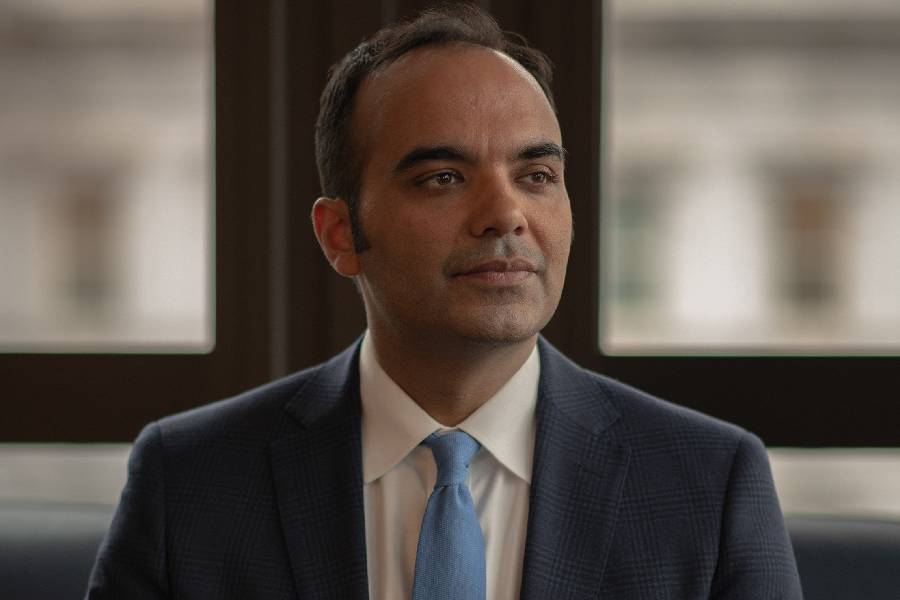

Rohit Chopra, the director of the Consumer Financial Protection Bureau, expected to be fired soon after President Donald Trump took office. More than a week later, he remains in his job — a source of puzzlement among his allies and frustration for those who want to see him gone.

“I swore an oath to a five-year term, and I will keep serving that until I can pass the baton to someone else,” Chopra, who was appointed in 2021 by former President Joe Biden, said in an interview this week. “I totally respect and understand that the president can choose a director of his choice.”

On Thursday, the agency announced its first enforcement action since Trump’s inauguration: It ordered Wise, a money transmitter, to pay a $2 million fine for violations including advertising inaccurate rates and failing to issue timely refunds. A Wise spokesperson said the issues were largely resolved in 2022, soon after the consumer bureau uncovered them during an examination. The company paid $450,000 to affected customers.

“While Wise strongly disagrees with the CFPB’s characterization of Wise’s conduct, we worked with the CFPB in good faith to conclude the matter,” she said.

Republicans, banking groups and other critics have openly sought the removal of Chopra, whose term runs through late 2026.

Sen. Tim Scott, R-S.C., chair of the Senate Banking Committee, told reporters Tuesday that he anticipates a “blockbuster announcement sometime soon” of who will take over the consumer bureau. For weeks, Scott has called for the resignation of Chopra, who he said is “no ally of consumers.”

Chopra became a thorn in the side of Wall Street for what it viewed as his aggressive use of the agency’s oversight and law-enforcement powers. He ordered financial services companies to repay to consumers more than $6 billion for violating consumer protection laws, led a crackdown that prompted most large banks to abandon or significantly reduce overdraft fees, and created a national registry of nonbank financiers that have been penalized for legal violations.

A 2020 ruling by the Supreme Court gave the president the power to fire the consumer bureau’s director. Biden fired Trump’s appointee, Kathleen Kraninger, on his first day in office.

Chopra declined to comment on any conversations he has had with Trump or White House representatives. The White House did not respond to requests for comment.

Another key financial regulator, the Office of the Comptroller of the Currency, is also still run by the leader Biden selected: Michael Hsu, who has been the acting comptroller since 2021. He remains in the office, an agency spokesperson confirmed.

One potential contributor to Chopra’s unexpectedly ongoing tenure is the Vacancies Act, which governs how federal agencies fill vacant leadership roles. If the president wishes to install an appointee from outside the agency, the person must generally hold a job for which they were confirmed by the Senate.

Trump used that route during his first term to install Mick Mulvaney, who was at the time the director of the Office of Management and Budget, as the consumer bureau’s acting caretaker.

“The longer Director Chopra stays, the harder it will be for this pro-growth administration to undo the politically driven, government-price setting agenda that former President Biden’s appointee has engaged in over the last several years,” Weston Loyd, a spokesperson for the Consumer Bankers Association, said in a statement.

Christine Chen Zinner, a senior lawyer for Americans for Financial Reform, a progressive consumer advocacy group, said: “Those billions that Chopra got back for consumers meant less profit for the industry. If Trump really cared about everyday people, he’d keep Chopra around.”

Chopra’s public remarks over the past week have noticeably skewed toward priorities favored by Trump and Republican lawmakers. He appeared at a panel discussion Monday organized by the Federalist Society, a conservative legal group, on “debanking,” the practice banks have of cutting consumers off — typically with little warning — from their financial services.

Trump chastised the CEOs of Bank of America and JPMorgan over the issue last week at the World Economic Forum, telling them that “many conservatives complain that the banks are not allowing them to do business within the bank.”

Chopra said the bureau has sought to increase its scrutiny of why banks cancel accounts.

“Just because you have a point of view that doesn’t exactly align with the views of a board room at a big bank or a financial company, that doesn’t mean you should lose access to your funds,” he said. “I do think there is room to be advancing some meaningful discussion and potentially policy change on whether consumers should be clearly told some of the reasons why they lost access to their account.”

Chopra also echoed a call by Trump for limits on the fees consumers pay to borrow on credit cards. During his campaign, Trump floated the idea of capping cards’ interest rates at 10%.

“The interest rate on credit cards has gone up so much faster than the Fed has raised rates, and we now have a set of issuers that have really jacked up their margins,” Chopra said. “Whoever I pass the baton to will have a lot to build off of based on what we’ve done these past few years.”

Chopra issued a rule last year that would limit credit card late fees to $8 per month. Litigation from banking trade groups has temporarily blocked the rule from taking effect. A new director would have to decide whether to continue defending against that lawsuit or drop it and abandon the late fee cap.

Patrick McHenry, a former Republican representative, said it was surprising that Trump had not fired Chopra yet and he did not think his tenure would last much longer. Still, he noted that Chopra and Trump had an overlapping desire to curb credit card interest rates, and keeping him in place for now signals that the administration “isn’t going to just fall over to do the banks’ will.”

“I think the message here is: Expect the unexpected,” said McHenry, a former chair of the Financial Services Committee.

The New York Times News Service