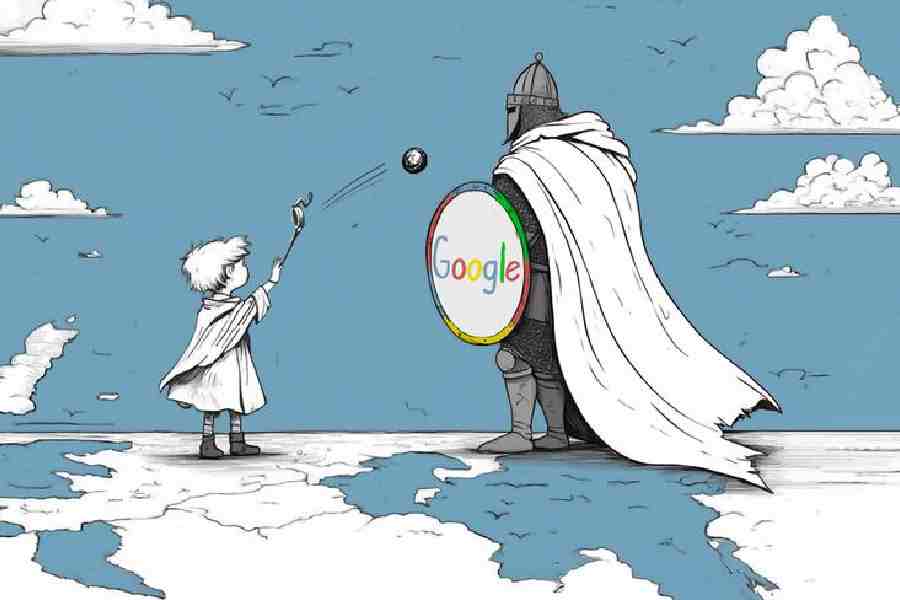

Ecosia and Qwant are teaming up to create a European search index, aiming to break the dominance of Google and reduce Europe's reliance on US tech giants. Can they succeed in challenging the status quo?

When it comes to searching the internet, there's little that Europeans can do without America.

When Europeans go looking for information, 90% of them rely on US tech giant Google to find what they're after. Around 5% use Microsoft's Bing.

Even if they choose a web browser based in Europe, it's most likely using Google or Bing's infrastructure, meaning requests are sent to the US companies and their rankings are displayed.

As Christian Kroll, CEO of Germany's largest search engine, Ecosia, puts it, "if the US turned off access to search results tomorrow, we would have to go back to phone books." In such a scenario, Europe would grind to a halt.

A search index for Europe

While a cutoff is unlikely, American companies have been making access to their search infrastructure more expensive, online enterprise technology news publication The Register has reported. There is nervousness around what a second term for President Donald Trump might mean for Europe's tech sector.

For two European search companies, the solution is to build a rival.

Earlier in November, Ecosia and French counterpart Qwant announced they are joining forces to create a European web index, essentially a huge database of webpages they can use to answer search queries.

"With the US election turning out as it has, I think there is an increased fear that the future US president will do things that we as Europeans don't like very much," Kroll told DW. "We, as a European community, just need to make sure that nobody can blackmail us."

Ecosia and Qwant are set to launch their project, called European Search Perspective (EUSP), for the French market at the beginning of 2025, with Germany following later in the year. Depending on investors, other language markets will follow.

EU's quest for digital sovereignty

The idea ties into a popular trend in European politics: digital sovereignty. Pushed in particular by France's Thierry Breton, the EU's former commissioner for the internal market, the argument is that the EU requires control over key digital infrastructure and services to reduce its reliance other global powers.

Kenneth Propp thinks the "flavor of it is more in the nature of autonomy." The senior fellow at the Atlantic Council's Europe Center and professor of EU law told DW that "there should be a European option" in some areas currently dominated by US providers.

"That is how I understand this latest business venture, and obviously it points to the possibility that there will be tenser relations between the US and the EU under a Trump administration, so they're trying to identify having a European option as a market advantage," he said.

Right time to take on Google?

Even with a favorable political landscape, trying to find space next to a behemoth like Google is extremely difficult. But recent events might make the task a little easier.

The EU's Digital Markets Act, which has largely been in force since mid-2023, ensures that end users such as Ecosia and Qwant have access to the US companies' data, which is vital for improving their own algorithms.

Google's parent company, Alphabet, is also facing a legal battle to keep its search business together. In August, a US federal judge found Google had been illegally monopolizing the search market and the US Department of Justice proposed it should sell off its own web browser Chrome as a remedy. Doing so could be hugely damaging to the company's profits and significantly affect its dominance.

Then there is the increasing integration of artificial intelligence (AI) into search engines, introducing other new players like OpenAI into the market. This new wave of search technology is set to be the biggest disruption in over two decades.

"Search engines are going through an evolution. No one knows yet what this will look like, but it will be different from what we have now," said Kroll. "Maybe we can also use this opportunity to create something new that makes us […] really the best product you can have in the market."

Kroll expects the Ecosia database to be useful to other companies looking to train so-called large language models (LLMs) in Europe.

Is Europe an attractive market?

However, succeeding in the tech sector is difficult in Europe. US companies typically have much easier access to investors' cash. While Kroll won't be drawn on how much Ecosia and Qwant are expecting to spend, they are still on the lookout for partners.

Propp also highlighted the different approach taken on regulation, where the US is often less stringent. "The view in Europe, particularly from the [European] Commission, is that you establish a comprehensive regulatory base, as has been done on privacy and artificial intelligence," he said. "That becomes a competitive advantage for European companies."

Although the tech sector in Europe had grown so far in general, he added, in reality it has not generated strong competitors to US companies.

Results to be more relevant to Europeans

For now, the sights aren't set on toppling any US companies. Kroll thinks Ecosia and Qwant could be aiming for between 5-10% market share in Europe by 2030.

While the figure might sound low, it would still represent a huge volume of search results, which in turn will be used to improve the algorithm.

The main difference, he noted, is that results should be more relevant to Europeans, providing examples such as more prevalence for European news outlets or more eco-friendly travel options.

"We won't paint this in European colors or anything like that. But, for example, if someone is looking for a trip from Berlin to Paris, we could highlight train connections instead of flight connections," he said.

If that's what Europeans are in fact searching for, it could prove a step away from US tech dominance.