“Dear User Your (name of bank) Bank Account Will be Suspended! Today please Update Your PAN Card number Click here link... Thank you.”

This text message, and similar others, designed to leave recipients panicked and prompt them to click any link to “update” their PAN card, resulting in disastrous consequences, are being sent at random, police said.

Recipients of those messages often fail to realise that those were sent by fraudsters, not by the bank.

Several bank officials and police officers told The Telegraph that many recipients of such messages click links sent by fraudsters, leading to instant transfer of money from their bank accounts.

The police said that after the “electricity bill” fraud, scamsters have taken to sending messages posing as bank officials. Earlier, fraudsters would send messages saying the recipient’s electricity bills were pending and the power connection would be snapped in a few hours if the dues were not paid by clicking a link in the message.

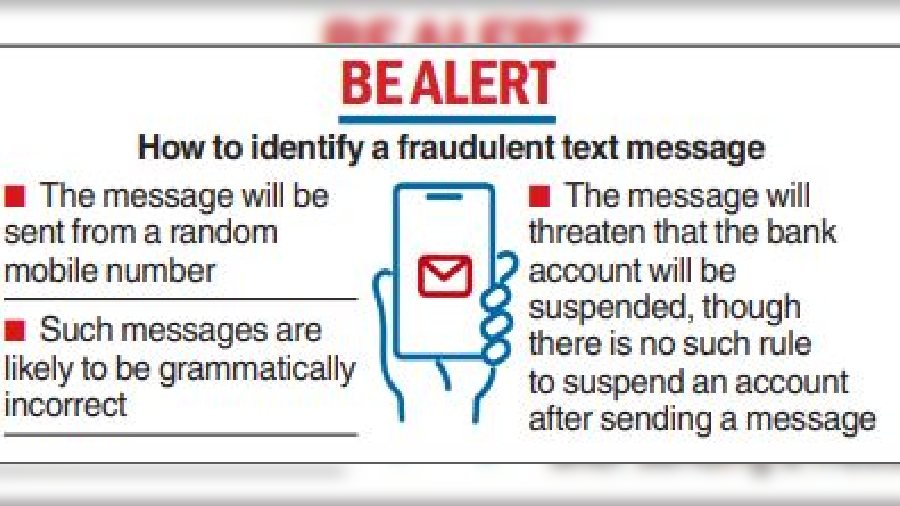

An official at a private bank said they never send text messages to their clients from random numbers. “Also, most fraudulent messages are in incorrect English. Our messages are written in grammatically correct English,” the official said.

“The two major human psychological traits that the fraudsters exploit are greed and fear. In this case, it is fear. Anyone who receives a message saying that his bank account would be suspended would obviously be scared. However, instead of panicking, the person should verify the content of the message with the branch (of the bank) where he or she has an account,” said a senior official of a private bank.

The official said a detailed procedure was involved to suspend a bank account. “Sending a mere text message is not enough to do that,” the official said.

A senior executive of another private bank, which has multiple branches across Kolkata, said “more than dozens of such cases” are reported every week.

“A customer gets duped by clicking links sent to him or her from unknown mobile numbers, with senders pretending to be officials of the bank where one has an account,” the official said.

“In such cases, we always advise our customers to report the matter to the police if there is a loss of money.

Else, we try to make them aware of the possible modes of communication that our bank uses to contact the customers. We clearly say that text messages from the bank are never sent from any individual’s phone number. The sender’s name will have the initials of our bank name,” said the bank executive.

Fraudsters try to convince their targets to click links that result in the installation of malware in the phone.

“Such malware can compromise all the data stored in the phone, giving fraudsters access to the banking details. That results in transfer of money from the user’s bank account,” said an officer in the cyber cell in Kolkata police.

A senior officer at Lalbazar said most fraudulent text messages are written in faulty English.

“The first thing that should strike people while reading these messages is the language. More often than not there are errors. That should be enough to alert bank customers about the fraudulent nature of such messages,” said the police officer.