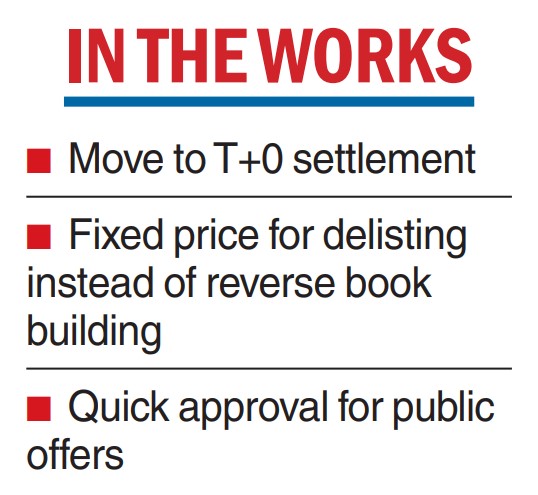

The Securities and Exchange Board of India (Sebi) is working on the instant settlement of stock market transactions and is mulling fixed prices instead of reverse book building in delisting, chairperson Madhabi Puri Buch said here on Monday.

India fully transitioned to a T+1 settlement system for equities in January. An investor buying shares will get delivery the next day as is the case for sellers. The country had earlier followed the T+2 system.

Buch said the market regulator is thinking of taking one further step. “One of the things that we think is not very far off is instantaneous settlement on the stock exchanges. We are currently working on that.’’

She did not give any timeline for the reform.

Reforms in delisting is the second major change under the consideration of the regulator. The bourses follow a reverse book-building process.

Buch said there are concerns that the reverse book-building process is being misused by certain operators. They pick up over 10 per cent of stock in a company in concert and move up the prices, which leads to delisting getting more costlier for companies. The regulator is also focussing on quick approvals of public offers with the help of technology.