Got your dream home during the lockdown? If not brace for realty prices to shoot up further as developers claim to be in an unfair battle with input costs.

The Bengal chapter of the Confederation of Real Estate Developers’ Association of India (Credai) apprehends unchecked rise of raw material cost would impact "Housing for All", a pet project of the governments at the Centre and the states. In the immediate aftermath of rising input costs, the affordable housing sector, which caters to 95 per cent of real estate projects in the country, could go up between Rs. 500-Rs.1000.

“Projects which are near completion five per cent increase has already happened. And there will be an additional increase of 10 per cent in the next six months to a year. No developer increases the price of a housing unit at one go,” said Sushil Mohta, president Credai West Bengal.

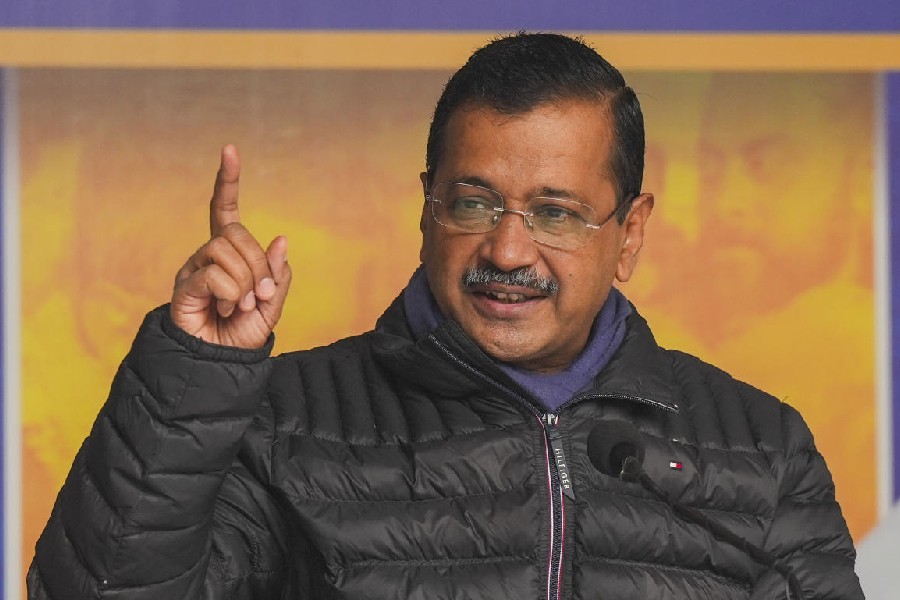

Sushil Mohta Telegraph Picture

One of the factors to have hit the industry hard is the perceived monopoly of certain business houses in some of the sectors. The developers identified two key components; cement and polyvinyl chloride.

“Reliance has a monopoly in PVC and they have increased prices. Everybody is aware of the cartels running in the cement manufacturers association. While cement prices are stable in Bengal, in other parts of the country, the situation is different,” said Mohta.

The bulk of housing units in Bengal are in the price range of Rs 3,000 per square feet to Rs. 6,000 per square feet. The real estate industry forecasts a hike between Rs 200-Rs 400 in these units in the coming days.

After the Mamata Banerjee government’s decision to reduce stamp duty by two per cent, the real estate sector saw a spike in sales, and believes that the post-pandemic economic recovery will augur well for the sector, but at this moment the industry is struggling despite meeting its average annual target of 15, 000 units sale. Most of the materials for construction come from outside the state _ tiles and flooring mostly from Gujarat and Rajasthan and plumbing materials from northern and western India. The change in state policy on sand mining, like a ban on overloading and the ever-increasing fuel costs have increased the price of ready mix concrete which needs stone chips and sand. Cost of sand has gone up by 60 per cent, while metals like copper, brass and aluminium used extensively in building projects have seen an average rise of 10 per cent. At the same time, labour cost has seen an increase of four to five per cent.

"Many of us did not increase prices (in new projects) expecting the market would stabilise, but that did not happen. In the units that we had already sold there is nothing that we can do,” said Sidharth Pansari, a Calcutta based real estate developer.

Developers say prices of steel, certain metals, ready mix concrete, transportation and labour costs have increased, which they have to bear and cannot recover the same from customers under the Real Estate (Regulation and Development) Act 2016 (Rera). The Bengal unit expects the national Credai body to take up the matter with the Union housing ministry.

“Unlike other industries the money cycle in real estate is anywhere between three to five years. While Rera has boosted the confidence of consumers, the clause of no escalation till delivery has hit the developers hard. Most of the developers now are suffering. There should be some insurance for the developers in Rera,” said Nandu Belani of Belani Group.

A Siliguri-based real estate developer Naresh Agarwal said the North Bengal situation was even worse and they were facing raw material shortage which was pushing the input costs by 10 per cent more than the rest of the state.

The industry, however, is banking on two factors that would keep it above the water levels in the coming years. “Home loans are cheaper now and because of the lockdown people have realised the need for bigger and better homes. We expect to sell more houses in the next calendar year,” said Mohta.