Finance minister Nirmala Sitharaman has unveiled a growth-oriented budget that included a nearly 140 per cent hike in healthcare spending and declared the government was “fully prepared” with measures to pull the Covid-hit economy out of an unprecedented contraction. At the same time, she blew out the country’s hitherto conservative fiscal deficit target.

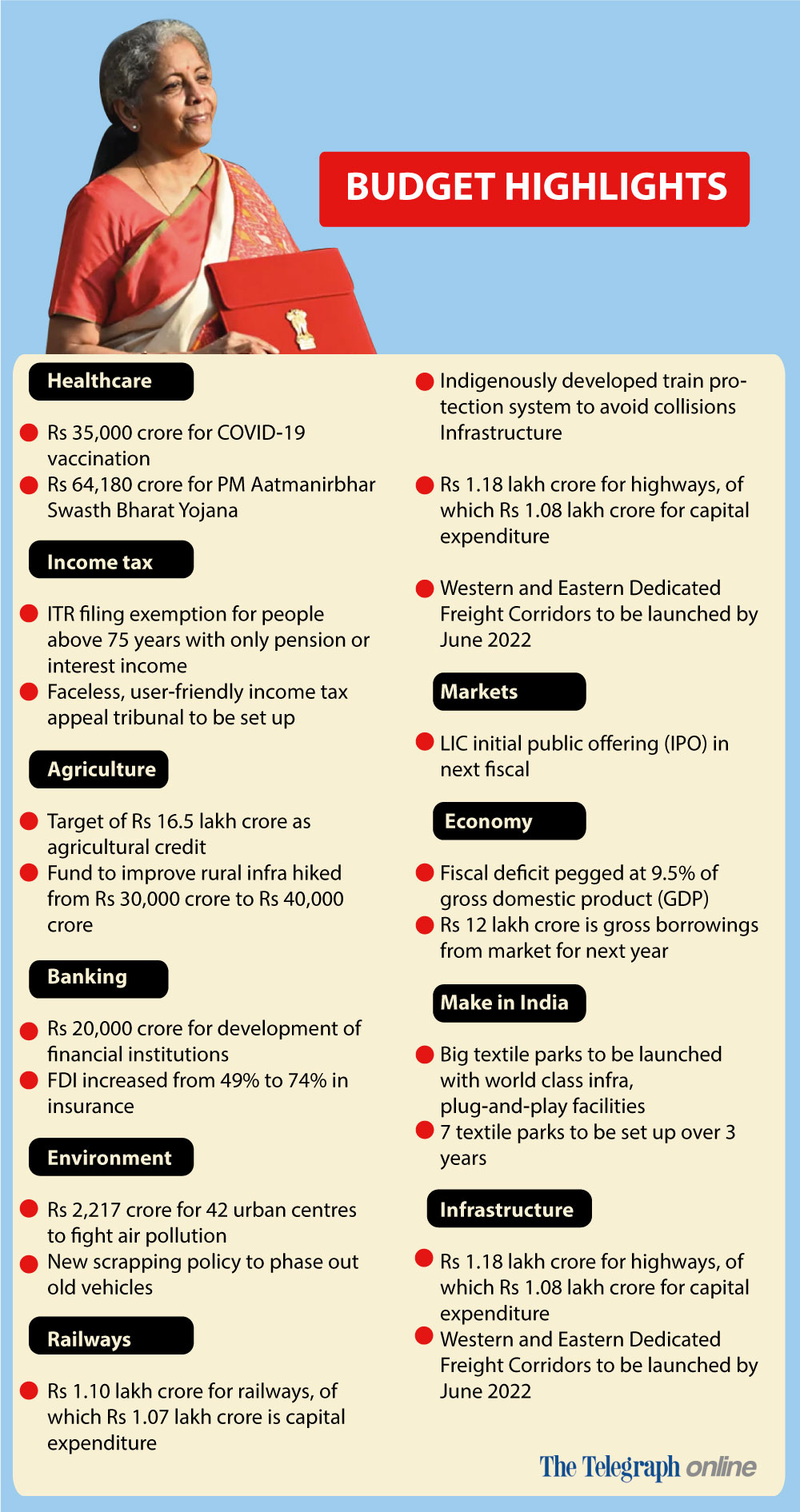

First, the key budget takeaways for taxpayers: there’ll be no change in tax rates and there also won’t be any need for senior citizens over 75 to file tax returns if their only income is from pensions and interest income. Also, the budget got a big thumbs-up from investors who drove the benchmark 30-share Sensex 5 per cent higher in its biggest budget day rally since 1971.

