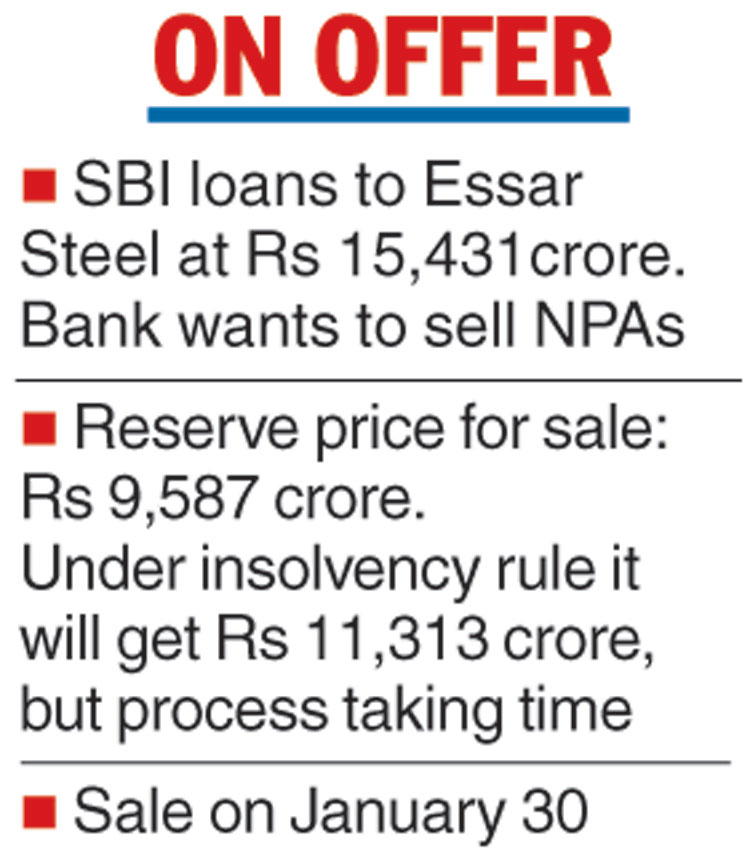

The State Bank of India (SBI) has put up for sale its entire exposure of Rs 15,431.44 crore to the debt-ridden Essar Steel.

“The State Bank of India invites expression of interest (EoI) from banks, ARCs, NBFCs, FIs for the proposed sale of its non performing financial assets with total dues of Rs 15,431.44 crore,” the country’s largest lender said in a sale notice put up on its website on Wednesday.

While setting the reserve price for the recovery of bad loans from Essar Steel India at Rs 9,587.64 crore, the SBI said it will be selling its exposure on a 100 per cent cash basis.

The lender said the resolution plan for the recovery of the non-performing asset (NPA) has been approved and filed in NCLT Ahmedabad, according to which the minimum recovery to the bank is Rs 11,313.42 crore.

The SBI said the reserve price is on the basis of net present value of minimum recovery discounted at 18 per cent with a time factor of one year.

The bank has asked interested entities that they can conduct due diligence of the asset with immediate effect, after submitting EoI and executing a non-disclosure agreement with the bank.

The sale of the NPA account is to happen through e-auction on January 30.

“We reserve the right not to go ahead with the proposed sale at any stage, without assigning any reason, subject to the extant RBI guidelines. The decision of the bank in this regard shall be final and binding,” the bank added.

In October last year, a committee of creditors (CoC) had picked ArcelorMittal to acquire the company for over Rs 42,000 crore.

ArcelorMittal's resolution plan for Essar Steel, included an upfront payment of over Rs 42,000 crore to settle debt and a further Rs 8,000 crore of capital injection into the company to support operational improvement, increase production levels and deliver enhanced levels of profitability.

Earlier, a group of operational creditors and Essar Steel shareholders had challenged the CoC decision.

While ArcelorMittal’s offer does not take care of dues of operational creditors, Essar Steel shareholders want to pay Rs 54,389 crore to clear all outstandings, including that of operational and financial creditors.

Incidentally, the Ahmedabad bench of the National Company Law Tribunal (NCLT) will pass an order by January 31 on the maintainability of the settlement proposed by Essar Steel Asia Holdings Ltd (ESAHL).

ESAHL had told the bench that lenders not considering its debt settlement proposal, which was higher than its rival offer, is surprising. However, ArcelorMittal, told the bench that there is no right to redemption under the bankruptcy law as being sought by ESAHL.

The Telegraph