Finance minister Nirmala Sitharaman has sent a roundabout message to the Reserve Bank of India to cut interest rates — piling pressure on the central bank to pare the repo rate and spur economic growth.

Sitharaman said that people were finding current interest rates “very stressful” and that banks ought to make them affordable. It is obvious that banks will not unilaterally cut lending rates until the RBI trims the repo from its current level of 6.50 per cent.

Sitharaman’s comments come just days after commerce minister Piyush Goyal bluntly said the central bank’s reluctance to cut rates was based on the flawed argument that food inflation was too high.

Retail inflation soared to a 14-month high of 6.21 per cent, largely driven by food prices.

The RBI’s monetary policy committee (MPC) has been worried about food inflation which surged to 10.87 per cent. The MPC last cut rates on February 8, 2023 when it trimmed the repo by 25 basis points.

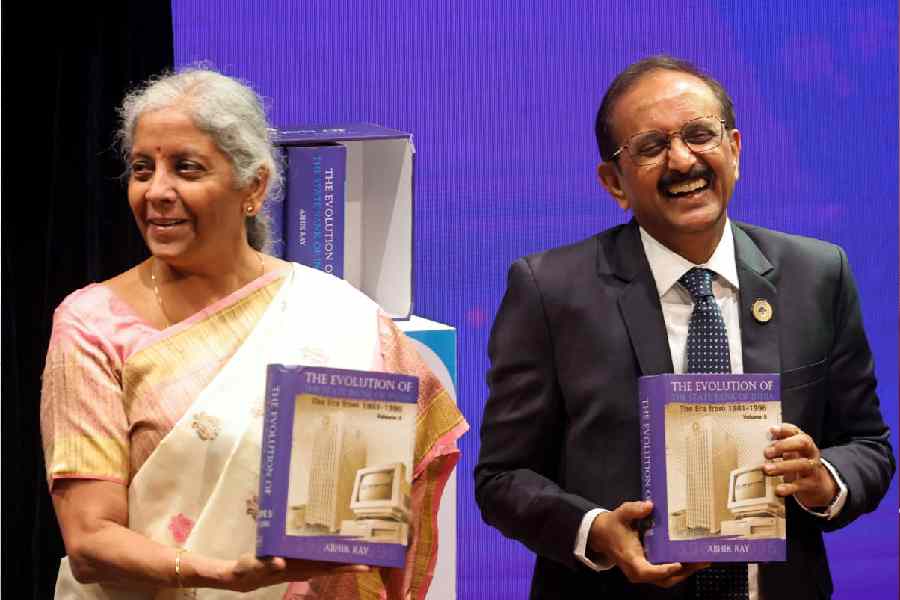

“It is important to look at India’s growth requirements…there have been so so many different voices saying that the cost of borrowing is really very stressful… (at) a time when we want industries to ramp up and create capacities, bank interest rates will have to become a lot more affordable,” Sitharaman said at an economic conclave organised by SBI in Mumbai. The finance minister feels lower borrowing costs can help achieve the aspirations of “Viksit Bharat” — Prime Minister’s grand dream to make India a developed nation by 2047.

The MPC is due to meet from December 4-6 and the statements from the two ministers are likely to weigh on the deliberations.

At its meeting in October, the MPC changed its policy stance on accommodation from surplus to neutral — which many saw as a precursor to a rate cut. But the retail inflation figure — which had running far ahead of the 6 per cent upper limit of the RBI’s tolerance limit — has confounded expectations about an imminent rate cut.

Many economists now believe that the RBI will not cut rates until inflation cools — which means they do not expect a rate cut until February.

The finance minister added that she did not want to join the debate on whether the RBI policymakers should take into account food inflation while deciding on rates. Goyal had said the MPC should “look past” food inflation and cut the repo.