Shareholder activism acquired momentum at the annual general meetings of Britannia Industries and Reliance Power.

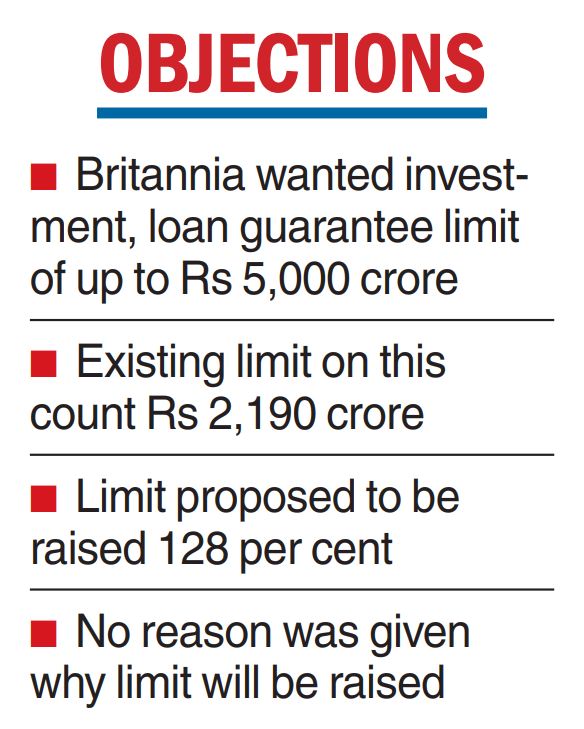

Britannia shareholders on June 28 voted against a board resolution for permission to make investments, and offer loans, guarantees and security up to Rs 5,000 crore.

Reliance Power shareholders on June 2 have turned down a special resolution to monetise its assets.

At the company’s 103rd AGM, held in the virtual mode, Britannia had placed six resolutions — three ordinary resolutions and three special resolutions.The special resolutions sought shareholder approval for the reappointment of independent director Keki Elavia, remuneration to be paid to chairman and non-executive director Nusli Wadia and sanction for an investment limit of Rs 5,000 crore under section 186 of the Companies Act.

While five of the six resolutions were passed, shareholder activism was in evidence in the vote on Wadia’s salary and the resolution on the financing limit.

The resolution on Wadia’s Rs 7.35 crore salary barely scraped through with 76.94 per cent votes in favour against the mandatory requirement of 75 per cent for a special resolution to pass. Only 73 per cent of the votes were cast in favour of the resolution on the financing limits, prompting the company to inform the bourses that it had not been passed “with the requisite majority”

The voting has been in line with the proxy advisory on the company’s AGM resolutions.

Proxy advisory firm Institutional Investor Advisory Services said Britannia’s existing approval of limits for making investment, loans, guarantees and security under Section 186 of the Companies Act, 2013 stand at Rs 2,190 crore, with utilisation lower at around Rs 1,840 crore.

But the company has now sought a 128 per cent increase in the available limit without stating the reasons before the shareholders.

“Under section 186, the company can give loans, and guarantees ... because of the expanded scope of the regulation, we expect companies to provide clarity with respect to the purpose of these limits — more specifically the companies to which the support will be extended, the expected quantum of transactions with each of these companies, and the rationale for extending such support.”

“In Britannia’s case, the proposed increase in limits toRs 5,000 crore was high, and the rationale for seeking such a large increase was unclear,” Hetal Dalal, president and chief operating officer, IIAS, told The Telegraph.

Reliance Power

Reliance Power shareholders have turned down a special resolution on asset monetisation.

As much as 72.02 per cent of votes were cast in favour of the resolution, while 27.97 per cent voted against it. Thus the special resolution could not be passed at the AGM.