The board of state-run Dena Bank on Monday approved its merger with Bank of Baroda along with another state-run lender, Vijaya Bank.

Last week, the government had announced the merger of Bank of Baroda, Vijaya Bank and Dena Bank to create the country’s third largest lender.

“The board meeting has decided to recommend for amalgamation of our bank with Bank of Baroda and Vijaya Bank,” Dena Bank said in a filing to exchanges.

The consolidation will enable creation of a bank with business scale comparable with global banks and capable of competing effectively in the country and globally, it said.

“Merger of our bank with BoB and Vijaya Bank would result in a strong amalgamated bank, equipped with a financial cushion to deal with post amalgamation requirements during the stabilisation phase,” the bank said.

Consolidation would also provide impetus for building banks with scale, ramping up credit growth, adoption of best practices across amalgamating entities for cost efficiency and improved risk management and financial inclusion through a wider reach, it said.

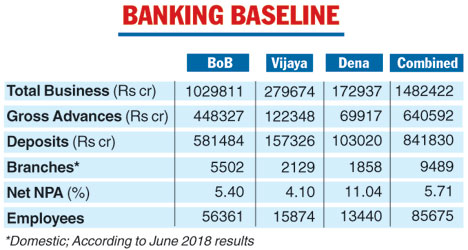

The combined business of the entities would make it the second largest state-run bank after the State Bank of India. As of June 2018, the combined business mix of these three lenders stood at Rs 14.82 trillion.

While announcing the merger last week, financial services secretary Rajiv Kumar had said the merged entity would have a greater financial strength.

Dena Bank’s net NPA ratio will be at 5.71 per cent, significantly better than the public sector banks’ average of 12.13 per cent, he had said. The provision coverage ratio would also be better at 67.5 per cent against an average of 63.7 per cent and cost-to-income ratio of the combined entity would come down to 48.94 per cent compared with the average of 53.92 per cent.

The amalgamation of the three banks would be through a share swap, which will be part of the scheme of merger.

After the merger of BoB, Vijaya Bank and Dena Bank, the number of PSU banks will come down to 19.