Provisions, which had risen in the corresponding three months period last fiscal year, and hurting the bottomline, came in at Rs 2,927 crore in the reporting quarter, against Rs 3,140 crore a year ago, thus boosting the bottomline.

Chief financial officer Jairam Sridharan guided towards a normalisation of the credit cost or provisions in the second half which should eventually help the bank reach its long-term average of having the credit costs at 1.10 per cent of total assets.

He said 88 per cent of the corporate slippages came in from a separately classified book on advances to companies rated BB and below.

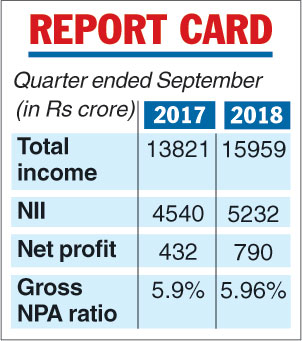

Lower provisioning driven by better asset quality and higher interest income helped Axis Bank on Friday to report an 83 per cent rise in net profit at Rs 790 crore for the September quarter, prompting the outgoing leadership to assert that the bank is well positioned for the future.

The third largest private sector lender had reported a huge dip in net profit at Rs 432 crore in the year-ago period on a jump in bad assets.

Shikha Sharma, the outgoing managing director and chief executive, said bad assets are nearing their peak and it is their resolution that will be the focus from here on.

Fresh slippages declined 69 per cent to Rs 2,777 crore, improving the gross non-performing assets ratio to 5.96 per cent from 5.90 per cent, but the provision coverage moved up 4 percentage points to 73 per cent.

Telegraph infographic