In the decade since he founded the private investment firm RedBird Capital Partners, Gerry Cardinale has acquired stakes in sports properties as varied as Fenway Sports Group, the Yankees’ YES Network and the Italian soccer team AC Milan. One of his partners at RedBird, Alec Scheiner, previously worked as a vice-president of the US National Football League’s (NFL) Dallas Cowboys, and later ran the Cleveland Browns.

Both men, then, are quite familiar with what a billion-dollar business looks like. The sport where they see the biggest upside these days, though, might be a surprise.

“When we first started looking at cricket, we were by no means experts,” Scheiner said. “But the more we studied it, the more we realised it felt like the NFL did 20 years ago.”

That was why, in June 2021, RedBird bought a 15 per cent stake in Rajasthan Royals, a team that competes in the Indian Premier League, for $37.5 million (Rs 300 crore). The money that has poured into the league over the past 15 months suggests that RedBird got a bargain.

Four months after that deal closed, a new IPL team sold for $940 million (Rs 7,750 crore). Eight months after that, the league negotiated television and digital broadcasting rights agreements worth $6.2 billion (Rs 51,000 crore).

At more than $1 billion (Rs 8,250 crore) a year, that means India’s top domestic Twenty20 competition now generates annual broadcast revenues on a par with top leagues like the NFL ($10 billion a year), England’s Premier League (about $6.9 billion) and America’s National Basketball Association ($2.7 billion).

On a per-match basis, the IPL, whose season lasts only two months, now ranks behind only the NFL. The IPL’s matches now draw domestic TV audiences of more than 200 million.

And suddenly a lot of people want in.

Disney and Sony were among the bidders in the broadcast rights tender last year. CVC Capital Partners, the private equity firm that used to own the Formula 1 auto racing series, just added an IPL team to a portfolio that already owns interests in rugby and soccer. Among those it beat out? The American owners of the NFL’s Tampa Bay Buccaneers and the English football giant Manchester United.

“I’m not sure even we thought there would be so much global demand for the franchises,” Scheiner said. RedBird’s $37.5 million investment has most likely quadrupled in value in just a year. And with new investors circling, most experts agree that every IPL franchise is now worth $1 billion or more.

The league’s ascent has been rapid. Its architect, Lalit Modi, was a mid-ranking executive with the Board of Control for Cricket in India. He correctly spotted that Twenty20 could marry India’s love of cricket to a host of commercial opportunities, and in late 2007 he pulled off a series of unlikely negotiations to assemble a sports league from scratch.

He promised a group of the world’s best cricketers salaries they wouldn’t be able to get elsewhere. He held a high-profile auction to sell the teams to members of India’s business and media elite. And then he persuaded Sony to pay $900 million for the broadcasting rights to the first 10 editions of the tournament.

“It ticked many boxes from an investment perspective,” said Mustafa Ghouse, a director of one of the league’s founding teams, Delhi Capitals. “It is a closed league with no relegation, so your revenue is secure irrespective of your performance, while costs are limited by a player salary cap.”

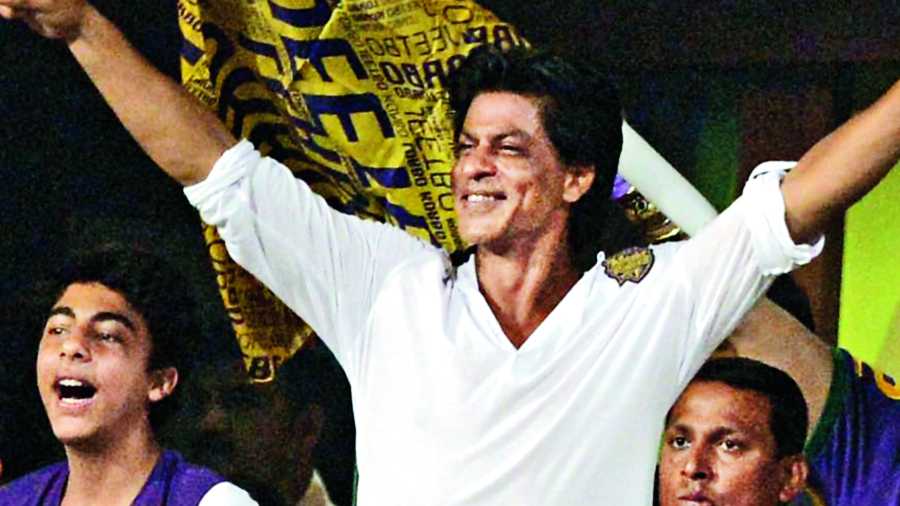

With these safeguards in place for prospective team owners, Modi sold his eight teams for a combined $723 million. The buyers included the industrialist Mukesh Ambani and the Bollywood actor Shah Rukh Khan. Twenty20 cricket, which had been dismissed as “hit and giggle” by traditionalists, began to be taken seriously.

