The Reserve Bank of India expects all of the Rs 2,000 notes — the country’s highest-denomination note that is headed for the shredder after last Friday’s announcement — to flow back into the banking system.

Chastened by the experience of the demonetisation in 2016 when over 99 per cent of the notes were returned, the authorities are no longer characterising this as an attempt to shake down the black money lurking in the darkest corners of the economy when there is increasing evidence that the high-value note is rarely used by individuals to pay for purchases.

The notes have been stashed by hoarders and have tended to tumble out during raids by federal agencies.

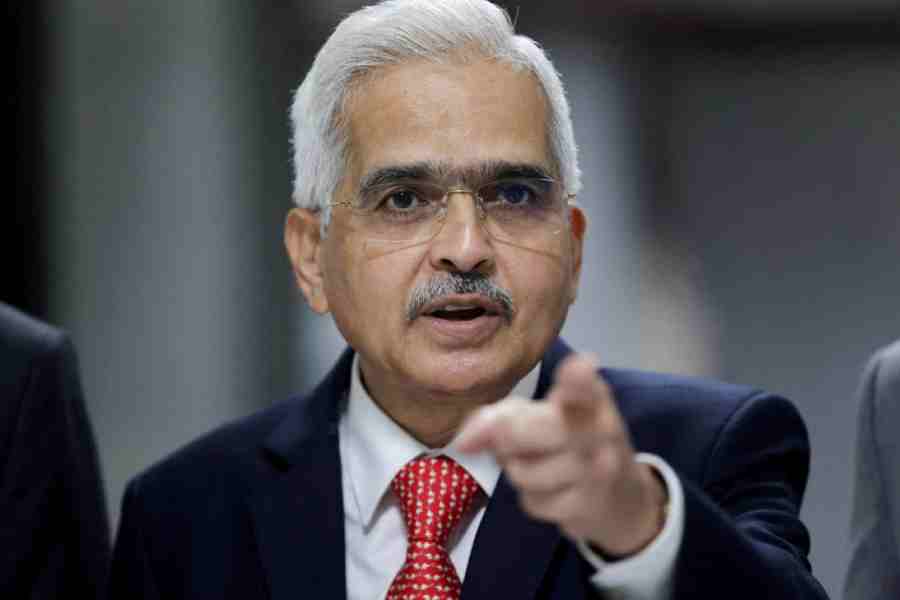

“We expect most of the notes to come back,” RBI governor Shaktikanta Das told reporters in the capital as he tried to defend the banking regulator’s announcement.

The RBI governor dodged a direct question when asked whether the decision had been taken at the behest of the Narendra Modi government. “Let us not discuss internal processes,” Das said in a terse reply.

On Tuesday, banks will start accepting deposits of these notes and also exchange these notes without insisting on any sort of identification from their customers. However, bankers said that people who do not have an account with the branch would be asked to produce at least one ID proof when they try to exchange the notes.

Governor Das advised bank customers not to rush to the banks as soon as they open since the notes can be converted till September 30.

The notes continue to be treated as legal tender but the governor refused to clarify whether this would be withdrawn when the window for conversion is slammed shut.

“We will see how many notes come back. And as we approach September 30, we will decide at that stage (whether the legal tender status of the Rs 2,000 note should be extended).”

“I do not expect a rush in the banks to exchange the Rs 2,000 notes,” the RBI governor said. “There is no need to panic; you have four months’ time.”

Purpose served

“The timing of the decision is not relevant,” governor Das said in response to another question, arguing that the Rs 2,000 note had served its purpose after being introduced after the demonetisation, which shredded over 85 per cent (by value) of all the currency in circulation at the time.

The cull, he said, was prompted by the RBI’s clean note policy of 1999 under which soiled notes are taken out of circulation.

However, the RBI governor did not seem to see the inherent contradiction in his statements: notes become soiled only if they are widely used; not if they are socked away in vaults and other storage bins.

Das admitted that the Rs 2,000 note was not widely circulated and had almost disappeared from the ATMs in the country for quite some time.

Reacting to reports that shops and establishments had already stopped accepting the Rs 2,000 note after the announcement, Das said: “There already was some reluctance to accept Rs 2,000 notes at shops and small establishments, mainly because they did not have change; most were insisting on QR code-based digital payments, anyway. Of course, this (refusal to accept the note which remains legal tender) may have increased since the announcement.”

Deposit surge

Das said the withdrawal of the high-value note would have minimal impact on the economy since it accounts for only 10.8 per cent of the currency in circulation and these notes are not used much in transactions.

“We have found that it is hardly being used for carrying out transactions. Therefore, economic activity will not be impacted,” he observed.

The decision was part of the currency management operations of the RBI which he claimed was robust.“Our currency management is very robust. Our exchange rate is also very stable,” he added.

The comment on the exchange rate is significant. Experts suggest that the scrapping of the note will lead to a surge in deposits with the banking system — mimicking the trend after the demonetisation. Some reports say that bank deposits which have swelled to Rs 184.35 lakh crore as of May 5 — growing at an annual rate of 10.4 per cent — will go up by another Rs 50,000 crore to Rs 90,000 crore which could stoke inflation and also precipitate a wobble in the exchange value of the rupee.

According to the RBI governor, the September 30 deadline for the exchange or deposit of the notes had been set to signify “finality” to the decision. “We set the September 30 date for a reason: You can’t leave the date open-ended so that people realise we are serious about the move.”

The RBI informed the banks on Monday that they must maintain a daily record on the “deposit and exchange of Rs 2,000 banknotes”. It also advised the banks to “provide appropriate infrastructure at the branches such as shaded waiting space, drinking water facilities, etc. considering the summer season”.