Bidhannagar Municipal Corporation has about Rs 160 crore in property taxes arrears. This astronomical sum has accrued over the last four years, when residents failed to paid their dues. The authorities, however, blame Rajarhat for the chunk of it.

Money received as property tax is used to provide civic services like streetlights, road repairs, water supply and solid waste management but several councilors and mayoral council members said that due to the accrued taxes, several development projects, including healthcare services, in the corporation could not be undertaken.

Lack in Covid care facility

“Had we managed to collect the taxes properly and on time, we could have started a hospital for Covid-19 patients that could also have started testing people living in the corporation area,” said a mayoral council member who did not wish to be named.

At present, the corporation has three medical facilities — Matri Sadan Hospital in EE Block, Vidyasagar Matro Sadan in Narayanpur and a third in Deshbandhu Nagar. None of these hospitals is now admitting Covid-19 patients.

Matri Sadan Hospital has, in fact, been shut for the past few years and has not been thrown open to patients despite a Rs 1.25 crore revamp.

An unlit street of Salt Lake. Lack of funds has hamperd repairs Sourced by the Telegraph

Dark streets

According to a mayoral council member, several areas in Salt Lake are plunging into darkness after sundown due to dysfunctional streetlights. “If we had money in our coffers we would have repaired our lights,” said the councillor.

Several roads in Salt Lake, including the First Avenue, parts of the Broadway and roads inside blocks, are in bad shape. “Tenders for road repairs have not even been called as there is no money at hand,” said another Salt Lake councillor.

A contractor who undertakes road repairs said that the civic body was yet to clear its dues for work that has already been completed. “We are still waiting for our last payments,” he said.

Tax bills sent

Of the total pending amount, Rs 150 crore is receivable from homes under the erstwhile Rajarhat Gopalpur Municipality like Kestopur, Baguiati, Kaikhali and Teghoria. Rajarhat alone has more than 1.17 lakh holdings as opposed to only 26,000 in Salt Lake.

Mayor Krishna Chakraborty said they had already initiated tax collections and that tax bills would soon reach all corners of the corporation.

“We have started sending out bills and have received assurances from several housing complexes in Kaikhali and Teghoria, who have outstanding taxes to the tune of a few crores, that they will pay up,” she said.

But a mayoral council member said that in reality very little effort was being made to collect taxes from these areas. “We are extending all services to these places but not receiving any taxes in return. Without money we cannot buy new equipment or launch new projects,” he said.

Deputy mayor Tapas Chatterjee said that holdings in Rajarhat need to be reassessed for updated tax rates. “The area had a different tax structure as part of the erstwhile Rajarhat Goplapur Municipality. But now it needs to be reassessed as it is part of the corporation,” said Chatterjee, who was earlier the chairman of the Rajarhat Gopalpur Municipality.

Ward by ward

In Salt Lake the scenario differs from ward to ward. Devasish Jana, councillor of Ward 34 that includes blocks IB, HB, GD, GE, FE, FF and IC, said that taxes amounting to at least a couple of crores were due. “I have sent all the tax bills with a request to residents to clear them at the earliest,” said Jana, who is also the mayoral council member of solid water management in Bidhannagar Municipal Corporation.

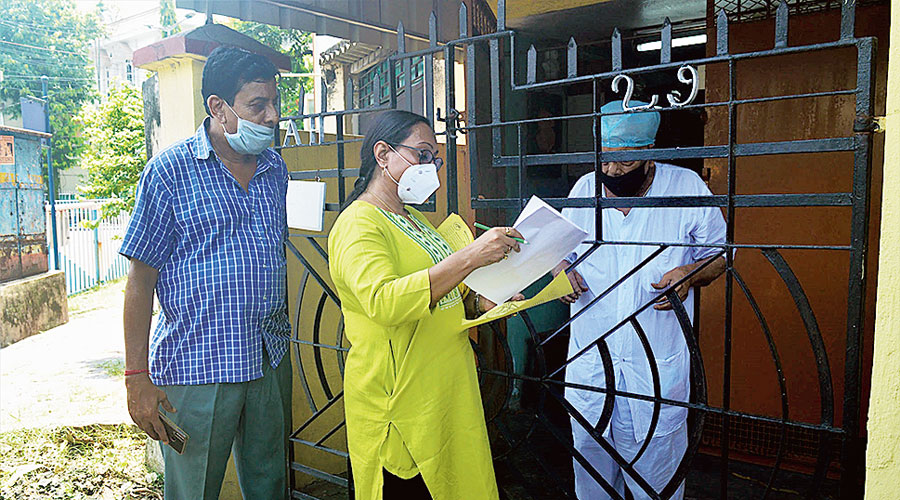

Councillor Anita Mondal hands over a tax bill to a resident in her ward Debasmita Bhattacharjee

Anindya Chatterje, the councillor of Ward 41 that encompasses blocks AA, AB, AC, AD, BA, BB, BC and BD, said that around Rs 12 crore was due from these areas. “I have gone around the ward personally delivering tax bills to residents who have large sums pending. Several of them have said they would pay up. Others said they felt the received was too high and would like a review.”

In such a case they are to send an application to the corporation seeking review. A mayoral council member even mentioned instances where residents have queued up to pay taxes but the civic body could not accept payment as the assessment procedure was not clear to resdients.

Chairperson of the civic body and the councillor of Ward 30, Anita Mondal, too has been visiting AG, AH, BG, BH, CG and DG blocks to hand deliver bills. “At least 35 residents have handed over cheques since then. Most came to the ward office for it. We expect payments to be faster once the pandemic is over,” she said.

Then there are those like Rajesh Chirimar, councillor of Ward 39 (including wards like blocks like CA, DA, DB), who say that most residents have already paid up. “There is not much due in from my ward. Residents of Salt Lake are law-abiding people and tend to keep their tax payments clear,” said Chirimar. Residents of Duttabad, an added area under his ward, do not have to pay taxes.

Tulsi Sinha Roy, the Ward 40 councillor, said that about Rs 2 crore worth of taxes was due from her ward.

“A chunk of these are receivable from commercial establishments like hotels and a shopping mall (City Centre),” said Roy whose ward includes CC, DC, CD and DD blocks.

Kumar Shankar Sadhu, a member of the Bidhannagar (Salt Lake) Welfare Association said that residents of Salt Lake did not have much taxes pending. “We know for a fact that residents here have been making payments as most of them don't want to increase liabilities.

Instead, the civic body should focus on areas that have been added during the formation of the corporation where no tax payments have been made over the past few years,” Sadhu said.

An official said only 10 per cent of Salt Lake's taxpayers pay property tax online. This could be because there is a sizeable population of senior citizens here, many of whom are not comfortable making payments online. Unlike in New Town the corporation does not have any dedicated personnel to help file online taxes. In New Town the New Town Kolkata Development Authority has roped in services of “tax sathis” to help people pay their property tax.