Nevertheless, the league faced many problems in the early years. The second season had to be moved to South Africa over security concerns, for the general election was being held at the same time. After a power struggle, Modi was fired by the BCCI in 2010. Three teams were terminated after getting into financial difficulties, and two others received multiyear suspensions after senior officials were implicated in match-fixing and illegal betting.

It was only after India’s Supreme Court intervened, appointing a judicial committee to tighten governance rules and ruling on conflicts of interest, that the IPL really took off as an investment vehicle.

The Supreme Court’s intervention was “a very important moment”, according to Matthew Wheeler of A&W Capital, which advises on investment in sports in India.

“Once the Supreme Court had been through it,” he said of the league, “you felt better than you did before.” A $2.5-billion broadcast rights agreement for the 2017 to 2022 seasons — a fivefold increase on the previous deal — only confirmed his view.

Wheeler, a former professional cricketer, said his firm began recommending that its clients consider buying IPL franchises in 2017. “The first one I spoke to said that its fund didn’t cover India,” he said. “The second was unsure. And the third one was CVC, who asked for our help.”

CVC Capital Partners had a presence in India but had not been involved in cricket. Wheeler said he spent three years learning all he could about the IPL and building relationships with team owners and the BCCI.

“You have to be patient,” he said. Then, in August 2021, the governing body announced it would expand the IPL to 10 teams from eight. The bidding was on.

An Indian conglomerate, the RPSG Group, bought a franchise based in Lucknow for $940 million, while CVC purchased the Ahmedabad team for $750 million.

The bids dwarfed both the BCCI’s minimum price, which it had set at $270 million, and RedBird’s $250 million valuation of Rajasthan Royals, made only four months earlier. It also meant that the value of a single franchise in 2022 now exceeded the total price paid for all eight original teams in the first auction in 2008.

Among those left disappointed were the Adani Group and Lancer Capital, a private equity group headed by Avram Glazer, an owner of the NFL team Buccaneers and Manchester United.

The timing of the league’s expansion was deliberate. A bigger league meant an increase in the number of matches it could sell in its new TV rights deal. The agreement that was reached stunned even veterans of the sports industry: $6.2 billion for the next five years, roughly split between domestic broadcasting rights and digital rights.

Adam Sommerfeld, a sports investment specialist at Certus Capital, said he now believes that buying into the IPL is “a no-brainer” for private equity firms and institutional investors.

“They would be investing in by far the most popular sport in the second-most populous country in the world,” Sommerfeld said. “Even if you just buy and hold, the value of IPL teams is clearly going to accrue considerable value.”

Unlike European football, for example, where even owners of large, historic clubs struggle to make regular profits, and where investors in mid-tier and smaller clubs face the annual prospect of punishing financial consequences if they are relegated to a lower division, the structure of the IPL means surpluses are virtually guaranteed.

Media rights and league sponsorships go into a pot of central revenue, shared equally by the BCCI and the 10 IPL franchises. Teams control all of their local revenue, which includes local sponsorship deals, ticket sales and merchandise, and player salaries — habitually the largest cost to sports teams — are capped at a manageable level.

Calculations by one Indian analyst, K. Shriniwas Rao, suggested the teams spent just 35 per cent of their central revenue on wages in 2021. Every IPL team is believed to have been profitable in 2021, even when the pandemic necessitated that games were played in empty stadiums.

The difficulty for would-be investors is now a lack of opportunity. Even after its expansion, the IPL still has only 10 franchises. Sommerfeld claims to have a list of “six or seven” existing owners of US professional teams who have enquired about the IPL.

The only problem, it seems, is that no one who currently owns a team is interested in parting with it.

“It’s an absolute seller’s market,” Ghouse, the Delhi Capitals director, said.

(New York Times News Service)