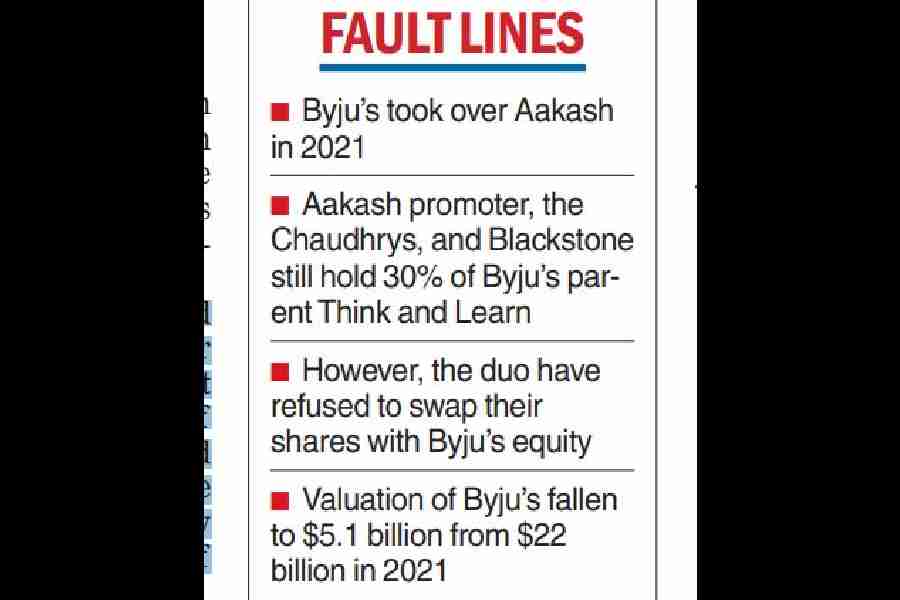

In 2021, Byju acquired AESL for nearly $940 million in a cash and stock deal. Post deal, TLPL owned 43 per cent while its founder Byju Raveendran another 27 per cent.

Founder Chaudhry’s family maintains about 18 per cent in AESL and Blackstone the remaining 12 per cent. The deal envisaged AESL merging with TLPL as it was more tax efficient for the seller Chaudhry’s.

However, due to delays in the proposed merger by the NCLT, TLPL has invoked the unconditional fallback agreement and issued a notice to the Chaudhry’s, requesting the execution of the share swap deal.

But the minority shareholders have declined to swap their equity holding in AESL with the firm’s parent TLPL, three sources aware of the matter said.

However, with the value of the start-up eroding to $5.1 billion from $22 billion in 2021 — according to Byju’s investor Prosus — the Chaudhry’s and Blackstone have not gone ahead with the share swap.

Around 70 per cent of the 2021 acquisition was made in cash, and the rest was meant to be adjusted against the equity of TLPL.

Sources said Blackstone and the Chaudhry family have written to Byju’s in the last few weeks, declining to comply with a TLPL notice sent in March to execute the share swap as per the original agreement.

Upon completion of the existing share swap obligation, the Chaudhry family’s stake in TLPL would be slightly below 1 per cent.

Chaudhry’s could face demands from the tax authorities, including on GST, in the swap deal, they said, adding that Chaudhry’s are eyeing a cash payout instead of a swap.

Byju’s declined to comment on the development while the query sent to AESL did not elicit any reply.

Sources said the share swap was an integral part of the acquisition agreement. The intention was to affect the share swap through a merger of AESL with TLPL, allowing for enhanced tax efficiency for the seller, Chaudhry’s, they added.

In June, Byju’s said that it will launch the initial public offering (IPO) of AESL by the middle of next year.

It had added that the revenues of AESL are on track to reach Rs 4,000 crore with an EBITDA (operational profit) of Rs 900 crore in the fiscal year 2023-24. Aakash has over 325 centres serving more than 4 lakh students.

The development comes at a time of separate reports which say that the Pai family from the Manipal group are planning to invest at least Rs 500 crore in Aakash.