Life and death

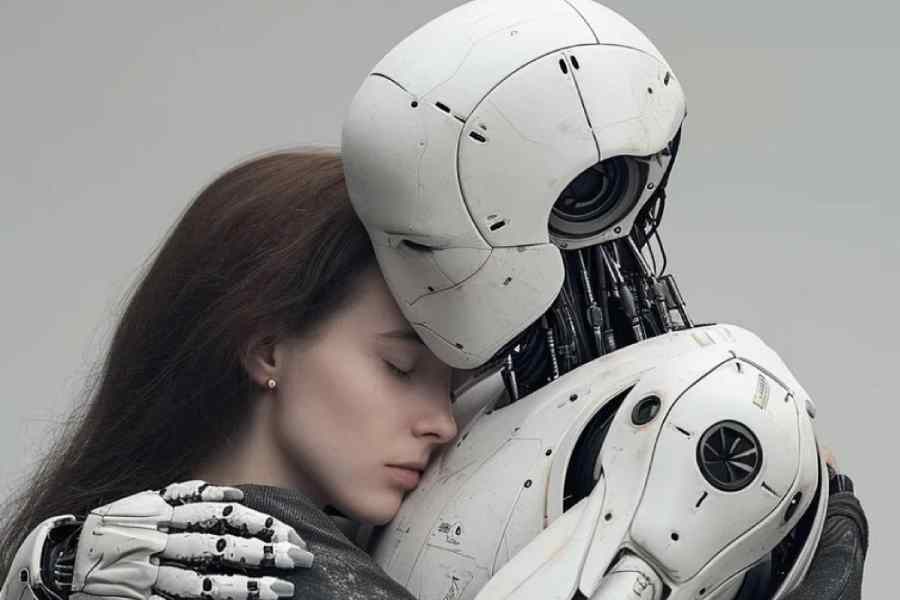

Sir — The immortality that humans have been trying to achieve since time immemorial might finally be within reach. Humans may now live on in technology. Digital clones of people — basically Artificial Intelligence chatbots created using a person’s likeness and voice — have taken over the market in countries like China. The one primary challenge to the rise of AI simulations of the deceased, or ‘deadbots’ as they are called, though, is data. While AI can easily mimic a person visually and aurally, imitating their thoughts and characters based on their life experiences is a near-impossible hurdle. People are thus being asked to prepare snippets of themselves 10-20 years in advance so that they can be cloned after death. It is ironic that the cost of a bid for immortality is the constant awareness of one’s imminent death.

Ritabhari Roy, Calcutta

Damp squib

Sir — The Union budget has made it clear that the fabled achhe din are not going to come anytime soon (“High on rhetoric”, July 24). There is nothing in the budget for the poor, farmers, low-income groups and self-employed people. The National Democratic Alliance’s economic triumphalism is at odds with the people’s lived realities. The budget lacks details on how it will generate gainful employment to tackle the crisis of rising unemployment. There has been no significant increase in allotments for education and healthcare. This betrays the government’s apathy toward human development indices. The bonanza of funds for Bihar and Andhra Pradesh was expected given their political importance for the NDA to survive.

G. David Milton, Maruthancode, Tamil Nadu

Sir — The 2024-2025 budget fails to adequately address the country’s healthcare needs. The elderly are struggling to afford medical treatment and out-of-pocket expenditure is on the rise. Yet subsidies for medical treatments are minimal in the budget.

Arun Kumar Baksi, Calcutta

Sir — The changes in financial policy announced by the Union finance minister, Nirmala Sitharaman, have invited criticism. These include the elimination of indexation benefits for property sales, which previously allowed property owners to adjust their gains for inflation as well as the increases in both long-term and short-term capital gains taxes. These decisions are poorly thought out and suggest a lack of understanding of the intricacies involved in calculating long-term and short-term capital gains. The changes are likely to have a profound impact on the real estate market. It is thus not surprising that the stock market experienced a sharp decline in response to these announcements. The changes reflect a broader shift in financial policy that has left many investors and property owners concerned about the future of their investments and the overall health of the real estate sector.

Dhananjay Sinha, Calcutta

Sir — The increase in taxes on capital gains proposed in the budget may prove beneficial to banks, which have been suffering from a deposit crunch in recent times. But it is a shock for the equity market. The unprecedented participation of retail investors in the equity market is key to absorbing shocks during institutional exits. This move will definitely push a large number of investors to go for small and midcap funds or to opt for future and options trading to maximise their returns, making them vulnerable to market risks. If the government’s purpose was to tax real estate, it could have been done separately.

Shayan Das, Calcutta

Sir — The decision to do away with the indexation benefit from the real estate sector will discourage investment in this area and increase the flow of cash component owing to the higher tax outgo for sellers. This opens up the door for malpractices and the exchange of black money. Why is it that this government ends up boosting a corrupt system which it repeatedly claims to be cleaning up?

Puja Goyal, Delhi

Sir — The budget has failed key social welfare sectors like education and healthcare. The government should also take more robust measures to strengthen the manufacturing and tourism sectors to support long-term economic growth. Balancing fiscal consolidation with economic stimulation through tax incentives and measures to boost consumption would have bolstered the Indian economy.

Bishal Kumar Saha, Murshidabad

Sir — Survival instinct has led the Centre to loosen the purse strings for Andhra Pradesh and Bihar. The prime minister, Narendra Modi, knows that keeping the Telugu Desam Party chief, N. Chandrababu Naidu, and the Janata Dal (United) leader, Nitish Kumar, happy is essential to his continuation in power. This appeased the Bharatiya Janata Party’s allies in the NDA.

The Opposition, though, has rightly pointed out that the bottom 40% of the population, whose real income has been worsened by galloping food inflation, has been ignored. Similarly, public healthcare and education have been given short shrift. Equally conspicuous by its absence was a comprehensive plan for ensuring the safety of the railways. One hopes the Opposition will raise these issues in Parliament and seek the government’s response during the debate on the budget.

S.K. Choudhury, Bengaluru

Sir — The Sensex and the Nifty plummeted by 1,266.17 points during the afternoon trade owing to the announcements made in the budget. This is a clear indicator of Nirmala Sitharaman’s failure to present a budget that addresses the country’s problems. The middle class and the poor are being pushed further towards penury. It is disappointing that the railways found no mention while luxury projects in Andhra Pradesh and Bihar were bankrolled under duress.

Bishwanath Yadav, Asansol

Sir — The tax burdens of the middle-income group have not been lightened. Personal income tax contribution to government revenue stood at 19%, higher than the income from corporate taxes. The revenue earned through goods and services tax and other indirect tax stood at 18%, further adding to the financial strain of this group. The rich have benefitted further at the expense of the rest of the country. This is appalling.

M. Rishidev, Dindigul, Tamil Nadu