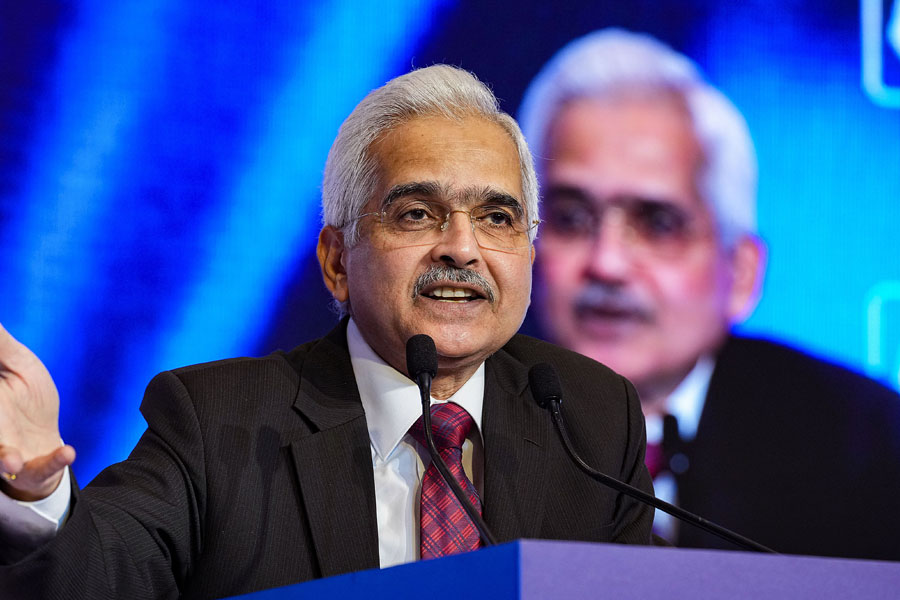

Reserve Bank of India (RBI) governor Shaktikanta Das on Wednesday said the moderation in inflation does not afford any scope for complacency on the price front as there is uncertainty over the impact of El Nino on the economy. Das was speaking at the CII annual session in Delhi.

At its last meeting in April, the monetary policy committee (MPC) of the RBI sprang a surprise by keeping the policy repo rate unchanged at 6.50 per cent which led to many economists saying the rate formed a pivot for rate cuts in the future.

Das had then said that it was a case of a pause in rates and not a pivot, and his views at the CII meet reiterated the stand. The next meeting of MPC is scheduled from June 6-8.

Retail inflation had cooled to an 18-month low of 4.7 per cent in April largely because of a moderation in food and vegetable prices — and the next number could be lower. “Inflation has moderated (and) the last print is 4.7 per cent. Perhaps the next print could be lower.” But while inflation was looking benign, policymakers must remain alert. “We have to remain alert. There is no cause for complacency. Especially, we will have to see how the El Nino factor, which has been anticipated plays out.’’

“There is evidence of positive Indian Ocean Dipole, which to some extent should be able to neutralise the impact of El Nino. But let us leave that to weather experts. This is an uncertainty which only time will tell to what extent it affects our economy,” he said.

At the MPC’s April meeting, he had cautioned that though prices will soften over the fiscal, the fall in inflation is likely to be slow and a protracted one and the estimated number in the fourth quarter at 5.2 per cent would still be well above the target of 4 per cent. He had said the central bank had to persevere with its focus on bringing about a durable moderation in inflation. At the CII meeting, Das looked back at the MPC’s decisions to raise rates by 250 basis over the past year and then hit pause in April and said the panel had been prudent and proactive in its approach.

He defended the decision to hike rates back in May 2022. “Nobody likes to give surprises. But subsequent developments have shown that the MPC’s surprise meeting in May 2022 was the correct decision.’

He went on to say that the move to go for a pause in April was also a prudent step. This decision was taken as the rate-setting panel wanted the effect of the six previous hikes to reach out across all the sectors. The RBI governor cited the moderation of inflation as one of the signs of economic stability. The current account deficit is manageable, fiscal deficit is on a consolidation path, while there is sustained GDP growth.

“So, on the back of macroeconomic stability and a robust financial sector, the percentage of gross non-performing assets of the banking sector at the systemic level was 4.4 per cent at the end of December 2022.”

Bad loans which were once a pain point have come down. Moreover, banks are witnessing resilient credit growth at 16.5 per cent. “And on top of that, we have the advantage of demography. And it’s something which will eventually add to our potential output or what some people prefer to call India’s growth potential. That’s a theme, which will play out in the medium- to long-term.” He expressed confidence in the final growth estimates of the last fiscal to be higher than the projected 7 per cent. On the downside risk to the economy, Das said any surprises on the geopolitical front could be a drag along with a slowdown in exports.