This is “a bold budget in many senses. The central intent has been to use expansionary fiscal policy to support growth sidestepping concerns over debt sustainability and sovereign ratings,” said HDFC chief economist Abheek Barua. The fiscal deficit will be 9.5 per cent for this fiscal year ending March 31, way beyond the 3.5-per-cent target set in the last budget. For next year, the government targeted a deficit of 6.8 per cent. Covid-19 has slashed growth, reducing tax revenues at the same time as increasing the need for higher spending to bolster the economy.

The nearly Rs 35-trillion budget, which emphasises fiscal stimulus, envisages a “self-reliant India” that provides “every opportunity for our economy to...capture the pace it needs for sustainable growth,” said Sitharaman, who set a precedent by reading her speech to Parliament from a computer tablet to reflect the country’s digital drive.

The government’s proposals will benefit the health care, real estate and construction, metal makers, state-run banks saddled with bad loans and textiles, innovation and research and development, among other areas, she said. "The government is fully prepared to support and facilitate the economy's reset," she said.

The key thrust of the budget on healthcare which has been a neglected priority under successive governments drew praise from all parties. Sitharaman said the government would increase healthcare spending by 137 per cent to Rs 2.2 trillion to bolster the badly ailing public healthcare system and administer Covid vaccines to nearly 1.4 billion people.

Also, under the budget, a new centrally sponsored scheme, PM AtmaNirbhar Swasth Bharat Yojana, will be launched with an outlay of Rs 64,180 crore over six years. “This will develop capacities of primary, secondary, and tertiary care health systems, strengthen existing national institutions, and create new institutions, to cater to detection and cure of new and emerging diseases,” said Sitharaman. The government also announced plans for “one nation, one ration card” to simplify distribution to the poor.

Growth over fiscal consolidation

“It is a growth-oriented budget with a lot of positive interventions, and with something in it for everyone. On healthcare, the Government has taken a big step with an outlay of Rs 2.23 lakh crore, a 137 per cent increase from last year, a step that was long overdue,” said Satish Reddy, chairman of Dr Reddy’s Laboratories, one of the country’s biggest drugmakers. But he added a strong note of caution: “As with all budgets, there are concrete proposals that are encouraging but it is the execution that finally matters and I hope this time the government gets it right.”

The swing to high fiscal deficits drew only praise from business leaders. Uday Shankar, president of FICCI, who called the budget “outstanding, clear-headed and growth-oriented… (one) that lays a strong foundation for an Atmanirbhar Bharat.” He said, “the fact that the government chose growth over fiscal consolidation is indeed heartening. There is a sharp focus on capital expenditure.”

No cushion for pandemic stressed sectors

Critics, though noted, the budget contained no specific support for pandemic-stressed sectors like the hospitality sector. There was also no cushion provided for households – especially in the informal sector hit the most by the pandemic which was likely to push the economy toward a K-shaped recovery in which the rich get richer and the poor become poorer.

Former Congress Union minister Anand Sharma tweeted that the budget was “without a roadmap for accelerating growth & revival of consumer demand... The nation needed a bold budget & more direct transfers to the weaker sections to revive demand, restart job creation.”

Prices of gold and silver fell after Sitharaman said the government would slash customs duties on the precious metals to 7.5 per cent from 12.5 per cent to bring them more into line with 2019 levels when the duties had been hiked from 10 per cent.,

Rise in tax revenue forecast

The government’s spending plans involve raising levies on imports such as mobile phone components to increase self-reliance, selling state assets and dividend income. The budget forecasts a 16 per cent rise next year in tax revenues to Rs 15.5 trillion rupees from the current year.

