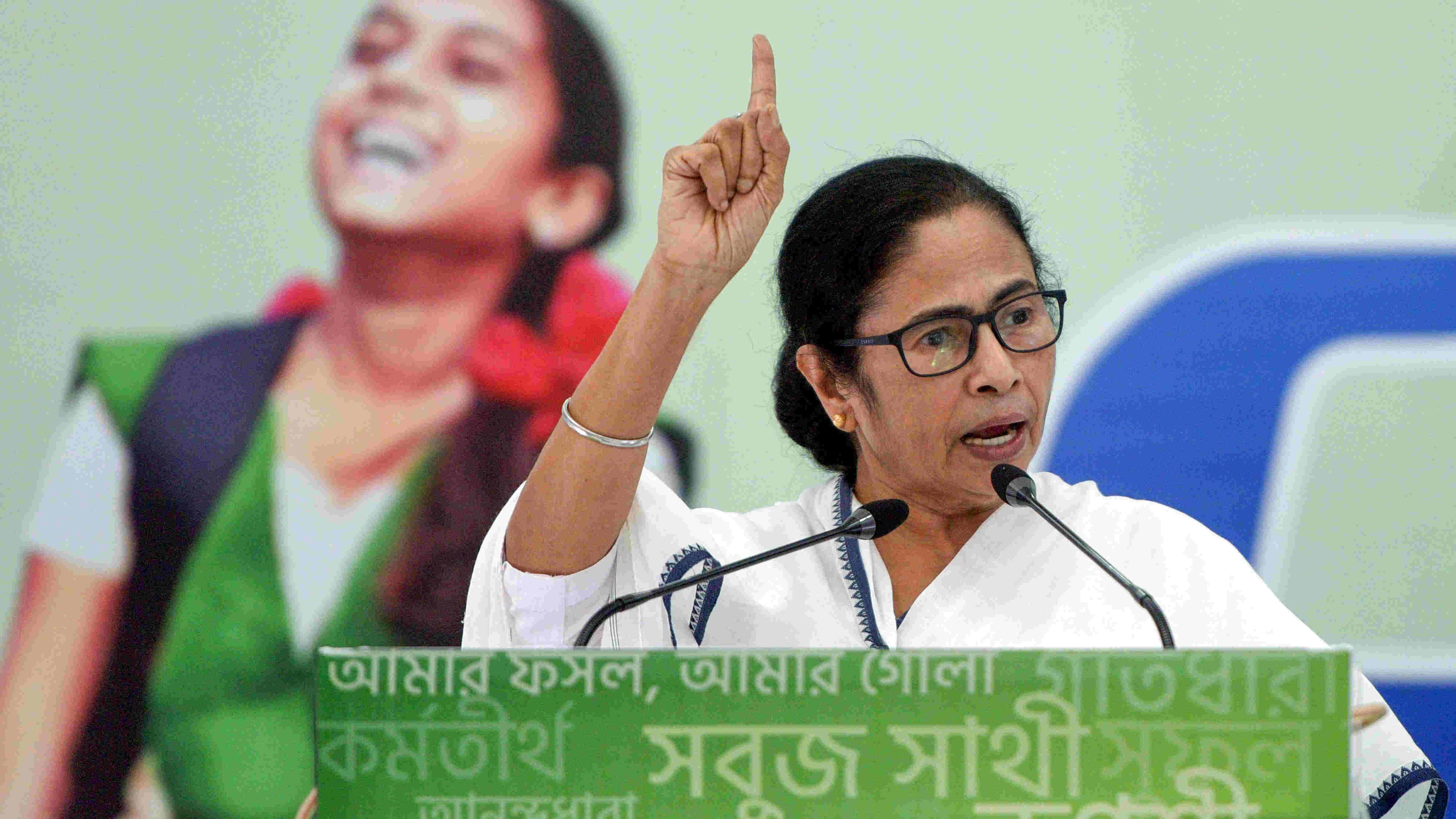

Bengal and Kerala, which were among the states that had opposed the Centre’s borrowing plan to meet GST revenue shortall, have accepted the proposal and will get Rs 10,197 crore through a special window.

