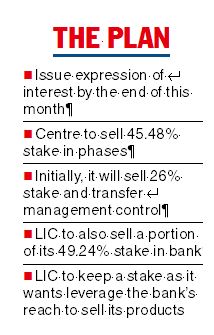

The government plans to issue Expression of Interest (EoI) for the strategic sale and management control of IDBI Bank later this month .

“The road shows have resulted in promising interest from investors and few more would be held before coming up with EoI by this month-end,” a senior finance ministry official said.

The government plans to sell its entire 45.48 per cent stake in the bank. Initially, the Centre may look to sell around 26 per cent along with handing over management control to attract investors, the official said.

Promoter Life Insurance Corporation will also sell a portion of its 49.24 per cent stake in the bank with an intent to relinquish management control.

“The entire stake may not be offloaded at one go as the new bidder will have to infuse fresh equity into IDBI Bank...the bidder may choose not to pay off the government and LIC’s shareholding,” Tuhin Kanta Pandey, secretary, department of divestment, told The Telegraph.

IDBI Bank became a subsidiary of LIC with effect from January 21, 2019, when the insurer bought an additional 82.7 crore shares of the bank.

On December 19, 2020, the bank was reclassified as an associate company of LIC whose shareholding fell to 49.24 per cent following the issue of

additional equity shares by the bank under a Qualified Institutional Placement (QIP) to investors. The bank raised Rs 1,435 crore from 44 investors.

Non-promoter shareholding stands at 5.29 per cent. IPO-bound LIC plans to retain some of its stake in the bank so that the insurer continues to reap the benefits of the bancassurance channel.

The Cabinet Committee on Economic Affairs had given in-principle approval for strategic disinvestment and the transfer of management control in May last year.

The amendments to the IDBI Bank Act have been made through Finance Act 2021, and transaction advisors appointed for the sale.

It is expected that these strategic buyer will infuse funds, technology and best management practices for optimal development of business potential and growth of IDBI Bank, minister of state for finance Bhagwat Karad had told Parliament recently.

He said the concerns of the existing employees and other stakeholders will be addressed in the share purchase agreement.

The sale of IDBI Bank will be the first such case of “voluntary discovery” of the buyer through an open bidding process. In similar cases, banks have been sold to buyers only under distress situations.

IDBI Bank, after a gap of five years, returned to profits in FY21. It reported net profit of Rs 1,359 crore. IDBI Bank has reported a 53 per cent jump in standalone net profit at Rs 578 crore for the third quarter ended December 2021.