Finance minister Nirmala Sitharaman’s new tax deduction for home owners is most welcome. Under a new Section 80EEA, the FM proposes to give tax payers an additional deduction of Rs 1.5 lakh on interest paid towards home loans. Taken with the existing interest rate deduction of Rs. 2 lakh provided under Section 24b, the total deduction now rises to Rs. 3.5 lakh-or to Rs. 5 lakh including the deduction of Rs 1.5 lakh available for home loan principal payments under Section 80C.

However, some number crunching reveals that most borrowers cannot derive the full value of this deduction. Those buying property in metros at high valuations —the ones who need such a deduction the most — will be left out of the ambit of the new deduction.

80EEA explained

From April 1, 2020, tax payers can avail the benefits of this new section for home loans taken in financial year 2019-20. The deduction isn't available to anyone who owns any other property on the date of the loan sanction. But the big exclusion here is that the stamp duty value of the house for which the loan is being taken cannot be more than Rs 45 lakh.

Banks and home financing companies typically provide a loan-to-value (LTV) of 80 per cent of the property’s cost. But even if we were to assume a high LTV of 90 per cent, the interest rate benefits don’t actually touch Rs 1.5 lakh.

How is this possible?

Let’s assume you’ve borrowed Rs 40.5 lakh on a property purchase, at the highest possible LTV of 90 per cent. The interest rate is 8.7 per cent, based on prevalent rates, and the tenure of the loan is 15 years, based on the illustration provided by the FM in her budget speech.

The Telegraph

On a loan with a reducing balance interest rate method, your EMIs at the start of your loan are directed primarily towards interest. Therefore, at the start of your loan tenure, your interest payments are the highest. But even at a 90 per cent LTV, the first year interest works out to only Rs 3.46 lakh, which is less than the new proposed total limit of Rs 3.5 lakh.

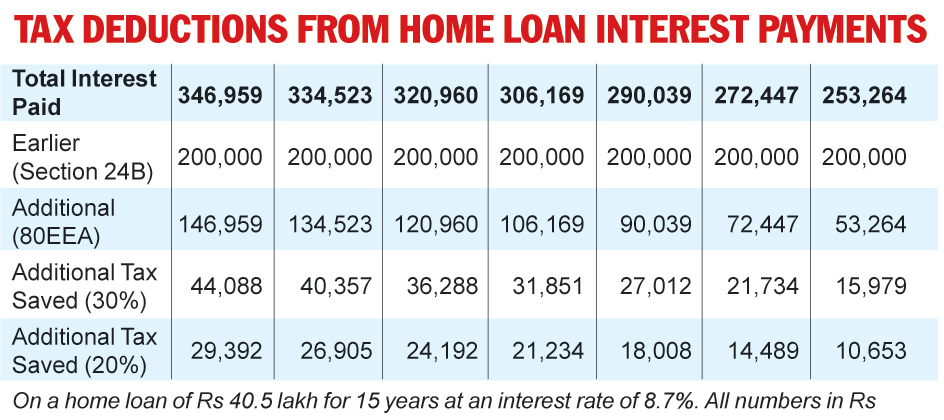

On the illustration above, here’s how your interest payment works out in the first seven years: Rs 3.46 lakh in the first year, Rs 3.34 lakh in the second, Rs 3.20 lakh in the third, Rs 3.06 lakh in the fourth, Rs 2.90 lakh in the fifth, Rs 2.72 lakh in the sixth, and Rs 2.53 lakh in the seventh.

Let’s be clear — the additional deduction is great. It will help the borrower of the above loan save taxes on Rs 7.24 lakh through additional deductions over the first seven years of the loan tenure alone. Calculating taxes for those in the 30 per cent slab gives us tax savings of Rs 2.17 lakh before cess. This works out to savings of Rs 2583 per month, or Rs 31,000 per year. These are useful savings.

A better option

Home buyers in Tier 2 cities would certainly welcome the move. The deductions would favour anyone looking for their first property purchase under the price of Rs 45 lakh. But in metros, with that price range, the options would be limited to small or budget housing. BankBazaar data indicates that in 2018, the highest home loan ticket sizes were Rs 5 crore in Delhi and Rs 2.2 crore in Chennai. The highest home loan ticket size in Calcutta during the period was Rs 1.2 crore. Nevertheless, the addition to the 24B is welcome and we hope that the benefits will be extended to all home buyers.

Adhil Shetty is CEO, BankBazaar.com