The government also is aiming to cut its stakes in at least two public-sector banks and in an insurance company as well as monetise land banks that it hopes will reap at least Rs 1.75 lakh crore. That target is lower than the Rs 2.1 lakh crore it hoped to gain from disinvestment in the current financial years that was badly hit by the pandemic. Privatisation sales under not only the government of Prime Minister Narendra Modi but also preceding administrations have rarely reached their targets because of the political sensitivity of such disposals and union opposition.

Plans to pull in investment

The budget sets out plans to draw investment to bolster the economy, raising the foreign investment ceiling in insurance to 74 per cent from 49 per cent in an attempt to draw long term funds for meeting the investment requirements of the sector. Among other moves, it also proposes simplifying the rules governing REITS and inVITS to attract foreign money. REITs and InvITs are both popular in global markets. REITs involve commercial real assets. InvITs are made up of infrastructure assets like highways.

The government will also raise capital expenditure by more than Rs 1 trillion to Rs 5.54 trillion.

The government has said the economy will grow by 11 per cent in the coming financial year, making it the fastest-growing worldwide, helped by the rollout of the Covid vaccine and hoped-for continued fall of Covid patient numbers. That growth will be a rebound from an unprecedented 7.7 contraction in the current year. While headline growth for 2021-22 looks impressive, in reality, it will be only a little over two per cent more than in 2019-20.

Still, the government’s overall spending for the next coming fiscal year is only going to rise only 0.8 per cent to almost Rs 35 trillion, raising questions about the funding feasibility of the government's ambitious schemes.

The government has also earmarked Rs 20,000 crore to recapitalise state-run banks that are groaning under the weight of bad loans. The aim is to allow them to give them leeway to meet the credit demands of a growing economy.

Manufacturing companies hold the key

For India to attain its target of becoming a $5-trillion economy, Sitharaman said the manufacturing sector must post double-digit growth and its manufacturing companies need to become an integral part of global supply chains, possess core competence and cutting-edge technology. In a bid to increase domestic manufacturing the government announced an up to 10-per-cent hike in customs duties for mobile chargers and phone parts which could mean costlier mobile handsets.

To achieve these goals, schemes to create “manufacturing global champions for an AtmaNirbhar Bharat” have been announced for 13 sectors, she said. For this, the government has committed nearly Rs 1.97 lakh crores over five years in the next fiscal year starting April 1. “This initiative will help bring scale and size in key sectors, create and nurture global champions and provide jobs to our youth,” Sitharaman said.

Textile parks

To enable the textile industry to become globally competitive, attract large investment and boost job creation, a Mega Investment Textiles Parks or MITRA scheme will be launched. Sitharaman said this will create world-class infrastructure with plug-and-play facilities to create “global champions in exports.” She said seven textile parks will be established over three years.

She said the government’s National Infrastructure Pipeline (NIP), “a first-of-its-kind, whole-of-government exercise,” was launched in December which included 6,835 projects. The project pipeline has now expanded to 7,400 projects. Around 217 projects worth Rs 1.10 lakh crore under some key infrastructure ministries have been completed.

She said the NIP is a specific target which the government is committed to achieving over the coming years and will require a major increase in funding both from the government and the financial sector. To accomplish these objectives, she said she would in this budget create the institutional structures; put a big thrust on monetising assets, and thirdly enhance the share of capital expenditure in central and state budgets.

She also announced plans to create a Development Financial Institution (DFI) to act as a provider, enabler and catalyst for infrastructure financing and provided a sum of Rs 20,000 crore to capitalise the institution. “The ambition is to have a lending portfolio of at least Rs 5 lakh crore for this DFI in three years time,” she said.

Investors cheered the budget, pushing up the Sensex by over 2,300 points to close at 48,601 while the broader NSE Nifty ended up 4.74 per cent or 674 points higher at 14,281.