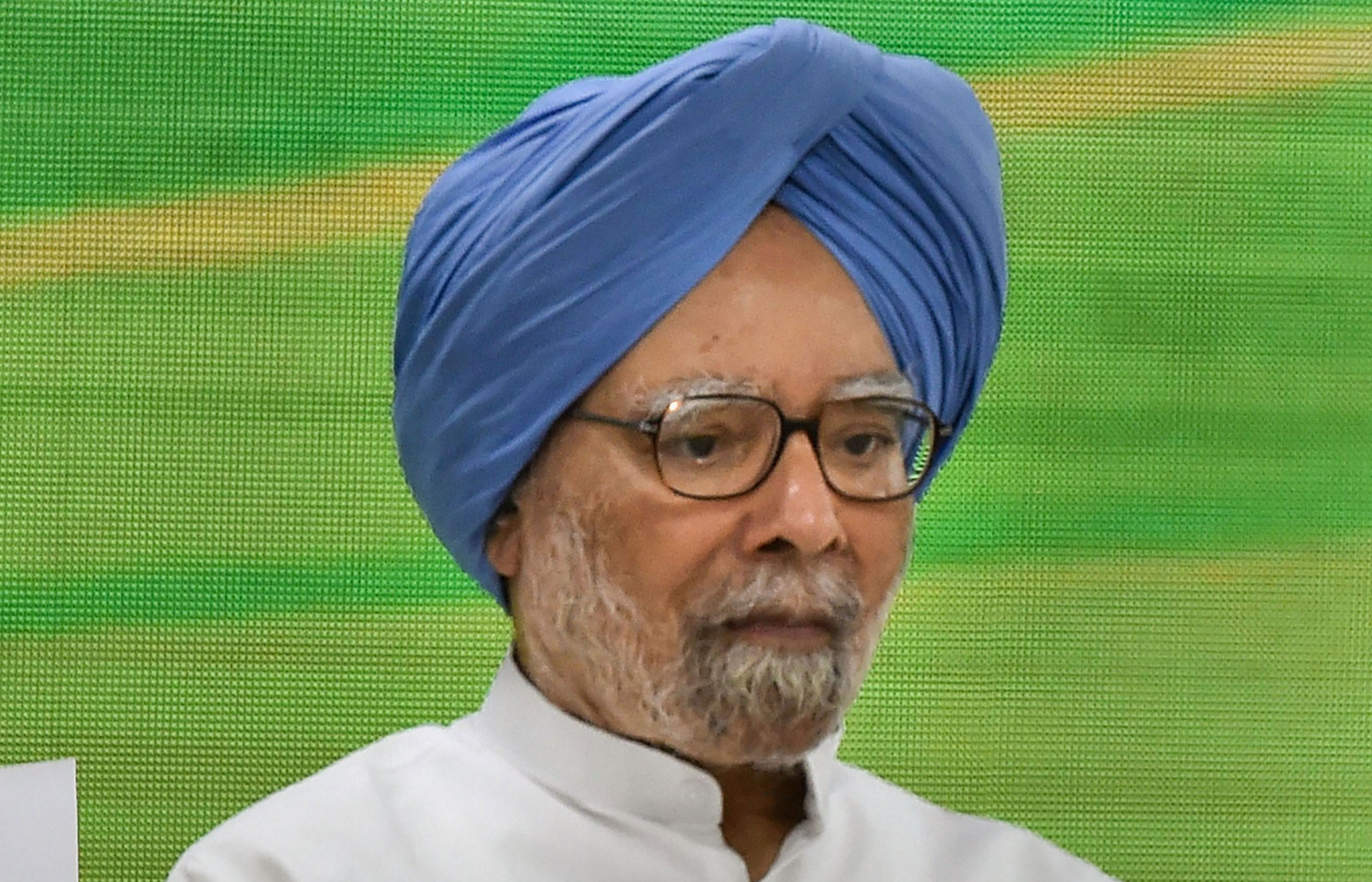

Former Prime Minister Manmohan Singh on Thursday said the country was in the midst of a “protracted slowdown” that was dangerous because the government does not recognise it, and warned that there was no hope of Narendra Modi’s target of a $5 trillion economy being achieved if the government did not act sensibly and without losing time.

Addressing a meeting of Congress office-bearers from across the country in New Delhi, Singh said: “The country is in the midst of a dangerously protracted slowdown and it is going from the bad to worse. The dangerous thing about the situation is that the government is complacent enough not to realise this. If this is not reversed, the worst will happen to the unemployment situation.”

He added: “Economic reality is different from the targets set. Modi’s target of $5 trillion economy will remain a pipedream. To achieve this, we need 12 per cent growth in nominal terms and 9 per cent growth in real terms. Growth is declining quarter after quarter and there is no hope of change.”

The former Prime Minister, who understands the economy better than most politicians, said: “There is an atmosphere of gloom and doom. There is tax terrorism in place of incentivising investments. There is no sign private investments will pick up. Agriculture, manufacturing, real estate… everywhere there is a downturn. In eight major cities, 4.5 lakh dwelling units are lying vacant; there is no demand. Rural wage is stagnant for five years, which is dangerous.”

The falling rupee could have been exploited to India’s advantage by boosting exports, Singh said. “Sluggish exports result in worsening balance of payment,” he said. The Congress has been arguing that only a high growth of 18-20 per cent in exports can sustain a high trajectory of GDP growth.

In an interview to the Hindu Business Line, published on Thursday, Singh had explained the reasons for the slowdown and suggested measures for recovery. Rahul Gandhi tweeted a link to the interview with this comment: “What India needs isn’t propaganda, manipulated news cycles and foolish theories about millennials, but a concrete plan to fix the economy that we can all get behind. Acknowledging that we have a problem is a good place to start.”

He said in the interview: “I believe that we are entering a different kind of crisis now, a prolonged economic slowdown that is both structural and cyclical. The first step in a crisis is to acknowledge that we are facing one. The government needs to address the issue in a transparent manner, listen to experts and all stakeholders with an open mind, and project serious intent to handle the crisis. The government must instil confidence in the people and send a message to the world. Unfortunately, I do not yet see such a focused approach from the Modi government.”

In an ominous warning, the Congress veteran said: “In my estimate, it will take a few years to get out of this slowdown, provided the government acts sensibly now. We must not forget though that it was the blunder of demonetisation, followed by the faulty implementation of GST, that triggered this slowdown. RBI has recently put out data that shows that gross bank exposure towards consumer goods loans has seen a steep and constant decline since late 2016 — that is, following demonetisation.”

Asking Modi to drop “headline management,” Singh said: “We cannot afford to deny that India is facing an economic crisis. Already a lot of time has been lost. Instead of wasting its political capital by adopting a sector-wise piecemeal approach, or on monumental blunders like demonetisation, the time has now come for the government to carry out the next generation of structural reforms.”

Subtly pointing to the constructive role Modi could have played, Singh said: “It is important to remember that this is a government with an overwhelming mandate, a full majority, not once, but twice in a row. When I served as the finance minister, or even as the Prime Minister, we did not have such huge mandates. Despite that, we achieved a lot, and successfully navigated through both the 1991 crisis and the 2008 global financial crisis.”