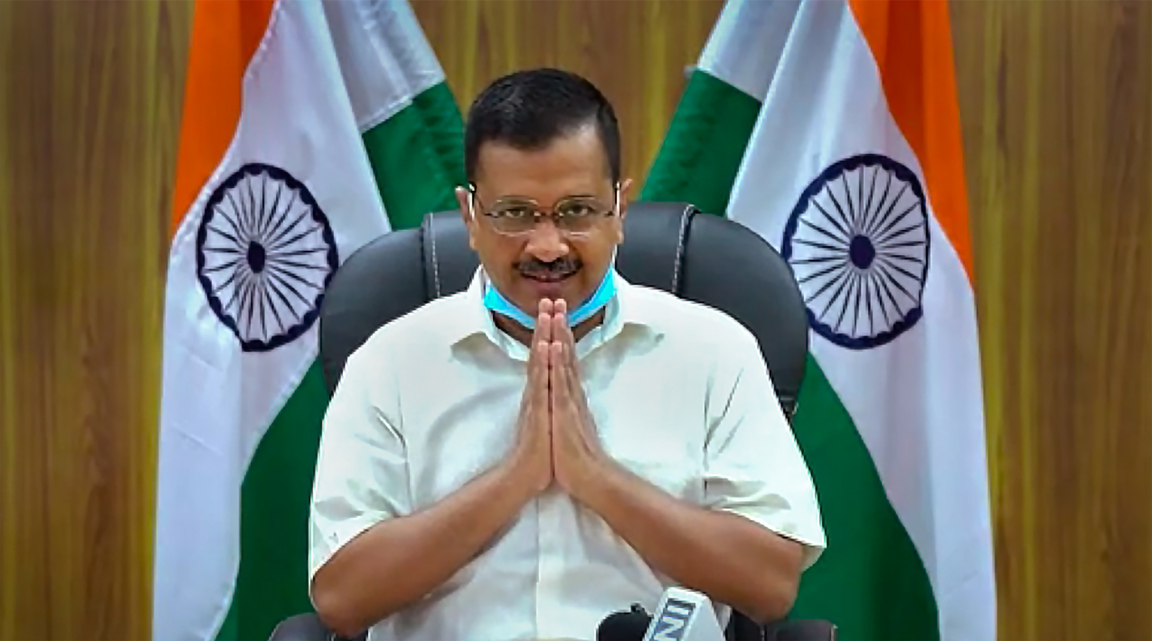

Sir — It was heartbreaking to see the Delhi chief minister, Arvind Kejriwal, thank the prime minister, Narendra Modi, after the national capital received 730 metric tonnes of oxygen on May 5, saying that it was the first time that Delhi received over 700 metric tonnes of the life-saving gas. Modi should be taken to task, not thanked. It is the Centre’s job to save citizens’ lives; chief ministers should not have to thank a negligent Central government for doing the bare minimum that it was elected to do. The oxygen should have reached Delhi long ago; it was clearly withheld all this while.

Rasika Kohli,

Delhi

Help out

Sir — The governor of the Reserve Bank of India, Shaktikanta Das, announced a slew of measures aimed at lessening the financial stress on the economy (“New credit lines to fight crisis”, May 6). The announcements come at a time of acute economic uncertainty, amid a wave of infections that is yet to peak, and are designed to boost the flow of funds to the healthcare sector, and ease the pain of small businesses and individuals — parts of the economy that are most at risk. By doing so, the governor has sent a clear signal — all possible policy support will be extended to the economy as the fallout of the second Covid-19 wave intensifies.

The central bank has provided an on-tap liquidity window, allowing banks to borrow Rs 50,000 crore at the repo rate of 4 per cent for lending to the healthcare sector. This lending will encompass vaccine manufacturers, suppliers of medical devices, oxygen and ventilators, and hospitals, among others. By allowing these loans to be classified as priority sector lending, the RBI is incentivizing the ramping up of support by the banks to the sector during these troubled times. Credit to small businesses and retail borrowers is also being incentivized.

Given that during this period of stress, cash flows of businesses are likely to come under pressure, the RBI has also announced a resolution framework for small businesses, MSMEs and individuals as well as the second tranche of its government securities acquisition programme of Rs 35,000 crore which is part of its stated commitment of Rs 1 lakh crore. For state governments, which are likely to face a mismatch between their revenues and spending in the near term, the central bank has eased their overdraft limits, allowing them greater access to funds to fulfil their expenditure priorities.

Considering the ferocity of the second wave and its uncertain economic fallout, it is reasonable to expect that more steps will be taken by the RBI. The Centre, too, has announced some steps. However, considering the gravity of the situation, and given that large parts of the economy were yet to recover to pre-pandemic levels even before the second wave, far greater support is needed from all levels of government.

Khokan Das,

Calcutta

Sir — Last year, during the first wave of Covid-19, the government was quick to take action along with the RBI. This time, the Centre has adopted a laid-back attitude towards the financial woes of small, medium and individual businesses. The RBI has come up with a myriad measures to ameliorate the situation. Even though there is no nationwide lockdown now, the situation on the ground is the same for businesses save for some large media houses and technological and e-commerce businesses. The loan restructuring would help the poor who are unable to pay off their equal monthly instalments owing to the non-activity of businesses and the curbs imposed by state governments.

Yashi Bairagi,

Ujjain