The Reserve Bank of India has decided to withdraw the Rs 2,000 note — the highest-denomination note currently in circulation.

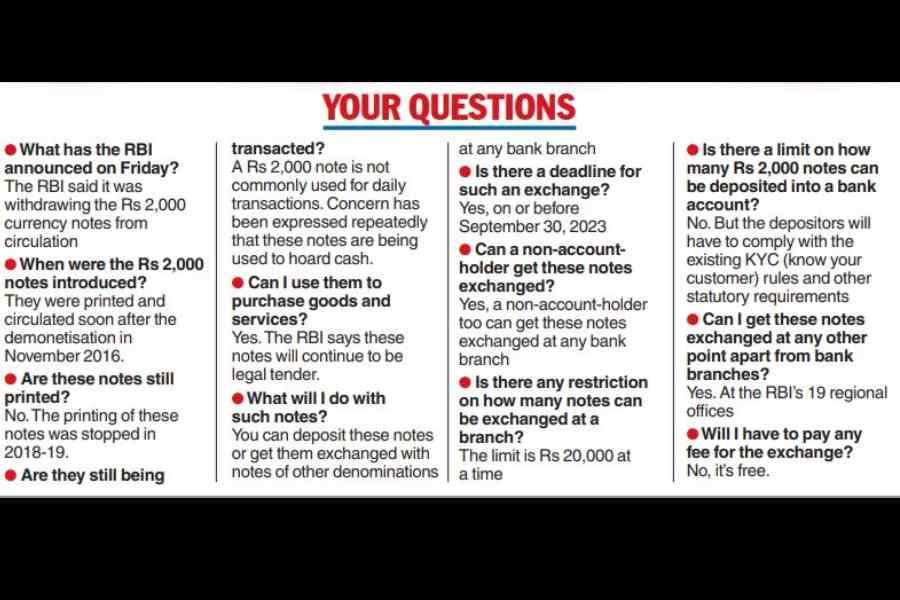

The RBI said that holders of the notes, which have not been printed since 2018-19, would be able to able to exchange them at banks till September 30.

For now, they will still be legal tender — which means that they can technically be used to buy goods and services. But sceptics believe that it will be hard to convince shopkeepers to accept the notes with the guillotine having already fallen.

The announcement of the note withdrawal sent a shock wave through the country, prompting finance secretary T.V. Somanathan to say the withdrawal of the high-value note, introduced soon after the demonetisation of November 2016, would not cause any “disruption in normal life or the economy”.

“Demonetisation has come full circle,” tweeted P. Chidambaram, finance minister during the UPA regime.

“The Rs 2,000 note was a band-aid to cover up the foolish decision of demonetising Rs 500 and Rs 1,000 notes which were popular and widely exchanged currencies. A few weeks after demonetisation, the government/RBI were forced to re-introduce the Rs 500 note. I shall not be surprised if the government/RBI re-introduced the Rs 1,000 note as well.”

Over the past four years, the Rs 2,000 note has rarely been seen after disappearing from ATMs. It has mostly been used by businesspersons to hoard cash — and they are certain to yelp in anguish over another capricious decision by the authorities.

“The Rs 2,000 note is hardly a popular medium of exchange. We said this in November 2016 and we have been proved correct,” Chidambaram said.

Bengal chief minister Mamata Banerjee tweeted: “So it wasn’t Rs 2000 dhamaka but a billion-dollar dhoka to a billion Indians. Wake up, my dear brothers and sisters. The suffering we have endured due to demonetisation can’t be forgotten and those who inflicted that suffering shouldn’t be forgiven.”

The RBI’s decision is buttressed by the logic of its so-called clean note policy, introduced in 1999, under which the banking regulator regularly culls soiled and mutilated currency.

According to the RBI, about 89 per cent of these banknotes were issued prior to March 2017 and are at the end of their estimated life span of four to five years.

The RBI has disclosed that the total value of these bank notes in circulation had declined from Rs 6.73 lakh crore at its peak, as on March 31, 2018 (37.3 per cent of the notes in circulation), to Rs 3.62 lakh crore — constituting only 10.8 per cent of the notes in circulation — on March 31, 2023.

Note exchange

The RBI said people could deposit the notes into their bank accounts or exchange them at bank branches or regional offices of the RBI from May 23 (Tuesday). They will be able to do so till September 30.

The statement did not say what would happen after September 30.

Bankers said the four-month period was sufficient to make the switch over to lower-denomination notes. Besides, the RBI might extend the deadline if there is popular demand for such a measure. However, if there is no extension, these notes will lose their status as legal tender.

The RBI has, however, set an “operational limit” of Rs 20,000 per transaction at a bank branch. Multiple transactions may be possible during the day if the lines are short.

Deposits of these notes into accounts can be made without restriction, subject to know-your-customer (KYC) and other requirements.

The RBI said that banks had been instructed to make special arrangements for senior citizens and people with disabilities to exchange their wads of Rs 2,000 notes without too much hassle.

If a bank branch refuses to accept a banknote, customers can first approach the higher officials of that particular bank. If the problem is not redressed, a complaint can be lodged under the RBI’s Integrated Ombudsman Scheme.

Banking sources indicate that while a large number of people may not be inconvenienced this time around, since the banknote is no longer widely held by the common people, businesses could face difficulties because of the RBI’s decision.

Some experts feel that the step would lead to an accretion in deposits at banks.

“As witnessed during the demonetisation, we expect the deposit accretion of banks could improve marginally in the near term. This will ease the pressure on deposit rate hikes and could also result in moderation in short-term interest rates,” said Karthik Srinivasan, senior vice-president, group head, financial sector ratings, at ICRA.