The Telegraph

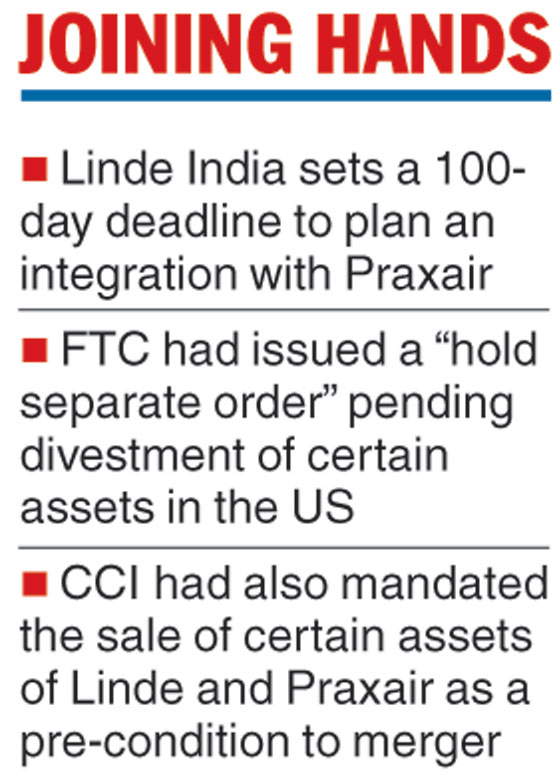

Industrial gas major Linde India has set a 100-day deadline to come up with plans to integrate its business with rival Praxair India to bring about a synergy between competing and complementing operations of the two entities.

In a filing with the bourses, Linde on Monday said it would “actively evaluate” various options for potential integration, following approval from the Federal Trade Commission of the US.

Even though the global merger between Linde Aktiengesellschaft (the erstwhile ultimate parent of Linde India) and Praxair Inc (the erstwhile ultimate parent of Praxair India) was completed on October 31, 2018, the FTC had issued a “hold separate order” (HSO) pending divestment of certain assets in the US.

The HSO mandated that until the completion of the majority of such divestitures in the US, Linde AG and Praxair operate their businesses globally as separate and independent companies, and not co-ordinate any of their commercial operations.

The HSO also prohibited the companies from sharing commercially sensitive information between them. On March 1, 2019, the aforesaid divestitures were completed and the HSO ceased to be applicable, the company informed the bourses.

“The lifting of the HSO as above now permits Linde India to have an insight into the businesses and assets of Praxair India, thereby enabling Linde India to actively evaluate various options and plans available to Linde India and Praxair India for possible/ potential integration between the two companies.

Over the next 100 days, Linde India will evaluate an appropriate integration plan for realising synergies between the competing/synergistic businesses of Linde India and Praxair India,” the company told the bourses.

CCI mandate

Back home, the Competition Commission of India has also mandated the sale of certain assets of Linde and Praxair as a pre-condition to the merger.

While announcing the quarterly result on February 19, 2019, Linde said it was in talks with “potential buyers” for sale. It expected that the fair value of the assets, minus cost to sale, would be higher than the aggregate carrying value of Rs 240 crore.

On September 9, 2018, the CCI had asked Linde to sell its entire shareholding in Bellary Oxygen Company , a joint venture between Linde and Inox Air Products, and an on-site plant in South India, JSW – 2 located at Bellary, Karnataka and two cylinder filing stations located in Hyderabad and Chennai.

Simultaneously, it also asked Praxair to sell three on-site plants in the east, Tata 1 and Tata 2 and 3 located at Jamshedpur and two cylinder filing stations located at Asansol and Calcutta.

Delisting

The merger plans are being outlined at a time promoters are seeking to buy out the rest of the shareholders through a buyback offer. Non-promoters hold 25 per cent in Calcutta-based Linde India, formerly known as BOC India.