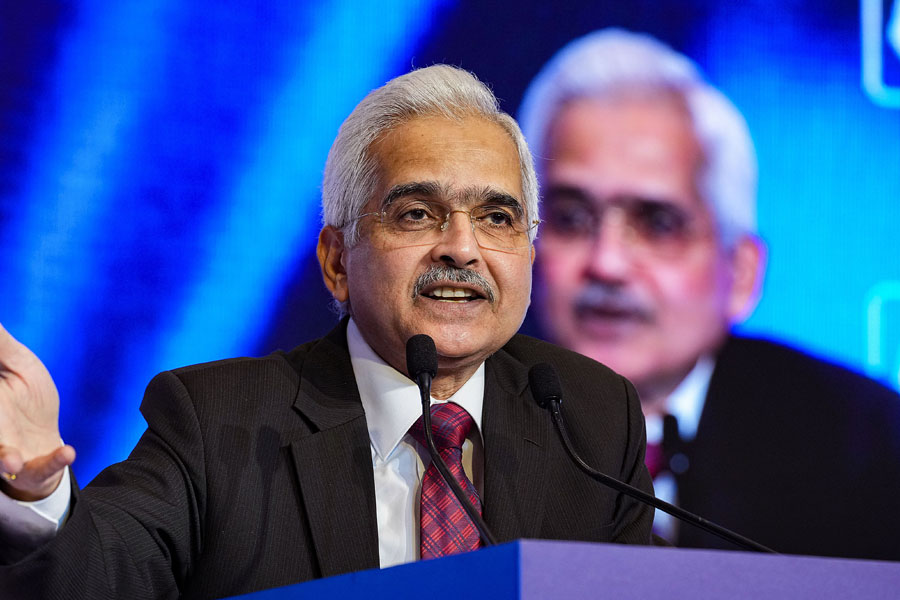

Reserve Bank of India governor Shaktikanta Das has said the banking regulator has come across several instances of lenders trying to hide the true state of the stressed assets in their books, admitting for the first time that the age-old problem of papering over bad loans in the banking industry hadn’t ended.

“During the course of our supervisory process, certain instances of using innovative ways to conceal the real status of stressed loans have come to our notice,” Das said during his inaugural address to directors of banks at a conference organised by the RBI.

The RBI governor did not name any bank but he illustrated the innovative methods that banks were using to brush the problem under the carpet.

The fact that Das has decided to raise the issue so dramatically suggests that the banking regulator could take action against errant banks in the days ahead.

Das said the RBI’s supervisors had spotted instances of sale and buyback of stressed loans between two lenders, structured deals with good borrowers to conceal stress, and disbursement of new loans close to the time of repayment.

“Such methods include bringing two lenders together to evergreen each other’s loans by sale and buyback of loans or debt instruments; good borrowers being persuaded to enter into structured deals with a stressed borrower to conceal the stress; use of internal or office accounts to adjust borrower's repayment obligations; renewal of loans or disbursement of new /additional loans to the stressed borrower or related entities closer to the repayment date of the earlier loans; and similar other methods…Such practices beg the question as to whose interest such smart methods serve. I have mentioned these instances to sensitize all of you to keep a watch on such practices,” he said at the conference.

This suggests that the pernicious practice of ever-greening loans — where a bank uses various artifices to label a loan as “standard” even though the borrower is on the verge of default — hasn’t really gone away and, therefore, kindles suspicions that things may not be as hunky dory as the regulator and the banks have been trying to portray.

The banking system has reported a sharp decline in the level of bad loans over the past five years.

After standing at nearly 16 per cent in March 2018, the gross NPA ratio declined to 4.41 per cent at the end of December 2022, from 5.8 per cent in March 2022 and 7.3 per cent on March 31, 2021. It is expected to further fall in the January-March 2023 period.

NPA stands for non-performing assets, which is banking parlance for bad loans.

“Over-aggressive growth, under-pricing or over-pricing of products both on the credit and deposit sides, concentration or lack of adequate diversification in deposit/ credit profile can expose the banks to higher risks and vulnerabilities,” he said.

The governor said that while the RBI had nudged banks to adjust their business strategies in some cases where they were creating “avoidable vulnerabilities” by being too aggressive, it did not interfere with their commercial decision-making.

Just over a month ago, the RBI governor had claimed in Washington during the annual spring meeting of the World Bank and the International Monetary Fund that the Indian financial system was “completely insulated” from the recent, spectacular bank collapses in the US and Switzerland that had rocked the global financial system.

“Our banking system is resilient, stable and healthy,” Das had said then. “All the parameters — capital adequacy, percentage of stressed assets, liquidity coverage ratio of individual banks both at individual and at the systemic levels, provision coverage ratio, aspects like net interest margin of banks, and profitability of banks — showed that the Indian banking system continues to be very healthy.”

Governance gaps

The RBI governor also flagged another issue of concern: independent directors on the boards of banks were not doing enough to hold top bank officials to account and were happy to let the executive chairman or CEO dominate decision-making.

“We would not like this type of situation to develop. At the same time, there should not be a situation where the CEO is inhibited from doing his duties,” he added.

“It is necessary that independent directors are truly independent; that is, independent not only of the management but also of controlling shareholders while discharging their duties,” Das said. He urged the independent directors to always remember that their loyalty is to the bank and no one else.

He said the RBI had uncovered several governance gaps at certain banks which have the potential to cause some degree of volatility in the banking sector. Some of these deficiencies have been mitigated, Das said but added that it was necessary that the boards and the managements do not allow such gaps to appear.

According to Das, the board of directors, particularly the audit committee of the board (ACB), should pay close attention to the accounting policies followed by banks and implement preventive controls to preclude smart or aggressive accounting practices. He added that the board or the ACB should engage with the statutory central auditors of the bank to ensure that their financial reporting is transparent and prudent.

Das also advised banks to be cautious in the pursuit of their growth strategies, pricing and portfolio composition.

Over the past few years, the RBI has tightened its supervisory standards. One such crucial area relates to the appointment or re-appointment of CEOs of private sector banks. In 2021, it released new norms that set a maximum tenure of 15 years. In the case of CEOs who are part of the promoter group, the tenure was fixed at 12 years. These are subject to a maximum age cap of 70.