Video-call blackmails, loan fraud apps, and duping people with threats of disconnecting power supply and into sharing device screens have become the most reported frauds, security experts said at a recent conference on cyber crime.

Senior cyber crime experts and police officers who attended the conference said it was important for professionals and others to remain cautious against cyber crimes and hackers.

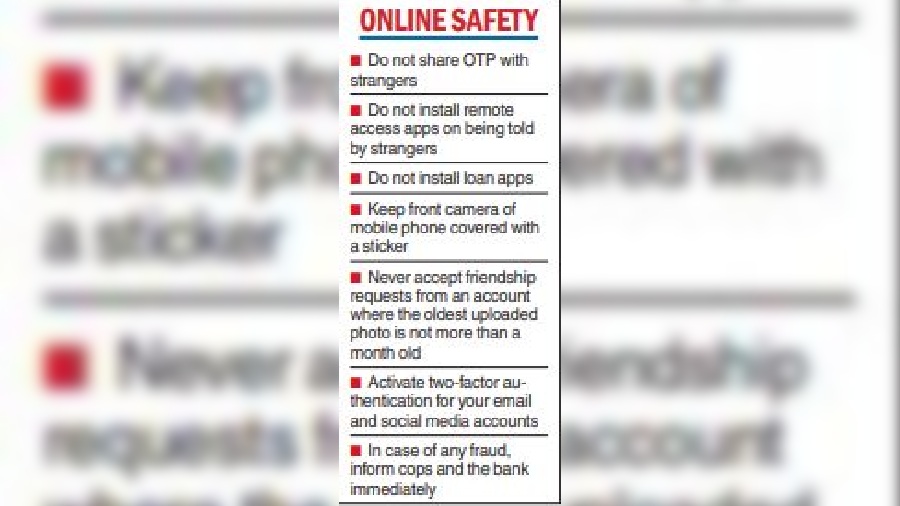

Here is a list of the various types of cyber frauds most frequently reported to law enforcement agencies and the ways to counter them.

- Video-call blackmail: Experts said one of the most reported cases of cyber crime in the recent past has been “video-calling for blackmail”.

“In this type of fraud, fraudsters approach their targets through social media from fake profiles and befriend them. Then they start video-chatting and take a screenshot of the conversation. The victim’s picture in the screenshot is then morphed with the picture of a nude person. The victim is then blackmailed for money with the threat that the morphed picture would be published on social media,” said Sandeep Sengupta, director, Indian School of Anti-Hacking (ISOAH), who was one of the attendees at the cyber security programme organised by the Calcutta Chamber of Commerce.

Sengupta said the solution is to cover the front camera of the phone with a sticker. “Even if a video call starts accidentally, they cannot see you. If you fall victim to such a fraud, just WhatsApp them that you have sent their number to the police cyber cell and block the number,” Sengupta said.

- Loan-app fraud: According to police records, many persons fall prey to loan app frauds by downloading loan apps and allowing access to the personal details stored on their phones.

“While downloading a loan app, the software seeks permission for gaining access to the image gallery, contact list and location of your phone. Many apps cannot be installed unless the user grants the permission. Ideally, one should not download such apps,” Sengupta said.

In this type of fraud, the data accessed by the loan app software are used to contact persons on the “contact list” for sharing misinformation about the victim and blackmailing him or her to shell out money.

- Screen-sharing fraud: “Fooling the victim into screen sharing is the easiest way to gain access to his or her phone. Fraudsters send messages to their victims telling them that their electricity bill is pending and the supply will be disconnected within hours if the dues are not paid by clicking a link in the message. Once the link is clicked, the fraudsters get access to the screen of the victim’s device and the data stored on it. The data is then used to transfer money from the victim’s account,” a cyber security expert said on the sidelines of the event. “Such fraudulent messages, containing similar links, also ask for urgent KYC updation,” the expert said.

Hari Kishore Kusumakar, special commissioner of police, Kolkata, attended the event and emphasised the need to create awareness on cyber crimes.