New Delhi: The move to merge Bank of Baroda, Vijaya Bank and Dena Bank will create the third largest lender in the country behind the State Bank of India and ICICI Bank.

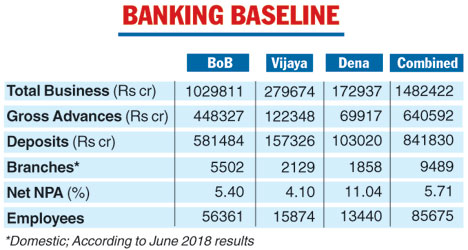

The merged bank will have combined deposits of Rs 8.41 lakh crore, gross advances of Rs 6.4 lakh crore, 9,489 branches and an employee base of 85,675.

Dena Bank is the weakest of the three banks and was placed under the Reserve Bank of India's prompt corrective action (PCA) framework, which has restrained it from further lending after its gross non-performing assets (NPA) ratio topped 22 per cent, the highest in the industry.

The big rationale for the merger is to reduce the number of public sector banks by merging the weak banks with stronger ones.

As a result of this merger, the net NPA of the combined entity will fall to a manageable 5.71 per cent. The net NPA of Dena Bank is currently at 11.04 per cent, while it is 4.1 per cent for Vijaya Bank and 5.4 per cent for Bank of Baroda.

In absolute terms, the gross non-performing assets will be at roughly Rs 80,000 crore, which means the gross NPA ratio will work out to about 13 per cent.

Bank of Baroda chief executive officer P.S. Jayakumar said that the combined entity will "benefit from a higher CASA (current account savings account) ratio and a well-diversified loan book".

"With the benefits of scale...a reasonable assumption is that there is a good opportunity to grow but that is something that will happen over a period of time," Jayakumar added.

The three banks have shown mixed results in the first quarter ended June 30. While Bank of Baroda more than doubled its profits in the April-June quarter to Rs 528.26 crore, Vijaya Bank reported a 57.5 per cent increase in net profit at Rs 254.69 crore.

Dena Bank, however, saw its first-quarter loss widen to Rs 721.71 crore in the June quarter from Rs 132.65 crore in the year-ago quarter.

The move to consolidate state-owned banks gathered steam after the Modi government approved the merger of five associate banks with the State Bank of India in February 2017.

Later in March that year, the cabinet approved the merger of Bharatiya Mahila Bank with the SBI. The SBI had first merged the State Bank of Saurashtra with itself in 2008. Two years later in 2010, the State Bank of Indore was merged with it.

While the announcement came after market hours on Monday, the Dena Bank scrip had closed at Rs 15.95 - a drop of 0.62 per cent over its last close. The BoB share ended higher by 0.41 per cent at Rs 135.10, while Vijaya Bank gained almost a per cent at Rs 59.80.

However, shares of Bank of Baroda (BoB) and Vijaya Bank are likely to come under selling pressure when trading resumes on Tuesday as these two lenders absorb a weak entity like Dena Bank.

"BoB and Vijaya Bank shares are likely to open in the red as these two banks will have to absorb the loss-making Dena Bank, which has a high amount of bad loans. The Dena Bank scrip is likely to rally,'' an analyst said.

He, however, added that the merger will be beneficial for BoB (into which the other two are likely to be amalgamated) in the longer run as its presence will improve, particularly in the western and southern regions and its loan book will grow.