A total of 12 cases of GST evasion involving Rs 345 crore have been detected against lottery distributors since July 2017, Parliament was informed on Monday.

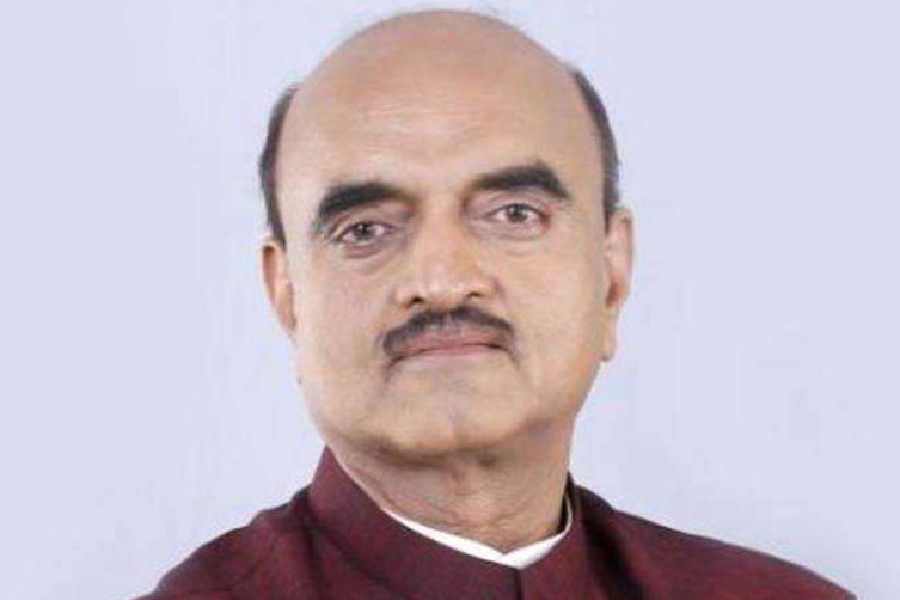

Minister of State for Finance Bhagwat Karad in a written reply to the Lok Sabha said Rs 622 crore, including interest and penalty, have been recovered from lottery distributors from July 2017 till November 2023.

"Twelve cases involving GST evasion of Rs 344.57 crore have been detected against lottery distributors and Rs 621.56 crore (including interest and penalty) has been recovered/realized from July 2017 to till November 2023," Karad said.

Karad further said the Finance Ministry had received a reference from the Ministry of Home Affairs (MHA) for comments regarding disbursement of prize amount of lotteries through formal banking channel.

"Comments in this regard have been sent to MHA. Using formal banking channel for any kind of transaction, including disbursement of lottery prize, is helpful in mitigating the associated money laundering/terrorist financing/proliferation funding risks in view of the robust banking system and effective regulation/supervision of the regulated entities," Karad said.

Under income tax law, a 30 per cent Tax Deducted at Source (TDS) is to be levied on winnings from lotteries, game shows, card games, online games provided the earnings exceed Rs 10,000 in a fiscal.

"The Income Tax Department takes appropriate action in cases involving evasion of tax whenever any credible information/intelligence of violation of provisions of direct tax laws relating to any taxpayer comes to its notice. Such action under direct tax laws includes conducting enquiries, mounting search and seizure or survey action, assessment and consequential action...," Karad said.

Except for the headline, this story has not been edited by The Telegraph Online staff and has been published from a syndicated feed.