The disappointment over Reliance Industries Ltd (RIL) spilled on to the bourses with the benchmark indices snapping a six-day rally.

The BSE Sensex fell 306.01 points to 55766.22, while the broader Nifty settled 88.45 points lower at 16631 with the auto, and oil and gas stocks also pulling down the market.

Reliance had reported a 46 per cent jump in its June quarter net profit on bumper earnings from its O2C business but that fell far short of analysts’ estimates.

RIL reported a consolidated net profit of Rs 17,955 crore whereas brokerages had projected the bottomline to come anywhere between Rs 24,000 crore and Rs 25,500 crore.

Reflecting the disappointment, the RIL stock fell almost four per cent to an intra-day low of Rs 2,403.95.

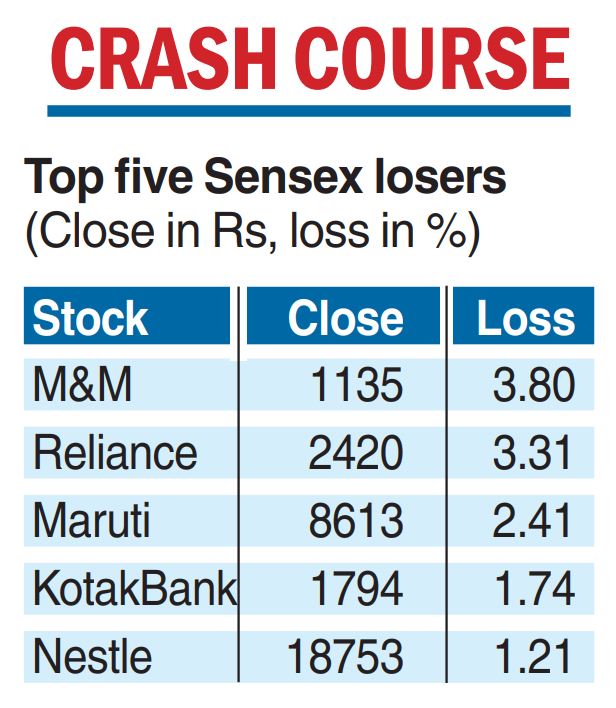

Though it clawed back some of the losses, Reliance ended lower at Rs 2,420.15 — a fall of 3.31 per cent over the previous close.

Another heavyweight Infosys came up with lacklustre numbers, though the upping of revenue guidance for this fiscal limited the losses.

On the Bombay Stock Exchange, the share ended 0.23 per cent lower at Rs 1,502.85.Moreover, selling pressure in auto, technology and financials saw the 30-share index finishing in the red.

After opening at 55877.50, the gauge hit a low of 55537.08 and later ended at 55766.22, a drop of 306.01 points or 0.55 per cent.

In the Sensex pack, Mahindra & Mahindra fell the most by 3.80 per cent.

The other laggards included Maruti Suzuki India, Kotak Bank, UltraTech Cement, Tech Mahindra and Nestle.

Tata Steel, IndusInd Bank, Asian Paints, HCL Technologies, Wipro and NTPC were among the gainers as they rose up to 2.66 per cent.

Market watchers said its course during the week will depend on the two-day Federal Reserve meeting that ends on Wednesday and the ongoing results.

“The domestic equities saw a pause in rally after markets reacted to the mixed set of results by index heavyweights that came over the weekend.

“Around 18 more Nifty companies are scheduled to declare their first quarter results during the week which would keep the stock market busy,” Siddhartha Khemka, head of retail research, Motilal Oswal Financial Services, said.

Provisional data from the stock exchanges showed that the foreign investors sold stocks worth Rs 844 crore in Monday’s trade.

However, the rupee showed a contradictory trend in the forex markets as it gained 12 paise to close at 79.73 against the dollar against the previous close of 79.85.

Dealers said that while the US Dollar Index was trading soft, the markets have scaled down expectations of an aggressive tightening of rates by the US central bank.

Some expect the amount to come down to 50 basis points in September.