After selling its East-West gas pipeline to an infrastructure investment trust (InvIT) sponsored by Brookfield, Reliance Industries Ltd has used this instrument to shed the liabilities of telecom arm Reliance Jio by around Rs 1,07,000 crore.

InvITs are like mutual funds that pool in money from various entities to invest in infrastructure assets.

At present, there are 11 such registered trusts regulated by the Securities and Exchange Board of India (Sebi).

Jio had recently received the approval of the National Company Law Tribunal (NCLT) to demerge its fibre and tower assets into two separate units (SPVs).

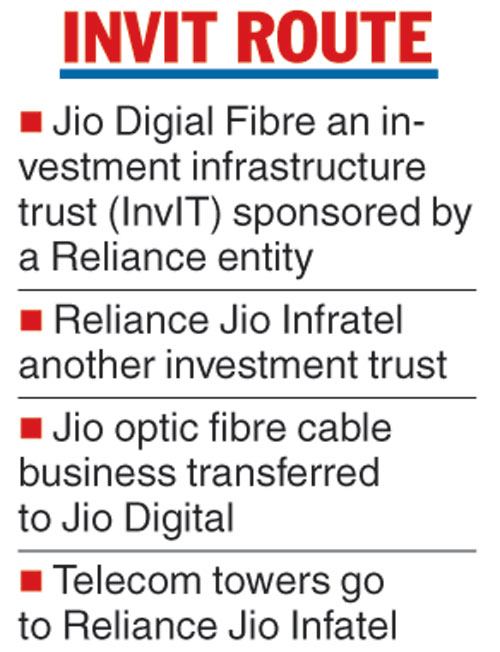

The majority stakes of these units have been transferred to InvITs. Reliance Industrial Investments and Holdings Ltd, a wholly owned subsidiary of RIL, is the sponsor of these InvITs.

Jio has demerged its optical fibre cable undertaking to Jio Digital Fibre Pvt Ltd (JDFPL).

The Telegraph

The tower infrastructure undertaking has been transferred on a slump-sale basis to Reliance Jio Infratel Pvt Ltd (RJIPL).

RIL, being the shareholder of Jio, will receive the equity shares and optionally convertible preference shares pursuant to the transfer of the fibre business.

According to an investor presentation put up by RIL, the fair value of JDFPL alone is Rs 1,65,000 crore based on studies by internationally reputed firms. It said the transaction will lead to the deleveraging of Jio’s balance sheet even as the arm will save on future capex on passive infrastructure as this will be undertaken by the two entities.

The trusts will hold assets of 7-lakh-route km of fibre, which is being expanded to around 11-lakh-route km, apart from 175,000 built and under-development towers. The company said the average age of these towers were less than two years and were predominantly based on the ground with the ability to take on multiple tenants.