Devi Shetty’s Narayana Health group launched a medical insurance policy on Monday that promises ₹1 crore coverage, for an annual premium of ₹10,000, to families whose yearly income is ₹40,000 or less.

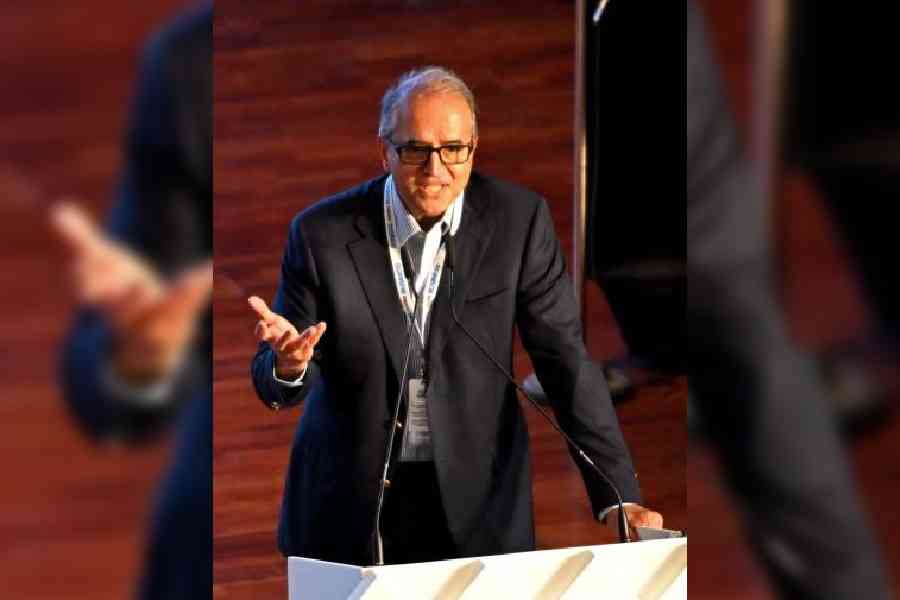

When a hospital chain offers a health insurance policy, it naturally takes care of the “trust issues” that plague insurance reimbursements in India, Shetty, chairman and founder of Narayana Health, said after the launch in Mysore.

The policy will be available for patients in Calcutta in two to three months, he said.

ADITI, the insurance policy, promises to reach out to 100 million “missing middle Indians”, who have some money but are not covered by any government insurance scheme, Shetty said after the launch.

For families whose income is above ₹40,000 or individuals aged above 45, the premium would be more but not as high as those charged by other medical insurance providers, he said.

“The scheme is aimed at removing inequality in healthcare access for people who cannot afford quality treatment because of affordability issues,” Shetty told Metro.

Shetty said the insurance policy would only be accepted at Narayana Health hospitals. The group has over 20 hospitals across India. An official of the group said they run four hospitals in Calcutta and seven in the entire eastern India.

“There is patient distrust in India about hospitals and insurance companies because of conflict of interest. Now, when hospital and health insurance interests are aligned, the distrust should reduce,” said Shetty.

“There are three stakeholders in the treatment process: patient, health insurance provider and hospital. There are huge trust issues. The three parties don’t trust each other. Business cannot be upgraded because of trust deficit,” he said.

“The distrust is because of the conflict of interest. Now (in regard to ADITI), hospital and health insurance interests are aligned. So the conflict of two parties will not be there.”

In India, 16 per cent of all cardiac surgeries are performed at Narayana hospitals, Shetty said. “So, before the insurance policy was launched, there was no incentive to prevent cardiac ailments. Now, it will be profitable to try and prevent cardiac ailments. If during enrolment, we find a person has a small blockage in the artery, our counsellors will monitor the policyholder and counsel him to modify lifestyle and be under treatment to prevent a heart attack.”

The Insurance Regulatory and Development Authority of India (IRDAI) gave Narayana Health permission to launch the policy earlier this year.

“This is the first time IRDAI has given licence to a hospital to become a health insurer. There are a few hospitals that provide health insurance but those are separate entities,” said Shetty.

The ₹1 crore coverage will be for surgeries. For medical treatment, it will be ₹5 lakh for one admission.

“Surgeries can be emergency and do not give time. Often patients and their families struggle to arrange the funds,” said Shetty.

For medical treatment, he said, there would be a minimal co-payment of around ₹2,000 per day, which the patient has to pay.

Shetty promised that unlike most other health insurance policies, there would be no waiting period for reimbursement. “There would be a health check-up before enrolment, which is worth ₹30,000,” said Shetty.