The lenders of Jet Airways, which stopped operations in April, will invite expression of interest (EoI) for the airline by the end of this week.

At the meeting of the committee of creditors on Tuesday, attended by resolution professional Ashish Chhauchharia of Grant Thornton, it was decided the EoI would be issued by July 20, or early next week. The deadline for the interested parties to submit their bids is likely to be in the first week of August.

The meeting comes after a two-member bench of the National Company Law Tribunal (NCLT) directed the RP to finish the resolution process for the airline in three months. The RP has received claims from financial and operational creditors, apart from the employees. The amount of claims accepted by the RP will be announced over the next few days.

The exposure of lenders, led by the SBI, to Jet is put at Rs 8,500 crore, The airline also owes Rs 10,000 crore to its vendors, which are mainly aircraft lessors, and over Rs 3,000 crore to its employees.

Meanwhile, a section of the employees of JetLite, a wholly-owned subsidiary of Jet, on Tuesday demanded that they be included in the ongoing insolvency proceedings.

The Telegraph

Shekhar Nanavaty, a lawyer representing around 150 employees of JetLite, told reporters here that they plan to move the NCLT for inclusion in the ongoing proceedings. The insolvency resolution professional did not accept the claims of the JetLite employees, he said.

Nanavaty said the dues owed to these 150-odd employees was around Rs 50 crore. The staff include pilots and aircraft maintenance engineers. PTI quoting Anil Shukla, a pilot with JetLite, said there were around 600 employees with the airline. JetLite was formerly Air Sahara, which was bought by Jet Airways in 2007 and operated as a budget carrier.

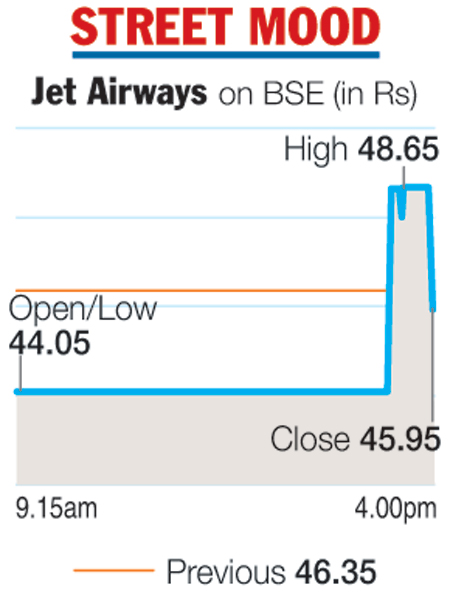

Shares of Jet Airways on Tuesday continued to be in the red as it settled nearly a percent lower at Rs 45.95.

It is also learnt that the lenders may raise some amount of priority debt in the interim. Earlier, the Hindujas had expressed interest in acquiring the airline and recent reports indicate it may team up with Etihad.

Last month, an employees consortium and Adi group had announced a partnership to bid for 75 per cent of Jet through the NCLT process.

The airline’s assets include 14 aircraft including 10 Boeing planes — down from 124 before the grounding — and a 49 per cent stake in Jet Privilege and a few buildings, while its liabilities are over Rs 36,000 crore, including more than Rs 10,000 crore of vendor dues, Rs 8,500 crore along with interest to the lenders, over Rs 3,000 crore in salary dues and more than Rs 13,500 crore in accumulated losses of the past three years.

The company is no more a going concern and had for many years run into negative networth.

The lenders also list spares, slots and routes as the ”assets” of the airliner that was promoted by Naresh Goyal and operated its last flight on April 17.