Encouraging macroeconomic data set the mood on Monday with the benchmark indices ringing in the New Year on a positive note — the Sensex gaining 327 points and the Nifty edging close to the 18200-mark.

The Indian markets gained momentum on their own from domestic developments with the bourses in Singapore, Japan and Hong Kong closed because of the New Year holiday. However, European indices were trading higher during the day.

Market circles said positive domestic data — in GST collections and manufacturing sector activity — supported the buying sentiment. With corporate India set to report their quarterly numbers from next week, there is growing optimism that they will report good numbers.

“The markets welcomed 2023 on a high spirit in the absence of global cues. Strong macros and expectations of healthy corporate earnings provided the support to domestic equities.

We expect the market to remain steady with a positive bias ahead of the December quarterly results and run up to the crucial Union budget in February. This should drive sector specific action in the market,” Siddhartha Khemka, head — retail research, Motilal Oswal Financial Services Ltd, said.

In Monday’s trading, the 30-share Sensex opened mildly in the green at 60871.24 points and built on its gains to rise 327.05 points or 0.54 per cent to end at 61167.79. Similarly, the broader NSE Nifty rose 92.15 points or 0.51 per cent to 18197.45.

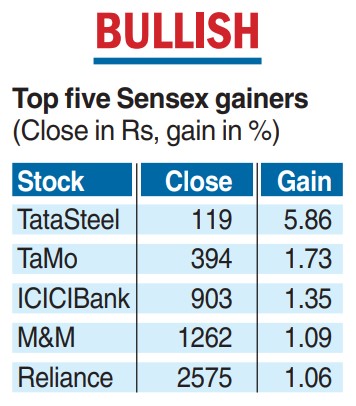

Tata Steel led the gainers list in the Sensex chart as it shot up 5.86 per cent. It was followed by Tata Motors, ICICI Bank, Mahindra & Mahindra, Reliance Industries, Infosys, NTPC and Bharti Airtel which rose up to 1.73 per cent.

On the other side, Asian Paints, Titan, Tech Mahindra, Sun Pharma, Bajaj Finance and SBI were among the laggards, losing as much as 1.47 per cent.

In the broader market, the BSE small-cap index rose 0.84 per cent while the midcap index advanced 0.57 per cent.

Among sectoral indices, metals jumped 2.83 per cent, telecommunications climbed 1.32 per cent, services (1.08 per cent), commodities (1.23 per cent), realty (0.99 per cent) and industrials (0.76 per cent).

The rupee ended at 82.75 to the dollar against the previous close of 82.73 to the dollar, after opening higher at 82.66. The rupee is likely to remain range-bound this week.