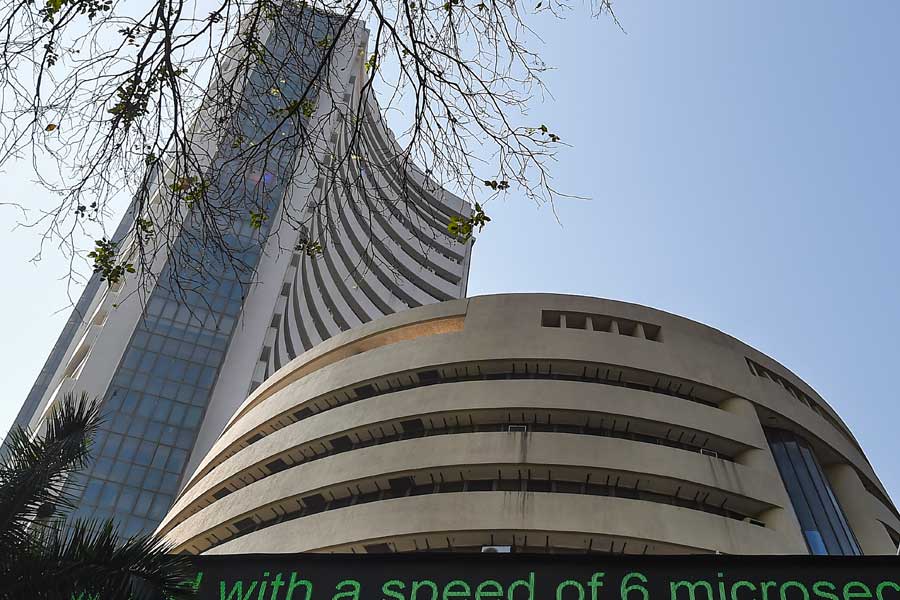

The benchmark Sensex on Wednesday rebounded nearly 567 points in a relief rally amid HDFC Bank reporting better than expected numbers for the third quarter ended December 31, 2024 and no fresh negative surprises coming from the Trump administration.

The 30-share gauge advanced 566.63 points or 0.75 per cent to close at 76404.99, after surging 624.77 points to hit an intraday high of 76463.13.

On the NSE, the broader Nifty climbed 130.70 points to finish at 23155.35.

Analysts said investors indulged in selective stock picking with some of them being available at better valuations.

Technology scrips also saw buying amid expectations that measures by Trump would boost the US economy leading to a pickup in discretionary spending.

The 47th President of the US also indicated that H1B visas will not be eliminated when he reportedly said, “we need great people to come to our country and we do that through the H1B programme’’. These factors led to IT stocks leading the rally.

Market circles added that though FIIs remained sellers, strong buying from domestic institutions cushioned stocks from a big fall. They pointed out that steady results from HDFC Bank also lifted the sentiment.

Infosys was the topmost gainer in the Sensex pack when it surged 3.16 per cent. It was followed by Tata Consultancy Services which jumped 2.97 per cent and Tech Mahindra by 2.28 per cent.

Sun Pharmaceuticals, Bajaj Finserv, HCL Technologies, Bajaj Finance, HDFC Bank, IndusInd Bank and Kotak Mahindra Bank were among the gainers.

On the other end, Tata Motors was the biggest loser dropping 2.24 per cent. PowerGrid, Axis Bank, State Bank of India, NTPC, Tata Steel and Adani Ports were the major laggards.

“The benchmark indices rebounded amidst heightened volatility following better-than-expected results from a major private bank. The IT sector led gains, recovering from recent losses, while mid and small-cap stocks continued to underperform due to valuation concerns,” Vinod Nair, head of research, Geojit Financial Services, said.

"Now with the budget around the corner, there are more speculations on what the government efforts could be to revive growth,” Jaykrishna Gandhi, head of business development institutional equities, Emkay Global Financial Services, said.

He said expectations ranged from income tax slabs, GST rationalisation, infrastructure allocation and regulatory updates to measures addressing economic distress and consumer sentiment.

Meanwhile, the rupee settled higher at 86.32 against the previous close of 86.58 to the dollar. This came amid a rally in Asian currencies even as the RBI was seen supporting the domestic unit. During the day, the dollar index was trending lower at 107.75 against its last close of 108.06.