The Narendra Modi government played a cruel April Fool joke on the country’s small savers with finance minister Nirmala Sitharaman issuing an early morning tweet announcing the rollback of the sharp interest rate cuts slapped on Wednesday on small savings deposits and schemes parked with the post offices and banks.

The Union finance minister said the circular had been issued “by oversight” and would be withdrawn.

The “correction” came on a day several Assembly seats in Bengal, including Nandigram, and Assam went to the polls. Several more rounds of elections are round the corner in Bengal and four other states.

“Interest rates of small savings schemes of the GoI shall continue to be at the rates which existed in the last quarter of 2020-21, i.e. rates that prevailed as of March 2021,” the finance minister tweeted a little before 8am, less than an hour after polling began in Bengal and Assam.

As has become typical of this government, it issued no apology or even try to explain what had led to the so-called “oversight”.

Bengal, which is in the thick of a bitterly contested election, has one of the largest pools of small savers in the country and there was a huge risk that the state’s voters would react with alarm to the piffling returns on their investments.

In a sarcastic response, Priyanka Gandhi Vadra riposted: “Really @nsitharaman ‘oversight’ in issuing the order to decrease interest rates on GoI schemes or election-driven ‘hindsight’ in withdrawing it?”

The Congress fired a harsher broadside in which it suggested that it might be time for Sitharaman to resign after the dreadful faux pas. The party tweeted: “Convenient how these ‘oversights’ only seem to happen around election time. Speaking of which, what kind of ministry are you running madam FM, that passes orders which affect crores of people without even a second glance. Smt Nirmala Sitharaman, it's time to resign.”

The Congress spokesperson said: “Why was this circular issued if it was not meant to be issued.… Was #AprilFoool joke erroneously cracked on 31st March? Ohh! U’ll raise it post elections.”

Kanhaiya Kumar, who describes himself as a whistleblower, had filed an application under the Right to Information Act (RTI) seeking the name of the “competent authority” who had approved the revision of the rates and whether finance minister Sitharaman was aware of the decision.

He also wanted to know whether there had been any meeting where the decision had been taken while seeking all the file notings, correspondence and official records relating to the issue.

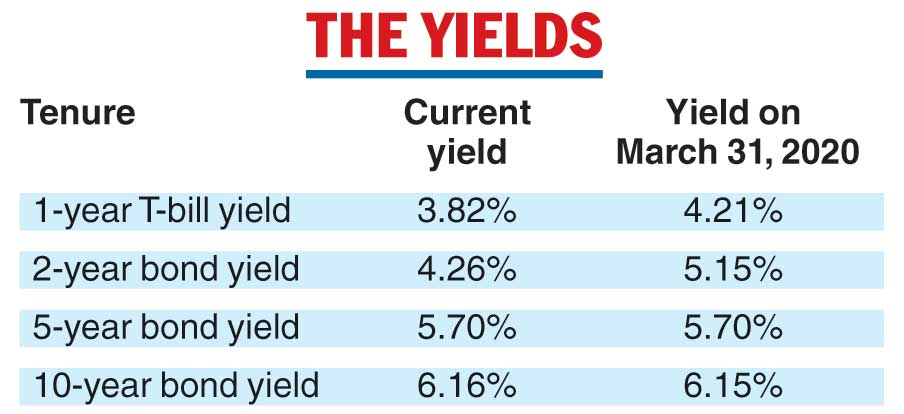

Small savings rates are linked to treasury and bond yields. The yield on the 10-year paper has been rising over the past month and currently rules above last year’s level -- shredding the only reason to justify a cut in the small savings rate. The yields on the shorter maturities are rising too.

The Shyamala Gopinath committee had recommended in June 2011 that “the interest rates on 1-year time deposit may be benchmarked to 364-day T-Bills and that on 5-year TD may be benchmarked to 5-year G-Sec. The interest rate on 2-year and 3-year TD may be determined through linear interpolation between the interest on 1-year and 5-year maturity instruments.”

Bond yields on 5-year and 10-year papers have virtually remained at the same levels as last year, which would therefore provide no justification for the 50-to-90-basis-point cut in the interest rates of these deposit schemes proposed on Wednesday.

The yields on the 1-year treasury bill and the 2-year bond have fallen: from 4.21 per cent to 3.82 per cent in the case of the 1-year paper, and from 5.15 per cent to 4.26 per cent in the case of the two-year paper.

The Reserve Bank has been trying to smoothen the yield curve for some time -- and it is possible that the yields may cool in the next few months. The Gopinath committee had suggested the small savings rates should be revised only once every year.

The Modi government has been setting rates by quarters. Even on Wednesday, the new rates were supposed to be valid only till June 30, raising the possibility of revisions later in the year if the bond market yields tend lower.

It is possible that the rate revision could still take place sometime after the Assembly elections. Small savers will have to continue to live in uncertainty as Sitharman did not commit to the old rates obtaining for the entire financial year.

The latest data shows that the outstanding balance in all small savings schemes stood at Rs 823,203.85 crore on March 31, 2020. Of this, Bengal accounted for the highest contribution at Rs 120,831.27 crore, roughly 14.7 per cent of the total corpus.