The Bengal government has asked banks to address students' complaints as they alleged that lenders are "harassing" them while processing loans under a state-run scheme, an official said on Friday.

They accused several banks of "cancelling applications or delaying the processing of loans" under the Student Credit Card programme, he said.

Over 1,20,000 applications have been submitted under the initiative till Monday, and of them, 50,000 have been sent to banks for approval, the official said.

"Banks have so far accepted around 6,000 applications. Not only that, some applications were rejected and returned to the district administrations. Chief Secretary HK Dwivedi has already directed officials to form a committee in each district to deal with the issue, the official said.

Students also alleged that lenders are "seeking information which is not required" to extend advances under the programme, he said.

The chief secretary had held a meeting on Wednesday with officials of the state education department, district administrations and banks to address the issue.

The higher education department has asked lenders not to harass students who are seeking loans under the Student Credit Card scheme. Bankers have also been requested to ensure that poor meritorious students are not deprived of it, the official said.

The state government had, in September, asked district magistrates to address students' complaints against private banks for allegedly seeking collateral from their parents in lieu of extending loans under the programme.

The banks were directed to take necessary steps to give priority to poor students, he said.

The government also instructed authorities of schools, colleges and universities to organise camps every Monday to promote the credit programme and directed the education department to send a report on the number of students coming to these facilities, the official said.

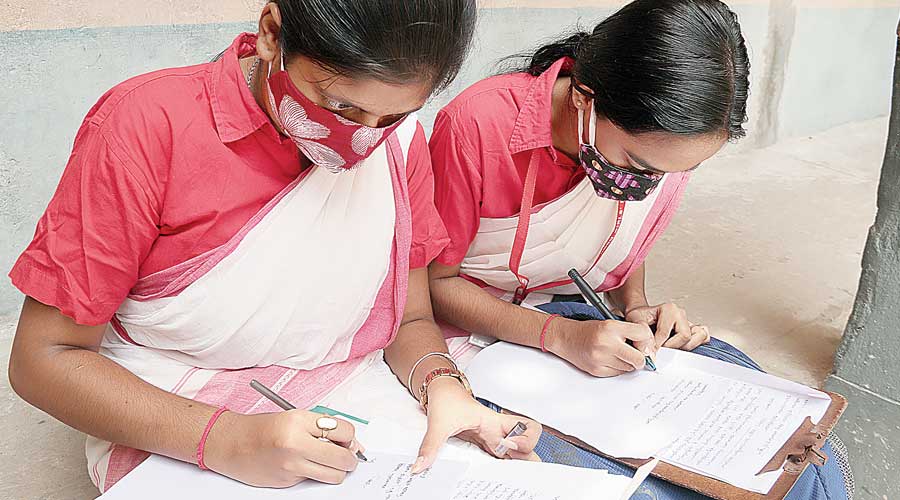

The state government had introduced the Student Credit Card scheme to enable beneficiaries to pursue their studies without having any financial constrain.

Under the programme, a student from West Bengal can obtain a maximum loan of Rs 10 lakh at 4 per cent annual interest from banks with a repayment period of 15 years. The upper age limit of students has been kept as 40 years.

The state government is scheduled to hold an event on the student credit scheme at Netaji Indoor Stadium here on January 8, 2022.