In a budget bereft of grand ideas, the finance minister has outlined a proposal that would potentially bring retail investors a step closer to the market, effectively weaning them away from deposits and sundry other fixed-income generating assets.

The government has now firmly renewed its faith in Exchange Traded Funds (ETFs), which have been identified specifically today for the significant investment opportunity they offer. In fact, the authorities are probably willing to provide what seems would be a separate investment option in ETFs.

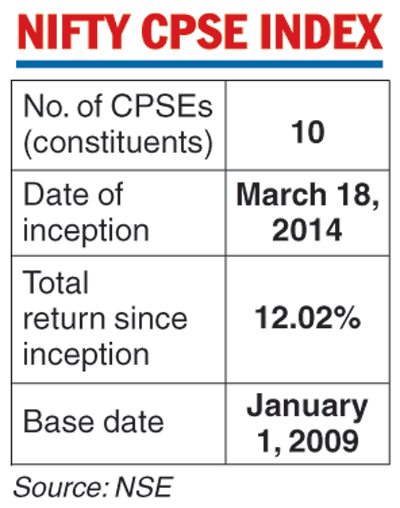

This would be worked out on the lines of Equity Linked Savings Scheme (ELSS). The latter, which currently come with a three-year lock-in period, extend tax breaks under Section 80C of the I-T Act. Such an accommodation would also encourage long term investment in central public sector enterprises (CPSEs).

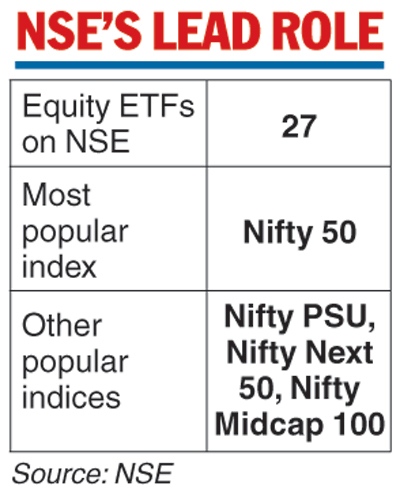

Retail participation in the market through ETFs has been given considerable importance. As recent statistics would reveal, the trend on this front has been quite positive. For any additional investment window to be created, government holding in CPSEs would need to be realigned. The market would have to be sufficiently deep and accommodative as well.

The issue raised by the FM today, I must mention, should be seen against a backdrop marked by an increased disinvestment target for 2019-20. For the record, this happens to be Rs 1.05 lakh crore of receipts - surely not a mean task! In fact, for such a target to be achieved, the government would probably have to consolidate some of its corporate assets too.

The FM, who has identified “strategic disinvestment of select CPSEs” as a priority, specifically mentioned Air India, which would necessitate re-initiation of the disinvestment process. She has also clearly indicated that more CPSEs for participation by the private sector would be offered.

The government has taken to the ETF route on a few earlier occasions. Indeed, these funds have already constituted a critical part of its overall policy on disinvestment with regard to state-controlled companies. This time, however, the Finance Minister has made it a point to clarify that the focus is on non-financial public sector outfits. In other words, a raft of only manufacturing or processing companies helmed by the government will be considered as disinvestment candidates over a period of time.

The extant policy on shedding stake, in fact, is probably headed for another distinct correction. The government, which has hitherto retained its plan not to let its holding drop below 51 per cent (that would still make it the majority holder), is considering a rejig of sorts. As the FM indicated, the existing 51 per cent standard may be diluted on a case to case basis. Thus the conclusion: the government is ready to modify the present policy of retaining even the most slender majority.

The FM has underlined the significance of international capital inflows into the domestic economy, especially in view of aligning 'domestic corporate systems and practices with global ones'. In the same vein, she has noted that global finance's involvement in equity often uses certain definitive evaluation parameters.

In an era marked by incessant shareholder activism, I would expect superior public ownership of enterprises that are largely controlled by the state at this juncture. Remember, interest in index-based investing is already gaining ground, and ETFs can serve as a useful tool in this context.

Emergence of exchange-traded investment vehicles would ultimately facilitate serious unlocking of value. It would also ensure greater corporate governance and investor orientation.

Public shareholding standards seem to be headed towards major changes in our country, and Sitharaman's maiden budget would be a step towards such the desired scenario.

Nilanjan Dey is CEO of Wishlist Capital Advisers