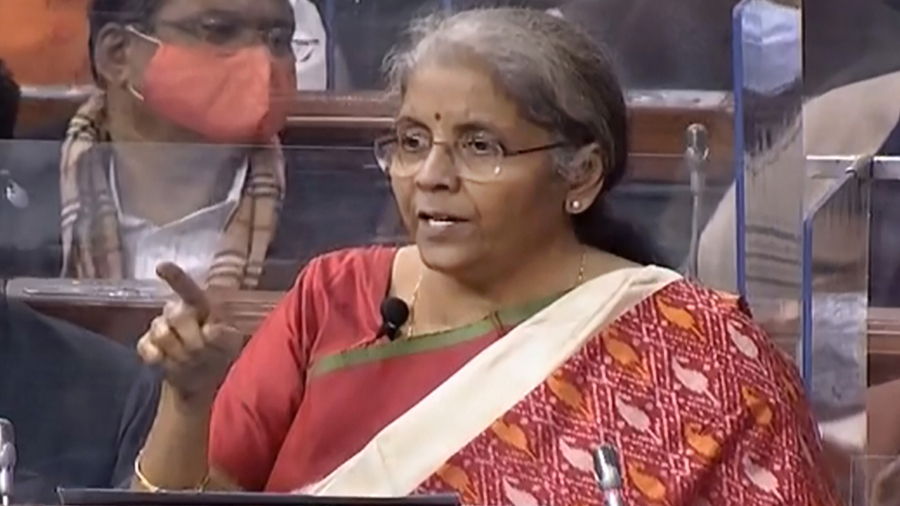

The Union budget for 2021-22 has delivered no surprises. The government has utilized fiscal policy as the last resort to stimulate economic recovery. As a result, the revised estimate for the current year’s fiscal deficit is 9.5 per cent of the gross domestic product and the budget estimate for 2021-22 is 6.8 per cent. These numbers are far away from the conservative target of 4.5 per cent. The finance minister, Nirmala Sitharaman, has not changed direct tax rates and tinkered with only a few customs duties. On this count though, Ms Sitharaman has kept open the possibility of introducing new customs duties in October 2021 when she finishes reviewing 400-old exemptions that are on the books. On the expenditure front, the finance minister has focused on the capital account, which has been raised from the revised estimate of Rs 4.39 lakh crore for the current year to Rs 5.54 lakh crore as the budget estimate for 2021-22. This will be financed, along with a revenue expenditure of Rs 2.92 lakh crore budgeted for the coming year, by borrowing Rs 1.50 lakh crore. This will constitute 36 per cent of the total spending. With the Central government claiming that it will take a couple of years more for the economy to surpass pre-Covid-19 levels, tax revenues available for the Centre are budgeted to be a little less than the budget estimates made a year ago. In 2020-21, the budget estimate was Rs 1.63 lakh crore against the budget estimate of Rs 1.54 lakh crore for 2021-22.

The government’s strategy, at least what is evident from the numbers, is to focus on capital expenditure projects, especially in infrastructure. Hopefully, this will create new employment and, hence, current demand for consumption goods. Since most of the consumer goods sector is experiencing excess capacity, the extra demand can be met and new incomes generated. The financial sector will benefit from new foreign funds coming into the insurance companies. Banks will also benefit from the proposed Asset Management Company and Asset Reconstruction Company. One revealing issue was the finance minister’s emphasis on declaring the numbers for agricultural subsidies and the growing amounts distributed in terms of minimum support prices for various crops. It is precisely for this reason any real or even perceived threats to take away that support would create enormous anxiety in the minds of the beneficiaries. However, the government has been sensible and not tried to shock and awe the economy by unusual policies.

Two things, however, remain to be seen. The first is the trust deficit with macroeconomic numbers. India’s lost credibility on this count is yet to be fully reversed. For instance, even in this budget, the announced amounts of expenditures were often for the next five years; the annual allocation being only a fifth of the declared amount. The other is the well-known and common issue of implementation delays. It must have been an exceptionally challenging situation for the finance ministry. Under the circumstances, the budget is as good as it can be.