"Governments of Kerala and West Bengal have communicated their acceptance of Option-1 to meet the revenue shortfall arising out of GST implementation. The number of states who have chosen this option has gone up to 25," the Ministry of Finance said in a statement.

“All the three Union Territories with Legislative Assembly -- Delhi, Jammu & Kashmir and Puducherry -- have also decided in favour of Option-1,” the statement added.

The Centre has, in four installments, borrowed Rs 24,000 crore on behalf of states and passed it on to 23 of them as well as three UTs on October 23, November 2, November 9 and November 23.

“Now, Kerala and West Bengal will receive funds raised through this starting from the next round of borrowings,” the ministry said.

"Kerala and West Bengal will get Rs 10,197 crore through a special borrowing window to meet the GST implementation shortfall," its statement added.

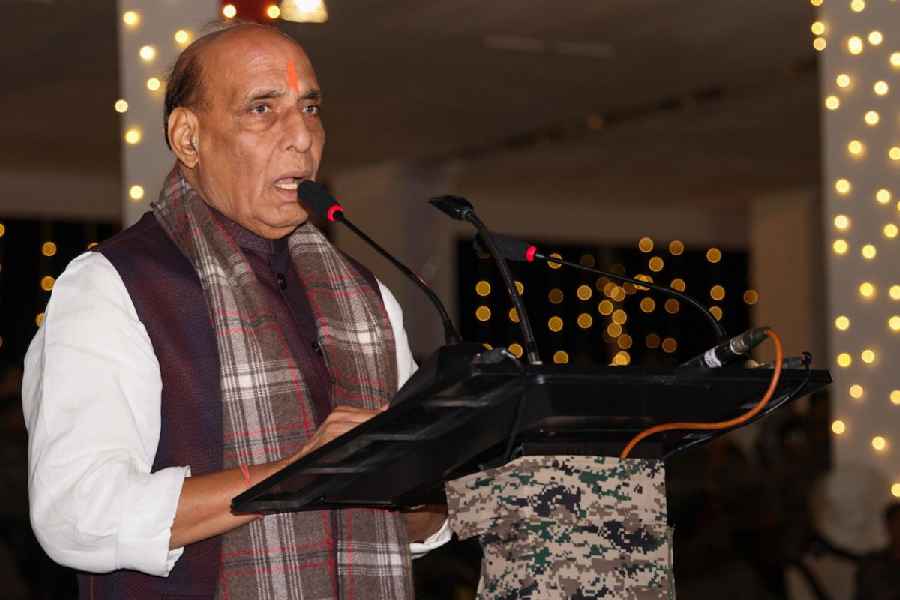

Under the terms of Option-1, besides getting the facility of a special window for borrowings to meet the shortfall arising out of GST implementation, states are also entitled to get unconditional permission to borrow the final instalment of 0.50 per cent of Gross State Domestic Product (GSDP) out of the 2 per cent additional borrowings permitted by the Centre under Aatmanirbhar Abhiyaan. This is over and above the special window of Rs 1.1 lakh crore.

The Centre has also granted an additional permission of borrowing Rs 4,522 crore to Kerala and Rs 6,787 crore to West Bengal, as it received their choice for Option-1.

States including Andhra Pradesh, Arunachal Pradesh, Assam, Bihar, Goa, Gujarat, Haryana, Himachal Pradesh, Karnataka, Madhya Pradesh, Maharashtra, Manipur, Meghalaya, Mizoram, Nagaland, Odisha, Rajasthan, Sikkim, Tripura, Tamil Nadu, Telangana, Uttar Pradesh, and Uttarakhand have also opted for Option-1. Union Territories like Delhi, Jammu and Kashmir and Puducherry have also chosen this option.

Punjab, Chhattisgarh and Jharkhand are among the states that have refused to agree to the plan, saying the Centre should borrow the entire Rs 1.83 lakh crore shortfall. Kerala and Bengal were also a part of this group.

Under the borrowing plan (Option-1), the Centre would borrow from market Rs 1.10 lakh crore which is the revenue shortfall on account of GST implementation.

The remaining Rs 73,000 crore shortfall is estimated to be the revenue impact of the COVID-19 pandemic.

The second option given by the Centre was for the states to borrow the entire Rs 1.83 lakh crore collection shortfall.