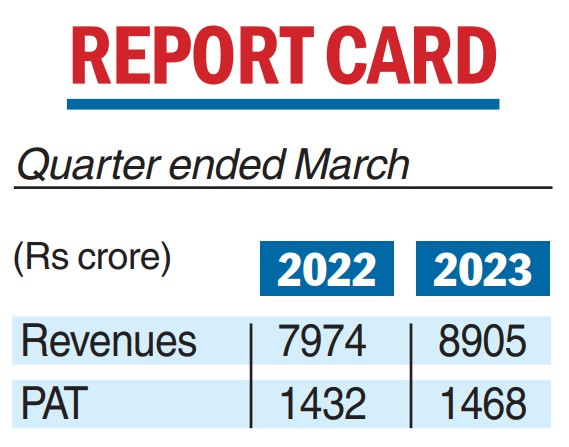

Bajaj Auto reported a marginal 2.5 per cent rise in standalone profit after tax at Rs 1,468.95 crore for the three months to March 2023.

The company had posted a standalone PAT of Rs 1,432.88 crore in Q4 FY22.

The company’s revenue from operations during the quarter under review increased 12 per cent to Rs 8,905 crore from Rs 7,974.84 crore in the January-March period of FY2022.

The growth in revenue from operations was led by the sustained momentum of the domestic business that delivered strong volume-led revenue growth of more than 50 per cent year-on-year, it noted.

At the same time, EBITDA maintained its strong run, growing 26 per cent year-on-year to Rs 1,718 crore, with margin accretion of 220 basis points to 19.3 per cent, Bajaj Auto said.

Domestic motorcycle sales during the quarter under review continued to deliver well, buoyed by the strong performance of the Pulsar portfolio and further scale-up in Platina 110 ABS volumes. Three-wheeler sales crossed the 100K units milestone for the first time since the pandemic.

While exports progressively worsened, given the deteriorating macros across overseas markets, a close watch on developments and decisive actions to salvage volumes ensured that Bajaj Auto’s competitiveness was intact with overall market shareholding steady.

For the full fiscal 2022-23, standalone PAT rose 12 per cent to Rs 5,627.60 crore from Rs 5,018.87 crore recorded in FY22, the company said.

Revenue from operations grew 10 per cent year-on-year to an all-time high of Rs 36,428 crore despite constrained supplies early on and particularly challenging overseas markets for the most part of the year.

HDFC AMC

HDFC Asset Management Company on Tuesday reported a 9 per cent growth in profit after tax (PAT) to Rs 376.1 crore for the three months ended March 2023. The company posted a PAT of Rs 343.5 crore in the year-ago period.

The firm’s total income grew by 10 per cent to Rs 637.8 crore in the quarter under review from Rs 580.9 crore in the January-March quarter of 2021-22 (FY22).

The company’s average asset under management stood at Rs 4.49 lakh crore as of March 2023 against Rs 4.32 lakh crore a year earlier.

For the full fiscal 2022-23, the fund house’s PAT grew by 2 per cent to Rs 1,423.9 crore. Its total income also rose 2 per cent year-on-year to Rs 2,482.6 crore.