The Reserve Bank of India (RBI) on Wednesday announced guidelines for digital lenders as it sought to crack down on unauthorised platforms that had mushroomed in the past.

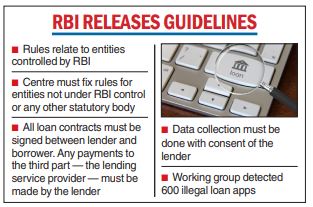

Accepting some of the recommendations made by a working group, the RBI said the guidelines were prepared on the principle that the lending business can be carried out only by entities that are either regulated by the RBI or entities permitted to do so under any other law.

It divided digital lenders into three groups: entities regulated by the central bank; those authorised to carry out lending as per other statutory or regulatory provisions but not regulated by the RBI; and entities lending outside the purview of any statutory or regulatory provisions.

The RBI’s regulatory framework focuses on the first group: those regulated entities (RE) that come under its regulatory purview and lending service providers (LSPs) engaged by them to offer credit services.

LSP is an agent of the regulated entity — which may be a bank — who carries out for a fee from RE one or more of the lender’s functions in customer acquisition such as underwriting support, pricing support, disbursement, servicing, monitoring, collection and recovery of specific loan.

With regard to the players in the second category, the RBI said that the respective regulator or the controlling authority may consider formulating or enacting appropriate rules and regulations on digital lending.

For the entities in the third category, its working group had suggested specific legislative and institutional interventions for consideration by the central government to curb the illegitimate lending activity being carried out by them.

The RBI said that all loan disbursals and repayments are required to be executed only between the bank accounts of a borrower and RE without any pass-through via a pool account of LSP or any third party.

Any fees or charges, that are payable to LSPs in the credit intermediation process will be paid directly by RE and not by the borrower.

The all-inclusive cost of digital loans in the form of annual percentage rate (APR) must be disclosed to the borrowers. APR should be based on all-inclusive cost and margin such as cost of funds, processing fee and verification charges. APR must be disclosed to the borrower upfront as part of the key fact statement, provided in a standardized format.

The RBI also barred an automatic increase in credit limit without the explicit consent of the borrower.

Data collected by the digital lending apps (DLAs) should be need-based and should have clear audit trails. It should be collected with prior explicit consent of the borrower.

Data collected by the digital lending apps (DLAs) should be need-based and should have clear audit trails. It should be collected with prior explicit consent of the borrower.

The borrowers have the option to accept or deny consent for use of specific data, including the option to revoke previously granted consent.

The central bank in January 2021 had set up a working group to study all aspects of digital lending activities in the regulated financial sector as well as by unregulated players.

The group found around 1,100 lending apps on Android, of which around 600 were illegal loan apps.